As we enter a fresh crypto bull market, the energy is palpable. For those aiming to achieve financial freedom, especially in the uncertain economic landscape we face, the crypto market presents both a challenge and an opportunity. Recently, a lot of focus has turned toward meme coins, AI tokens, and new blockchain projects as potentially lucrative avenues. The question is, how do we approach these trends strategically?

I can’t help but notice how, despite sceptics’ warnings, meme coins are leading the charge in terms of returns. They might not be for everyone, but in a time when economic pressures are squeezing income and opportunities, these coins are capturing a lot of attention. But there’s more to consider curating your feed to stay ahead, engaging with crypto communities, and looking to new blockchain projects, while not forgetting the importance of an exit strategy. Here’s a look at how to approach these opportunities with a plan.

Meme Coins: The Wild Card with High Reward Potential

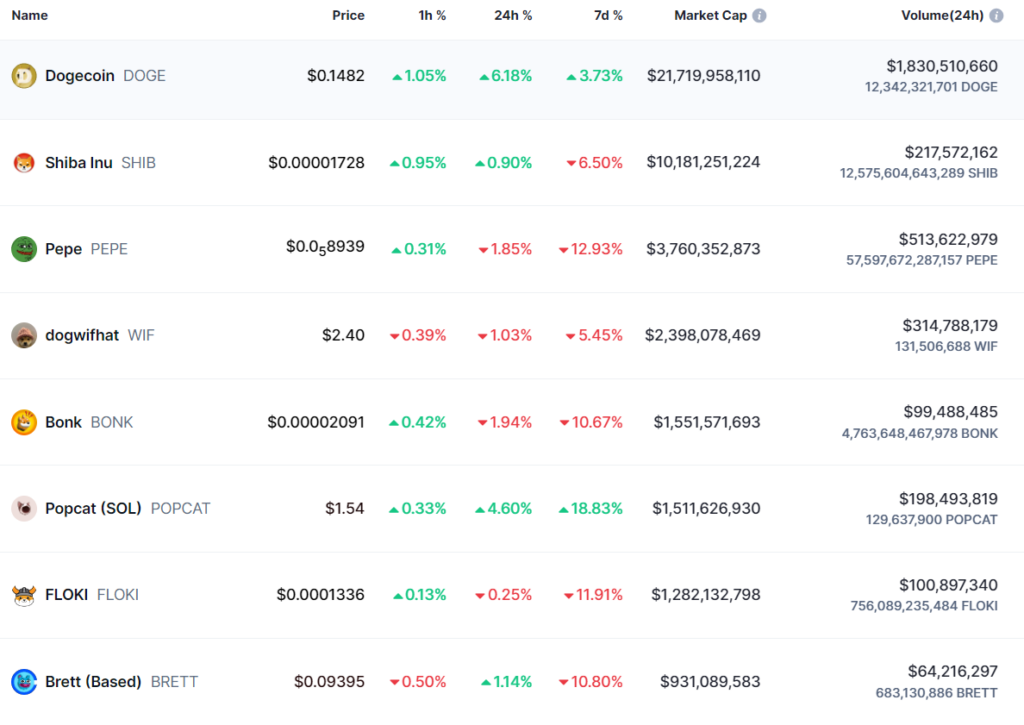

Love them or hate them, meme coins have a strong hold on the market right now, and for good reason. They tap into something unique an almost primal desire for quick gains in an era where traditional financial stability feels out of reach for many young investors. Meme coins, for all their volatility, offer a high-risk, high-reward path, and it’s no surprise they’re thriving. If you’re looking to get involved, the key is to focus on low-cap meme coins with strong community backing and liquidity. These are typically the projects that have room to grow.

In this bull cycle, meme coins have become what NFTs were a few years ago: they’re cultural, they’re hype-driven, and they’re creating waves across social media. For those of us trying to capitalize on this trend, it’s about finding the projects that have already gained traction or have the potential to do so. The sweet spot often lies in meme coins with market caps between $50 million and $200 million, particularly after they’ve retraced from a big pump. These coins can offer a fair balance between risk and reward without the extremes of ultra-low caps.

Building an Information Edge: Curate Your Feed for Success

One of the biggest advantages you can give yourself in this market is information. Being plugged into the right news sources, influencers, and crypto research feeds can make all the difference. Crypto moves fast, and having up-to-date, reliable information can help you identify trends before they explode. In this space, information asymmetry is real those who know more, sooner, have a clear edge.

For me, this means keeping my social media and news feeds laser-focused. I’ve trimmed out the noise, ditched the cat videos, and prioritized accounts and channels that provide alpha on new projects, market updates, and sector insights. Platforms like Twitter (or X) allow you to create lists of key influencers, researchers, and traders. Setting up a curated feed of high-quality crypto content can save hours of doom-scrolling and allow you to stay ahead of market movements.

The Rise of AI Tokens: The Next Big Thing?

