EthosX, an innovative platform for trading derivatives on blockchains, is reshaping the derivatives trading industry. With backing from high-profile investors such as Franklin Templeton, Y Combinator, Token Metrics Ventures, Ascensive Assets, Global DeVC and Taisu Ventures (among others), EthosX is tackling the longstanding challenges of complexity and inefficiency in derivatives trading.

Derivatives trading, particularly options trading, has historically been a complex and opaque process. Retail traders often find it overly intricate, with limited applications beyond speculative trading. Institutional traders encounter high costs, notably lower trading volumes, and concerns about the risks associated with centralised exchanges. Additionally, the existing decentralised derivatives market offers limited products and requires traders to balance capital efficiency with counterparty risk.

EthosX’s solution simplifies derivatives trading through the use of blockchain technology. By eliminating intermediaries and automating the entire trade lifecycle – from order matching and clearing to settlement, the platform reduces costs, operational risks, and enhances transparency and security.

Deepanshu, CEO of EthosX, stated, “EthosX is dedicated to democratising derivatives trading, making it accessible, efficient, and secure for all participants. We are focusing on directly addressing the pain points experienced by both retail and institutional traders, offering a seamless and transparent trading experience.”

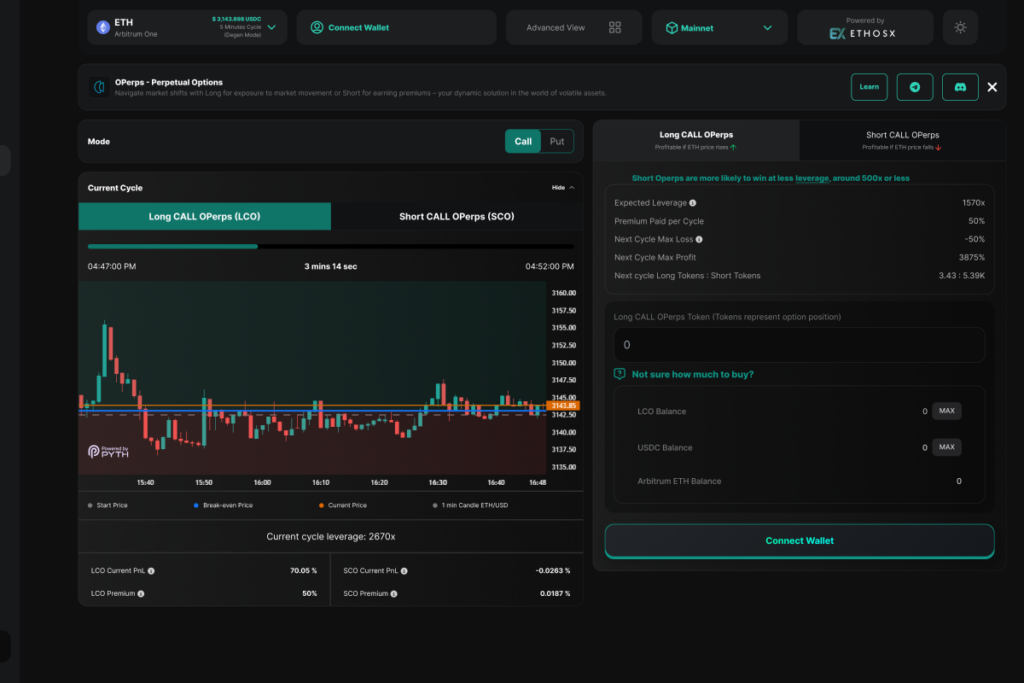

EthosX’s first set of products, Operps (Perpetual Options), is operational on Arbitrum Chain and has been launched by EthosX’s partner Kanalabs on their front-end (operps.kanalabs.io) Operps streamline options trading, enabling users to respond to market fluctuations effectively. With settlement cycles as short as five minutes and profits delivered directly to users’ wallets, Operps provide a dynamic solution for traders navigating the volatile crypto market. The main attraction of Operps is that no matter the leverage, max loss is fixed at 50% for all users which completely changes the risk and reward dynamics.

Operps offer unique features like ultra-fast trading with 5-minute cycles, accessibility for all trading styles, and a low barrier to entry with examples of successful trades starting with as little as $0.25.

They are designed to be very user-friendly, even for those new to options trading. They offer two primary types of options, “Call Operps” for predicting price increases and “Put Operps” for anticipating price decreases. Users can enter and exit positions before and after each 5-minute cycle, providing flexibility and control.

Operps profitability is influenced by two key factors: leverage and price change.

Leverage acts as a multiplier for potential profits, and it can be significantly amplified by the number of liquidity providers and long token holders. This active leverage adds an exciting dimension to trading, as it can change with each cycle based on market anticipation. Operps offers the potential for massive gains on even small price movements due to their high leverage, reaching over 7000x for some people. Users have achieved profits exceeding 1000% in a single 5-minute cycle. Even with minimal price changes, under 1%, returns can be significant over 200%.

The company is also developing a pioneering liquidation protection solution for lending protocols. This innovative feature will allow users to protect their collateralised positions by purchasing options-based protection directly within lending protocols. By automating the protection process and promoting competition among market makers, EthosX aims to deliver the most cost-effective liquidation protection available.

EthosX offers a comprehensive derivatives Request for Quote (RFQ) platform for institutional clients. This platform, much like the way over-the-counter (OTC) trading operates in traditional finance, enables institutions to create and respond to RFQs for highly customisable options and strategies, addressing various use cases across asset classes. While it’s worth noting that in traditional finance, 80% of derivatives trading is OTC and not on exchanges, the crypto market is still evolving in that direction. Further, EthosX promotes a fair and efficient marketplace for institutional derivatives trading by providing anonymous liquidity and equal access to all traders.

EthosX’s on-chain clearing and settlement mechanism ensures that all derivatives are fully on-chain, eliminating settlement risk and minimising counterparty risk. The platform’s capital efficiency is enhanced by an ‘on-chain clearinghouse,’ which facilitates under-collateralised trading and ensures trade continuity. This decentralised approach guarantees that trades and assets remain unaffected even if EthosX were to cease operations. It provides advanced risk management features to traders like cross-trade netting, on-chain trade auctions in case of defaults, multiple tranches of insurance funds with different risk-reward structures, etc. It is as if the mighty London Clearing House itself was running on the blockchain.

The derivatives market presents a vast opportunity, with the notional value of traditional derivatives exceeding $600 trillion. The crypto derivatives market is also experiencing rapid growth, with projections indicating a substantial compound annual growth rate (CAGR) by 2030. EthosX is well-positioned to capitalise on this expanding market by offering innovative solutions that meet the evolving needs of traders.

To learn more about EthosX and its platform, visit www.ethosx.finance or connect with the company on X, Discord, & LinkedIn.

About EthosX

EthosX is a pioneering platform for trading derivatives on blockchains. The company aims to democratise derivatives trading by making it accessible, efficient, and secure for all participants. EthosX offers a range of innovative products and services, including Operps (Perpetual Options), lending protocol liquidation protection, and a derivatives RFQ platform for institutional clients. Backed by prominent investors and driven by a team of experienced professionals, EthosX spearheads the evolution of on-chain derivatives trading.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.