The rise of Non-Fungible Tokens (NFTs) has transformed the way we perceive digital ownership, allowing artists, collectors, and investors to buy and sell unique assets on blockchain-based marketplaces. However, with any emerging financial technology, there are risks associated with fraudulent activities. Two of the most prevalent illicit practices in the NFT space are wash trading and money laundering. These activities not only undermine the credibility of the NFT market but also pose serious legal and financial consequences.

While both wash trading and money laundering involve deceptive transactions, they serve different purposes. Wash trading is primarily used to manipulate market prices and create an illusion of demand, whereas money laundering focuses on disguising the origin of illicit funds by integrating them into legitimate financial systems. Understanding how these fraudulent activities work and their impact on the NFT ecosystem is essential for buyers, sellers, and regulators alike.

In this guide, we’ll explore these fraudulent practices in detail, discuss how they affect the NFT market, and provide insights into regulatory efforts aimed at preventing such activities. We’ll also share actionable steps to help individuals protect themselves from falling victim to these scams.

What Is Wash Trading?

Wash trading is a market manipulation technique where the same asset is bought and sold multiple times by the same entity to create the illusion of high demand. In the NFT space, this involves an individual or group using multiple wallets to repeatedly trade the same NFT, artificially inflating its value and trading volume.

The goal of wash trading is to mislead potential buyers into thinking that an NFT is highly valuable and in demand. Once a false sense of scarcity and desirability is established, unsuspecting buyers may be convinced to purchase the asset at a significantly inflated price, believing it to be a sound investment.

How Does Wash Trading Work?

Wash trading in NFTs follows a simple but deceptive cycle:

- Minting or Acquiring an NFT: The fraudster either creates or buys an NFT on a marketplace.

- Selling the NFT to Themselves: Using multiple wallets under their control, they repeatedly buy and sell the NFT back and forth.

- Increasing Perceived Value: This series of transactions creates an illusion of demand and artificially raises the NFT’s price.

- Attracting Real Buyers: The fraudulent trading activity attracts unsuspecting investors who believe the NFT has genuine value.

- Selling at an Inflated Price: Once real buyers enter the market, the wash trader sells the NFT for a profit, leaving buyers with an overpriced and potentially worthless asset.

Real-World Examples of NFT Wash Trading

One of the most notable cases of wash trading in NFTs occurred in October 2021, involving a CryptoPunks NFT called “CryptoPunk 9998.” This NFT was sold for 124,457 Ether (ETH), worth hundreds of millions of dollars at the time. However, blockchain analysis revealed that the funds were returned to the original buyer through a series of transactions, proving that the sale was merely a fabricated transaction.

Another major case was uncovered in April 2022, when an NFT tracker reported that 95% of the trading volume on LooksRare, a popular NFT marketplace, was generated through wash trading. This equated to over $18 billion in fake transactions designed to make the platform appear more active than it actually was.

The Impact of Wash Trading on the NFT Market

The consequences of wash trading extend beyond individual buyers who may fall for artificially inflated prices. This practice can have far-reaching negative effects on the entire NFT ecosystem:

- Market Manipulation: Investors and collectors make decisions based on misleading data, leading to financial losses.

- Reduced Trust in NFTs: Buyers become skeptical of NFT valuations, leading to decreased confidence in the industry.

- Regulatory Scrutiny: Governments and financial watchdogs may impose stricter regulations, affecting legitimate NFT projects.

- Hindrance to Market Growth: As scams become more prevalent, mainstream investors may avoid NFTs, slowing adoption.

What Is Money Laundering?

Money laundering in NFTs is the process of disguising illegally obtained funds by purchasing and selling NFTs. Criminals use NFTs as a tool to move illicit money through the digital economy while making it appear as though the funds originated from legitimate sources.

This form of financial crime has gained traction due to the pseudonymous nature of blockchain transactions, making it challenging for authorities to track the origin of funds. Additionally, the global and decentralized nature of NFT platforms allows criminals to move money across borders with ease.

How Does NFT Money Laundering Work?

Money laundering through NFTs generally follows a structured three-step process:

- Placement: Criminals use illegally obtained money (such as funds from fraud, drug trafficking, or cybercrime) to purchase NFTs.