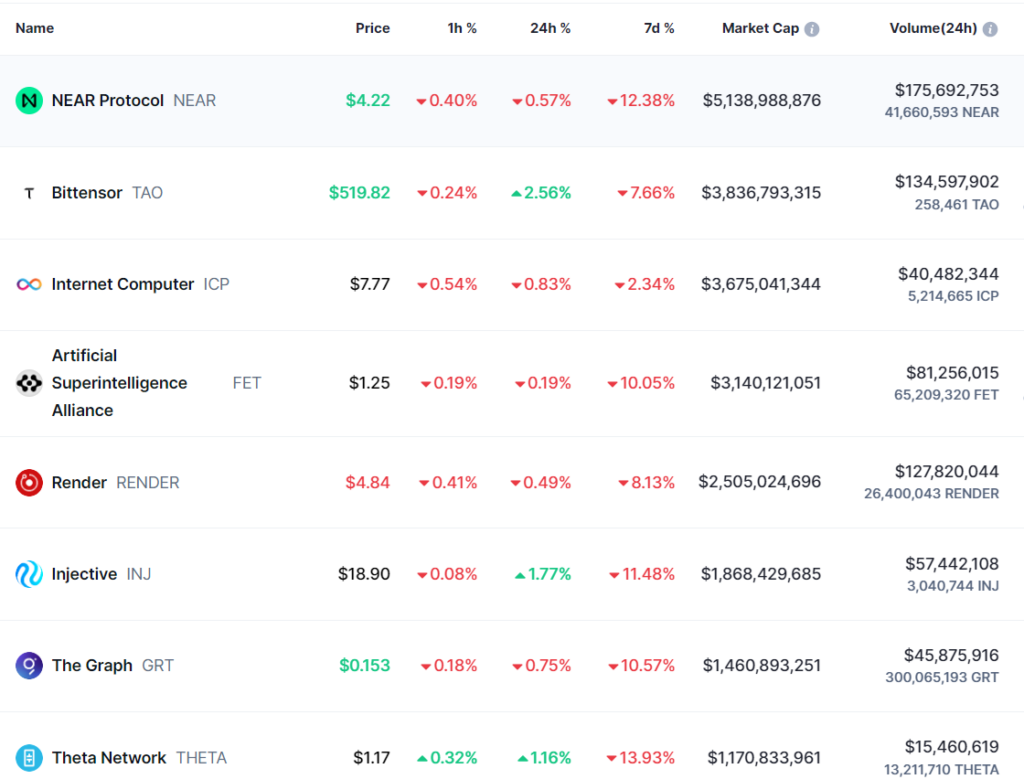

As we move deeper into 2024, AI is taking a prominent position in the crypto world. The AI narrative is everywhere, with AI tokens capturing substantial attention. Despite the excitement around meme coins, AI tokens are also rising and may be the next sector to see a massive uptick in value. What’s intriguing is that the market cap for AI tokens remains relatively low compared to other sectors, which signals untapped potential.

The intersection of AI and crypto is particularly compelling. Imagine AI-driven tokens that work autonomously, engaging in trades or providing decentralized services without human intervention. This sector has already seen significant surges and retracements, but as the bull market gains momentum, AI tokens could offer massive returns, especially those linked to high-demand technologies like cloud rendering or neural networks.

If you’re looking for an opportunity with potentially high returns but a bit less volatility than meme coins, AI tokens may be worth exploring. Established names like Render and BitTensor have solid track records and community support, making them good options for those seeking high potential without the unpredictability of meme coins.

Finding Your Tribe: Engage with Crypto Communities

One thing I’ve learned in the crypto world is that community matters. Staying isolated in this market can make it tough to keep up. Crypto communities on platforms like Telegram and Discord are not just places to share news they’re vital for discussing new projects, sharing insights, and learning from others. In a space where trends shift rapidly, being part of a community helps you stay adaptable.

For me, engaging with a crypto community offers more than just information. It provides an environment where I can exchange ideas, discuss strategies, and learn about new projects that might otherwise fly under the radar. It’s also a way to gauge sentiment. Is there excitement around a particular project? Is the community actively discussing it? These are the kind of insights that can’t be gleaned from charts alone.

Out with the Old, In with the New: Layer 1 Blockchains on the Rise

Another trend worth paying attention to is the rise of new layer-1 blockchains. While classic chains like Ethereum and Bitcoin are here to stay, there’s an undeniable shift toward newer, faster, and more scalable blockchains. This trend reflects a larger “out with the old, in with the new” mentality, where investors are gravitating towards the latest projects, often because they bring novel technologies and fresh utility.

Sui and Aptos are two such examples that have garnered attention recently, with strong backing and innovation in their ecosystems. Unlike some older chains, these projects are positioning themselves as solutions for the modern blockchain era, capable of handling the demands of DeFi, NFTs, and scalable applications. Allocating some capital to promising new layer-1s can provide both stability and growth potential, but it’s essential to remain selective. Not every new chain will thrive, but those that do could offer substantial returns.

Preparing an Exit Strategy: Don’t Let Gains Slip Away

One of the hardest lessons I’ve learned over the years is that in crypto, gains can evaporate as quickly as they appear. It’s easy to get caught up in the excitement of a bull run, watching your portfolio grow and thinking it will only go up. But we all know that markets are cyclical, and there will be another bear market eventually. Preparing an exit strategy is key to ensuring that you don’t lose the profits you worked so hard to earn.

Planning an exit strategy before the market reaches its peak allows you to lock in gains without making decisions driven by fear or greed. Knowing when and how to take profits whether it’s a certain percentage of your holdings at specific price points, or a complete exit once your target is met can save you from the heartache of watching your portfolio peak and then plummet.

Final Thoughts: Navigating the Bull Market with a Plan

As we move further into this bull market, the opportunities are exciting but require a well-thought-out approach. Whether it’s the high-risk potential of meme coins, the promising growth of AI tokens, or the stable returns from new layer-1 blockchains, there are multiple avenues to explore. But more than anything, success in crypto is about positioning yourself intelligently, staying informed, and having a clear strategy.

The crypto market may be unpredictable, but with the right mindset and tools, it’s possible to make gains that can be genuinely life changing. By focusing on key narratives, engaging with communities, and ensuring that you have an exit plan in place, you’re setting yourself up to navigate this bull run strategically and avoid common pitfalls. For those ready to take on the risks, this market offers opportunities unlike any other and the chance to build a financial foundation that could last a lifetime.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.