Quick Links

Introduction

Hello, fellow crypto enthusiasts! I’m one of the seasoned traders here at Platinum Crypto Academy, and today, I’m excited to share insights into the dynamic world of altcoins. Like many of you, my journey in the crypto space has been filled with highs, lows, and plenty of learning opportunities. Altcoin investing, in particular, has been a thrilling part of my adventure, offering both challenges and significant rewards.

Understanding Altcoins

In the vast ocean of cryptocurrencies, altcoins stand out as intriguing islands of opportunity, distinct from the mainland of Bitcoin. The term “altcoin” encompasses every cryptocurrency other than Bitcoin, including well-known names like Ethereum, Ripple (XRP), Litecoin, and thousands of others, each with its unique features and purposes.

Origins and Evolution Altcoins didn’t just emerge as competitors to Bitcoin; they represent continuous innovation in the blockchain space. Many altcoins were created to build upon the foundational technology of Bitcoin, addressing issues such as scalability, energy efficiency, and transaction speed. For instance, Ethereum introduced smart contracts, enabling not just currency transactions but also decentralized applications (dApps) to run on its blockchain.

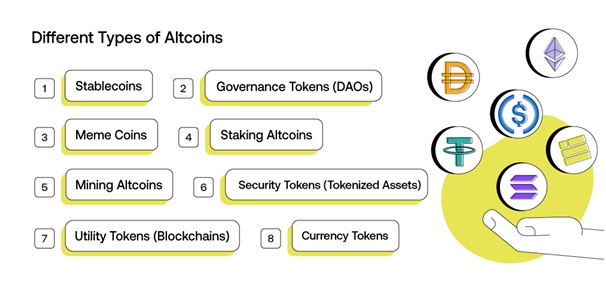

Types of Altcoins Understanding the different categories of altcoins can give us a clearer picture of the altcoin landscape:

- Payment Tokens: Like Bitcoin, these altcoins, including Litecoin and Dash, are primarily designed for transactional purposes.

- Utility Tokens: These tokens provide access to a blockchain’s functionality. Ethereum is a prime example, with its Ether (ETH) token used to interact with smart contracts.

- Security Tokens: Often representing an investment, these tokens are akin to traditional securities. They might signify ownership in a real-world asset or a set of rights within their ecosystem.

- Stablecoins: Designed to combat the volatility of cryptocurrencies, stablecoins like Tether (USDT) or USD Coin (USDC) are pegged to more stable assets like fiat currencies or gold.

The Potential and Risks The allure of altcoins lies in their potential to offer more than just a digital currency. They are at the forefront of blockchain innovation, from facilitating decentralized finance (DeFi) to powering digital identities and beyond. This innovation frontier opens up new investment horizons with the possibility of high returns.

However, the world of altcoins is not without its risks. The market can be highly volatile, and the relative novelty of many projects means they can be more susceptible to market sentiment, regulatory changes, and technological challenges. Moreover, the sheer number of altcoins, each vying for a spot in the digital ecosystem, makes picking the right investment a daunting task.

Navigating the Altcoin Universe As traders and investors, our journey through the altcoin universe should be marked by diligent research, a keen understanding of market trends, and an awareness of the broader technological and economic factors influencing the crypto space. By doing so, we can better identify those rare gems that have the potential to grow and make a lasting impact in the blockchain world.

Why Altcoins?

When I first dived into the world of cryptocurrencies, like many, I was initially captivated by Bitcoin – the pioneer and giant in the space. However, as I delved deeper, I discovered that altcoins are much more than just alternatives to Bitcoin; they are a diverse and vibrant part of the crypto ecosystem with unique value propositions.

Innovation and Technology Altcoins are often at the forefront of blockchain and cryptocurrency innovation. Many altcoins come with new functionalities and capabilities that Bitcoin doesn’t offer. For example, Ethereum’s introduction of smart contracts opened the doors to a whole new range of applications, from automated decentralized finance (DeFi) platforms to non-fungible tokens (NFTs). Other altcoins focus on improved privacy features, energy efficiency, or faster transaction speeds, addressing some of the limitations found in Bitcoin.