- Layering: To obscure the money trail, the NFTs are transferred across multiple wallets, often using different blockchain platforms to create complexity.

- Integration: The NFTs are eventually sold, and the “cleaned” money is withdrawn or reinvested into legitimate assets, such as real estate or businesses.

Case Study: NFT Money Laundering in Action

A prime example of NFT-related money laundering involved Chatex, a Russia-based cryptocurrency exchange that facilitated illicit transactions through Telegram. The US Treasury Department sanctioned Chatex in November 2021 for its role in enabling criminals to launder money using NFTs and other crypto assets. By allowing anonymous transactions, Chatex became a hub for laundering millions of dollars linked to ransomware attacks and fraud.

The Impact of Money Laundering on the NFT Market

Money laundering poses significant threats to both NFT platforms and the broader financial system:

- Legal and Regulatory Risks: NFT platforms could face legal action and fines for failing to comply with anti-money laundering (AML) regulations.

- Market Reputation Damage: The association of NFTs with crime can lead to a negative perception of the industry.

- Increased Scrutiny on Users: More stringent identity verification processes (KYC) may be imposed, affecting privacy-conscious users.

- Loss of Investor Confidence: Investors may hesitate to participate in the NFT market due to fears of involvement in illegal activities.

How Authorities Are Addressing Wash Trading and Money Laundering in NFTs

As the NFT market continues to expand, it has attracted increasing scrutiny from regulators, law enforcement agencies, and financial watchdogs worldwide. While NFTs present groundbreaking opportunities in digital ownership, their decentralized and pseudonymous nature has made them a breeding ground for fraudulent activities such as wash trading, money laundering, and other illicit financial schemes. Governments and regulatory bodies are now actively working to introduce measures that prevent abuse, protect investors, and ensure compliance with financial regulations.

Regulatory Bodies Taking Action Against NFT Fraud

Various financial regulatory authorities have begun monitoring and enforcing stricter oversight on NFT marketplaces. These organizations are working on establishing guidelines, identifying bad actors, and penalizing fraudulent activities to create a more transparent and trustworthy NFT ecosystem.

1. U.S. Securities and Exchange Commission (SEC)

The U.S. SEC plays a critical role in overseeing financial markets, including digital assets like cryptocurrencies and NFTs. While NFTs are often considered digital collectibles or art, certain types of NFTs may be classified as securities, making them subject to U.S. investment laws.

How the SEC is Addressing NFT Fraud:

- The SEC closely monitors whether NFTs function as securities—meaning they provide buyers with an expectation of profit based on the efforts of others.

- NFT projects that promise future returns, share profits, or operate like traditional investment vehicles may be classified as securities, subjecting them to strict regulatory oversight.

- The agency has issued subpoenas to NFT companies suspected of engaging in fraudulent or misleading investment practices.

- Enforcement actions are taken against companies and individuals violating federal securities laws by selling unregistered NFT-based securities.

Example Case: In 2023, the SEC took legal action against Impact Theory, a media company that sold NFTs while making claims that suggested profit potential. The SEC ruled that these NFTs functioned as unregistered securities, requiring the company to refund $7.7 million to investors. This case set a precedent for how NFT projects promoting financial gains may face regulatory action in the future.

2. Financial Action Task Force (FATF)

The FATF is a global organization that sets standards for anti-money laundering (AML) and combating the financing of terrorism (CFT). Since the NFT industry operates across international borders, FATF’s policies provide guidance for governments and businesses worldwide to combat illicit financial activities.

FATF’s Approach to NFT Regulation:

- NFT platforms must implement Know Your Customer (KYC) policies to verify the identity of buyers and sellers.

- Anti-money laundering (AML) compliance is required for NFT marketplaces, ensuring that large transactions are monitored and reported if suspicious.

- FATF advises nations to treat NFT platforms as Virtual Asset Service Providers (VASPs) if they facilitate transactions that resemble traditional financial services.

- Countries that fail to enforce AML policies for digital assets risk being placed on FATF’s “gray list”, which can result in economic and trade restrictions.

