As someone been working in Crypto space since late 2016, I’ve witnessed the ebbs and flows of the market over the years. The rise and fall of various altcoins, and the ongoing evolution of the crypto ecosystem have been nothing short of fascinating. Recently, I’ve been reflecting on where we are right now, particularly considering the growing institutional interest in Bitcoin. If someone had told me five years ago that we would be in the situation we are today, I would have called them crazy. Yet here we are, witnessing a fundamental shift in the market that has profound implications for the future of Bitcoin and the broader crypto landscape.

First and foremost, it’s important to understand that Bitcoin is not going anywhere. Despite the market’s volatility and the occasional downturns, Bitcoin has consistently shown resilience. It’s a long-term game, and if you zoom out, the trend is clear: Bitcoin’s value is on an upward trajectory, while fiat currencies continue to lose purchasing power. The entry of institutional players, particularly through Bitcoin ETFs, has further solidified Bitcoin’s place in the financial world.

The introduction of ETFs by major Wall Street firms like BlackRock and Fidelity has been a game-changer. These products have captured a significant portion of the global ETF market, making it easier than ever for the average investor to gain exposure to Bitcoin without the need for technical know-how. Gone are the days when one needed to navigate the complexities of setting up a wallet and managing private keys. Now, you can simply log into your brokerage account and buy Bitcoin, which is securely held by some of the world’s largest financial institutions.

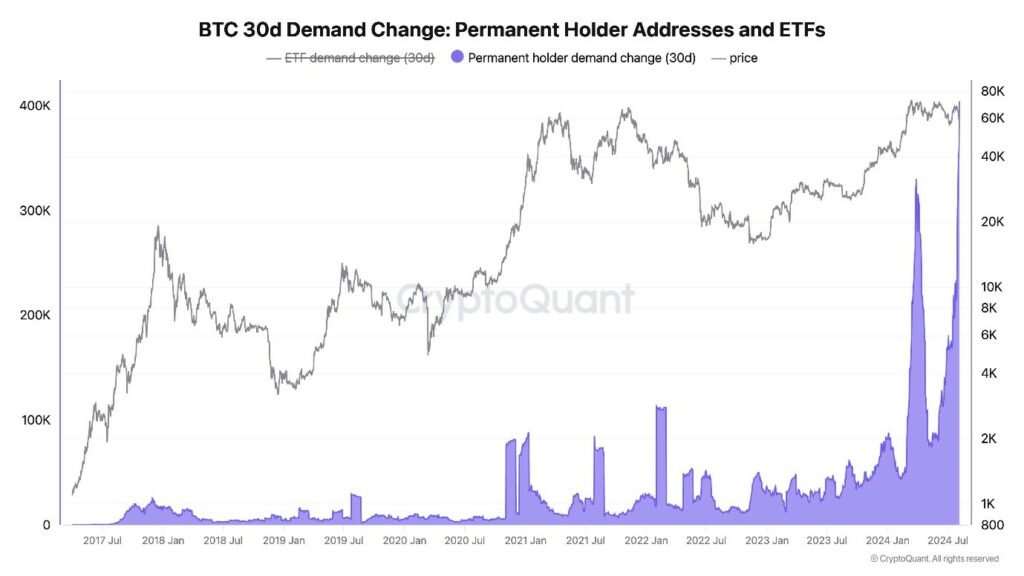

This shift has opened the floodgates for institutional money to flow into Bitcoin. We’ve already seen over $17 billion in net inflows into these ETF products, and what’s remarkable is that many of these investors are holding strong, even during significant market selloffs. This institutional backing is a testament to the growing recognition of Bitcoin as a legitimate and valuable asset class.

Moreover, the involvement of big banks and financial institutions is further proof of Bitcoin’s legitimacy. Morgan Stanley, for example, has unleashed a team of 15,000 salespeople to promote Bitcoin to their clients. While not every investor will jump on board, the fact that such a major player is actively pushing Bitcoin is a clear sign that the landscape is changing. Other big banks are likely to follow suit, driven by the desire to capture their share of the lucrative fees associated with Bitcoin investments.

But it’s not just the institutional players making moves. Bitcoin whales—the large holders of Bitcoin—have been strategically accumulating during recent market dips. These whales “drank deep,” purchasing thousands of Bitcoins when prices were low. Their actions are a strong indicator of confidence in Bitcoin’s long-term potential. Whales have always been a significant force in the crypto market, and their continued accumulation suggests they believe Bitcoin’s value is poised to rise substantially in the future. This behaviour reinforces the idea that those with significant capital see Bitcoin as a valuable asset for the long haul.

It’s also worth noting the growing interest from sovereign wealth funds. While we already know that countries like El Salvador and Bhutan have been involved in Bitcoin for some time, the possibility of large sovereign wealth funds entering the market could have a massive impact. These funds have deep pockets, and their entry into the Bitcoin market would likely result in significant supply being removed from circulation, driving up the price over time.

Similarly, pension funds and other institutional investors are starting to dip their toes into the Bitcoin market. While the amounts may seem small at first—like Jersey City’s $3 million investment—these investments add up quickly. As more institutions recognize the long-term potential of Bitcoin, we can expect to see even more money flowing into the market.

In addition to whales, a growing number of companies are also doubling down on Bitcoin. Leading the charge is MicroStrategy, the business intelligence firm that has become synonymous with corporate Bitcoin investment. The company is raising an additional $2 billion to purchase more Bitcoin, reflecting CEO Michael Saylor’s unwavering belief in Bitcoin’s long-term value. MicroStrategy’s strategy is clear: accumulate as much Bitcoin as possible, betting that its value will appreciate significantly over time. This bold move has made MicroStrategy a major player in the crypto space, demonstrating how corporations can significantly influence Bitcoin’s adoption.

Similarly, Marathon Digital, a prominent Bitcoin mining company, is raising $250 million to buy more Bitcoin. Marathon’s decision to invest heavily in Bitcoin itself—beyond just mining it—shows their belief in Bitcoin’s future value. The company’s strategy is to acquire Bitcoin now while prices are perceived to be low, anticipating higher prices in the future. This move underscores the broader trend of companies within the crypto space not only participating in Bitcoin but also actively holding it as a long-term investment.

There are hints that there is possibility that even larger corporations, particularly tech giants like Facebook (Meta), could soon start adding Bitcoin to their balance sheets. While this remains speculative, the idea that major global companies might begin to hold Bitcoin as a strategic asset is becoming more plausible. As these companies look to stay ahead of financial trends, they could be compelled to invest in Bitcoin to avoid being left behind.

These corporate investments, both from companies directly involved in Bitcoin and those outside the crypto space, are significant because they contribute to reducing the available supply of Bitcoin on the market. As more companies accumulate and hold Bitcoin, the scarcity of available Bitcoin increases, which can drive up prices over time.

In conclusion, the game has fundamentally changed for Bitcoin. It’s no longer just the domain of tech-savvy enthusiasts and early adopters. Bitcoin has entered the mainstream, and its future looks brighter than ever. While there will undoubtedly be volatility along the way—this is Bitcoin, after all—the long-term potential is enormous. For those who can hold on for the ride, the rewards could be life changing.

Bitcoin isn’t just surviving; it’s thriving. And as the world wakes up to its potential, the only question left is: Are you ready to be a part of this revolution?

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.