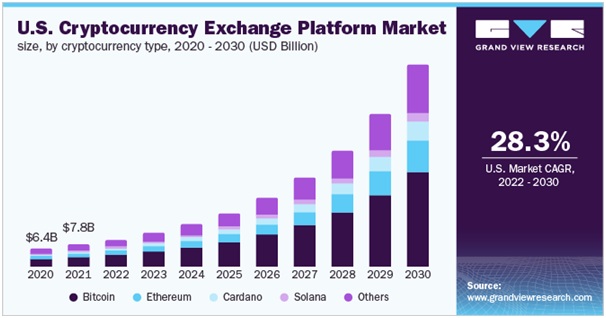

Market Potential Altcoins can sometimes offer a higher profit potential, albeit with higher risk. Due to their lower market capitalization compared to Bitcoin, altcoins can have a much higher growth ceiling. This means that savvy investors who can spot promising projects early on might enjoy significant returns on their investment. It’s like finding a hidden gem in the rough before it becomes the talk of the town.

Diversification Investing in altcoins also allows for greater diversification of a crypto portfolio. While Bitcoin remains a relatively safe and stable investment in the crypto world, diversifying into different altcoins can spread risk and increase the potential for returns. Each altcoin reacts differently to market events, and having a mix in your portfolio can mitigate losses if one particular segment underperforms.

Participation in Emerging Trends Investing in altcoins is not just about financial returns; it’s also about being part of emerging trends and innovations in the crypto and blockchain space. Whether it’s a new method for validating transactions, a novel governance model, or a groundbreaking application, altcoin investors often find themselves at the cutting edge of new technological developments.

Community and Governance,Many altcoin projects have vibrant communities and unique governance models that allow for more democratic participation in the project’s future. This aspect can be particularly appealing for those who want to be more actively involved in the direction and development of their investments, rather than just being passive holders.

Key Strategies for Altcoin Accumulation

- Research and Analysis Research is your best weapon in the altcoin battlefield. I spend hours analysing market trends, understanding the technology behind different coins, and keeping an eye on industry news. Tools like CoinMarketCap and CryptoCompare have been invaluable for getting real-time data and insights.

- Market Timing and Entry Points Timing the market isn’t easy, but understanding market cycles can give us an edge. I’ve learned to identify patterns and potential entry points, which are crucial in maximizing returns and minimizing risks.

- Portfolio Diversification is key in managing risks. I balance my portfolio with a mix of high-risk, high-reward altcoins and more stable investments. This strategy helps in cushioning against market volatility.

- Risk Management In crypto trading, risk management can’t be overstated. Setting stop losses, managing the size of your investments, and keeping emotions in check are essential practices. Remember, not all trades will be winners, but managing your risks wisely can help preserve your capital for future opportunities.

Practical Tips and Tricks

- Over the years, I’ve picked up a few tricks that have served me well:

- Stay active in crypto communities and forums. The insights and discussions you find there can be goldmines of information.

- Use tools like Blockfolio or Delta to track your investments and market movements.

- Keep learning. The crypto world evolves rapidly, and staying informed is crucial.

Conclusion

The journey of altcoin accumulation is both challenging and potentially rewarding. Altcoins are not just mere investments; they represent the frontier of technological innovation, a testament to the ever-evolving landscape of blockchain technology.

Investing in altcoins allows us to be part of a movement that is shaping the future of finance, technology, and societal structures. Each altcoin has its story, its purpose, and its potential to disrupt traditional models. As investors, we’re not only seeking financial returns but also supporting the visionaries and innovators who dare to reimagine our world.

However, let’s not forget that with great potential comes significant risk. The world of altcoins is fraught with volatility and uncertainty. It’s crucial to approach this space with a balanced perspective, armed with research, patience, and a clear understanding of your risk tolerance. Never invest more than you can afford to lose, and remember, diversification is your ally in the face of unpredictability.

I encourage you to stay curious, keep learning, and remain engaged with the community. At Platinum Crypto Academy, we’re committed to providing you with the knowledge, tools, and insights to help you make informed decisions. Your success is our success, and we’re here to guide you every step of the way.

So, whether you’re a seasoned trader or just starting out, remember that every expert was once a beginner. The path to mastering altcoin accumulation is a journey of continuous learning and adaptation. We’re excited to have you with us on this journey, exploring the vast potential of altcoins and contributing to the shaping of a new digital economy. Together, let’s embrace the future, one altcoin at a time.

Happy trading, and here’s to the growth of your portfolio and your journey in the captivating world of cryptocurrencies!

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.