Why FATF’s Role is Important: Criminal organizations, corrupt officials, and cybercriminals have used NFTs to launder illicit funds, taking advantage of anonymous wallet addresses and decentralized trading. FATF’s regulations aim to increase transparency in NFT transactions while helping financial institutions and law enforcement identify suspicious activities more effectively.

3. European Union’s Markets in Crypto-Assets (MiCA) Regulation

The European Union (EU) has been proactive in regulating the cryptocurrency and NFT sectors through its Markets in Crypto-Assets (MiCA) regulation. MiCA aims to create a clear legal framework for digital assets, including NFTs, ensuring compliance with financial and consumer protection laws.

MiCA’s Impact on NFTs:

- Requires NFT platforms to register as financial service providers if their activities resemble investment or trading markets.

- Establishes clear rules for investor protection, ensuring that buyers receive transparent information about NFTs before purchasing.

- Mandates platforms to conduct thorough identity verification (KYC) to prevent money laundering and fraud.

- Helps reduce market manipulation by requiring greater disclosure on NFT pricing and ownership records.

- Introduces penalties and legal actions against entities engaged in fraudulent NFT sales.

Why MiCA Matters: The EU is setting a precedent for NFT regulation worldwide by treating digital assets with the same level of oversight as traditional financial instruments. As MiCA’s regulations take effect, other countries may adopt similar policies to bring clarity and accountability to their own NFT markets.

4. Government Crackdowns on NFT Fraud

Many national governments have initiated investigations, arrests, and sanctions against individuals and platforms involved in fraudulent NFT schemes.

Examples of Government Crackdowns:

- United States: The Department of Justice (DOJ) has prosecuted individuals using NFTs for money laundering, particularly in cases where criminals purchased NFTs with illicit funds and resold them to “clean” their money.

- China: In an effort to combat crypto-related financial crimes, China has banned NFT speculation and imposed strict regulations on blockchain-based trading.

- United Kingdom: The UK’s Financial Conduct Authority (FCA) has issued warnings about NFT scams and unregistered investment schemes, urging consumers to exercise caution.

- Russia: Russian authorities have monitored the use of NFTs in black-market transactions, particularly as a tool for sanctions evasion and money laundering.

Key Takeaway: Government actions signal a shift toward stricter NFT regulation. As fraud cases increase, more nations will introduce laws to protect consumers and prevent financial crime in the NFT sector.

Recent Enforcement Actions Against NFT Fraud

While regulations continue to evolve, authorities have already cracked down on several NFT-related scams. These enforcement actions serve as a warning to bad actors and highlight the growing seriousness of legal compliance in the industry.

SEC vs. Impact Theory (2023) – Unregistered NFT Securities Case

- Case Summary: The SEC accused Impact Theory, a media company, of selling NFTs that functioned as investment contracts without proper registration.

- Ruling: The SEC determined that Impact Theory’s NFT sales violated U.S. securities laws because the company marketed the NFTs as profit-generating assets.

- Penalty: Impact Theory was required to refund $7.7 million to investors and cease future NFT sales that could be classified as securities.

Why This Matters: The SEC’s ruling sets a legal precedent that NFT projects making investment-related claims may be subject to securities laws.

LooksRare Wash Trading Scandal – $18 Billion in Fake Transactions

- Case Summary: NFT tracker CryptoSlam found that over 95% of the trading volume on LooksRare was generated through wash trading—fake transactions between related wallets.

- Impact: The fraud created an illusion of high market activity, misleading investors into believing that LooksRare was one of the most active NFT marketplaces.

- Response: Following the exposure, LooksRare faced regulatory scrutiny, leading to a significant decline in its trading volume.

Lesson Learned: Buyers should always analyze transaction histories and avoid NFTs with unrealistic trading activity to prevent falling for manipulated pricing schemes.

How to Protect Yourself from NFT Fraud

The growing popularity of Non-Fungible Tokens (NFTs) has created exciting opportunities for artists, collectors, and investors. However, with any emerging financial market, fraudsters and bad actors take advantage of unsuspecting individuals. Fraud in the NFT space can take various forms, including wash trading, money laundering, counterfeit NFTs, and phishing scams. As the industry evolves, it is crucial to adopt strategies to protect yourself from falling victim to fraudulent schemes.

1. Purchase NFTs from Verified Creators and Reputable Marketplaces

One of the most effective ways to protect yourself from NFT fraud is to ensure that you are purchasing from legitimate and verified sellers. Many NFT marketplaces provide verification badges for reputable creators and collections. However, fraudsters still find ways to imitate well-known artists, tricking buyers into purchasing counterfeit NFTs.

How to Verify an NFT Seller

- Look for Verification Badges – Trusted NFT marketplaces such as OpenSea, Rarible, and SuperRare use verification systems to distinguish legitimate creators from impostors. A blue checkmark or similar badge next to the creator’s name indicates authenticity.

- Check the Official Website or Social Media – Many reputable NFT creators have official websites and social media accounts linking directly to their NFT collections. Always cross-check links before making a purchase.

- Join the Community – Many NFT projects have active Discord, Twitter, or Telegram communities where you can interact with the creators and team. Engaging in these groups allows you to confirm whether an NFT listing is legitimate.

- Be Wary of Fake Collections – Scammers often create fake collections that mimic popular projects. Always verify that you are buying from the correct contract address, which can be found on the official project website.

By taking the time to verify the authenticity of NFT sellers, you significantly reduce the risk of purchasing counterfeit or scam NFTs.

2. Identify Suspicious Trading Patterns

Another key strategy to avoid fraud is to analyze the transaction history of an NFT. Scammers often engage in wash trading, where they artificially inflate an NFT’s price by repeatedly buying and selling it between wallets they control.

How to Check an NFT’s Transaction History

- Use Blockchain Explorers – Platforms like Etherscan, Solscan, or Polygonscan allow users to track NFT transactions on the blockchain. By entering an NFT’s contract address or token ID, you can see its entire transaction history.

- Identify Red Flags – If you notice that an NFT has been sold multiple times between the same wallets in a short period, it is likely a case of wash trading aimed at manipulating the price.

- Compare with Similar NFTs – Check how other NFTs in the same collection are priced and traded. If an NFT’s price has suddenly skyrocketed without any real demand, it might be a scam.

- Verify Wallet Activity – If an NFT is being transferred between wallets with little or no other transaction history, it could be part of a money laundering scheme.

Taking the time to examine an NFT’s on-chain transaction history helps you avoid falling for artificially inflated assets and deceptive trading practices.

3. Beware of Sudden Price Surges

NFTs, like any other asset, gain value based on demand and market interest. However, fraudsters use price manipulation techniques to deceive buyers into believing an NFT is worth more than it actually is.

How Price Manipulation Works

- Wash Trading – A scammer repeatedly buys and sells the same NFT to increase its price and make it seem like a hot asset.

- Fake Bidding Wars – Some sellers use multiple accounts to place fake bids on their NFTs, tricking real buyers into overpaying.

- Pump-and-Dump Schemes – Scammers promote an NFT project aggressively, causing a sudden price surge. Once buyers invest, the fraudsters quickly sell off their holdings, leaving buyers with worthless assets.

How to Spot Suspicious Pricing

- Research Floor Prices – The “floor price” is the lowest price for an NFT in a collection. If an NFT is priced significantly higher than similar ones without any added value, be cautious.

- Check the Seller’s History – If the seller has no previous NFT sales or a history of high-price spikes, it could indicate fraudulent activity.

- Look at Market Trends – If an NFT’s price has increased dramatically overnight without any major announcements or real demand, it may be a scam.

By avoiding artificially inflated NFTs, you can ensure that you are making sound investment decisions based on genuine demand and market value.

4. Trade Only on Trusted NFT Marketplaces

Not all NFT marketplaces have strong security measures in place to protect buyers and sellers. Choosing a reputable and secure platform is critical to preventing fraud and scams.

Characteristics of a Secure NFT Marketplace

- Verification System – Platforms like OpenSea and Rarible verify legitimate creators and projects, helping users distinguish between real and fake collections.

- Smart Contract Audits – Some marketplaces use audited smart contracts to ensure that transactions are secure and free from vulnerabilities.

- KYC (Know Your Customer) Processes – While many NFT platforms allow anonymous transactions, those with KYC policies add an extra layer of security by verifying users’ identities.

- Built-in Fraud Protection – Reputable platforms actively monitor suspicious activities and flag potential scams before users fall victim.

Examples of Trusted NFT Marketplaces

- OpenSea – One of the largest and most established NFT marketplaces, known for its verification processes and fraud detection tools.

- Rarible – A decentralized marketplace that uses a community voting system to identify and remove fraudulent listings.

- SuperRare – Focuses on high-quality digital art and thoroughly vets artists before allowing them to list NFTs.

Using a secure and reputable NFT marketplace reduces the risk of encountering fraudulent listings, counterfeit NFTs, and security breaches.

5. Report Suspicious Activity

If you come across an NFT listing, seller, or transaction that appears fraudulent or suspicious, it is important to report it immediately. Many NFT marketplaces and blockchain analytics firms are working to combat fraud, and your report can help prevent others from becoming victims.

How to Report NFT Fraud

- Contact the NFT Marketplace – Most platforms, including OpenSea and Rarible, have fraud reporting features where users can flag suspicious listings and sellers.

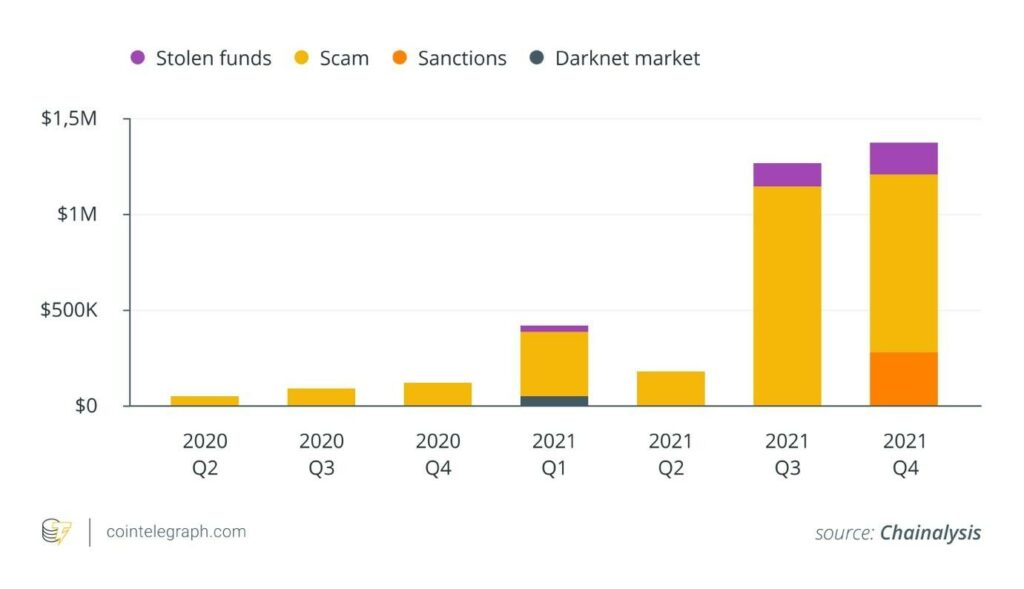

- Use Blockchain Analytics Tools – Companies like Chainalysis and Elliptic track fraudulent blockchain activities and help authorities identify criminal behavior.

- Report to Law Enforcement – If you suspect large-scale fraud or money laundering, report it to cybercrime units or financial regulatory bodies in your country.

- Warn the Community – Posting alerts in NFT communities on Discord, Twitter, and Reddit can help others avoid similar scams.

By actively reporting fraudulent activities, you contribute to a safer NFT ecosystem and help prevent scams from spreading.

Final Thoughts

The NFT space presents exciting opportunities for digital ownership and investment, but it is also vulnerable to fraudulent practices such as wash trading and money laundering. By understanding how these scams operate, you can make informed decisions, protect your investments, and contribute to a more transparent and trustworthy NFT market. As the industry matures, increased regulation and improved security measures will help shape a safer and more legitimate marketplace for all participants.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.