Yuga Labs, known for creating Bored Ape Yacht Club (BAYC), has become one of the most iconic names in the NFT space. From leading the charge in NFTs to expanding into gaming and metaverse spaces, Yuga Labs has always been at the forefront of innovation. But as the initial NFT hype has faded, questions are being raised: Can Yuga Labs deliver on its lofty $4 billion valuation, and more importantly, is it still a good investment opportunity?

As an analyst who has closely watched the rise of NFTs and the evolution of digital assets, I find Yuga Labs’ journey particularly interesting. The company has achieved incredible milestones, but the NFT market—and the broader Web3 ecosystem—has changed dramatically. To truly understand whether Yuga Labs is still worth considering as an investment, we need to examine not only their past success but also how they’re positioning themselves for the future.

The Initial Rise: From NFTs to Cultural Phenomenon

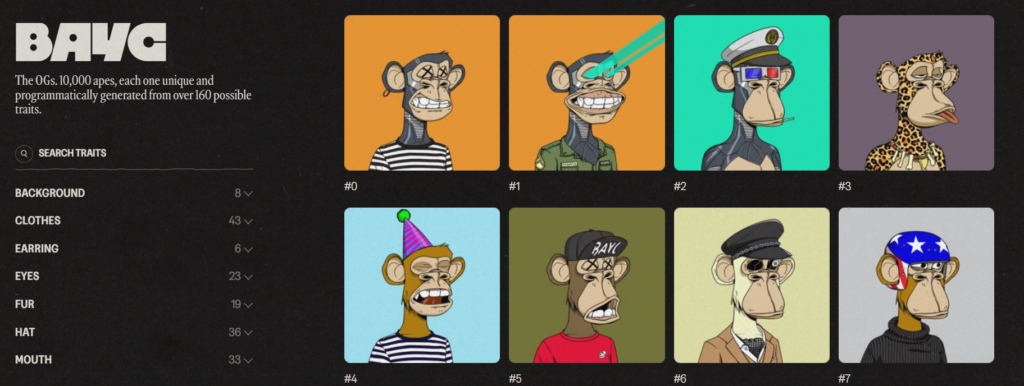

Yuga Labs’ journey began with the Bored Ape Yacht Club, a collection of NFTs that quickly became one of the most coveted in the world. BAYC wasn’t just an art project; it was a social movement. Owners of these NFTs became part of an exclusive club, gaining access to private events, networking opportunities, and even real-world perks like parties and meetups. The sense of belonging that BAYC fostered turned it into a cultural phenomenon, one that attracted both celebrities and everyday investors alike.

This sense of community, combined with the rapid rise in value of the NFTs themselves, created immense excitement around Yuga Labs. But like many things in crypto, the euphoria didn’t last forever. The NFT market faced a downturn, and Yuga Labs, despite its best efforts, has been navigating these rough waters.

The Challenges: Can Yuga Labs Deliver on Its Valuation?

One of the most significant challenges facing Yuga Labs is living up to the massive valuation it garnered during the height of the NFT craze. With a valuation of $4 billion, expectations are sky-high. Investors who bought into the hype at the peak, paying exorbitant prices for NFTs and virtual land in projects like Otherdeed, may be feeling disillusioned. Many of these speculative purchases have not appreciated as hoped, leaving buyers questioning the long-term value of their investments.

It’s clear that Yuga Labs is aware of these challenges. They’ve made strategic moves to adapt, bringing in a management team and refocusing on the future of digital assets. But as the market evolves, Yuga Labs is faced with the daunting task of building something truly transformative, particularly in the realm of the metaverse. And this is where the conversation gets more complicated.

The Metaverse: Is Yuga Labs Too Late?

When Yuga Labs launched its vision for the Otherside metaverse, there was significant buzz. The idea was that the Otherside would become a virtual world where users could buy land, interact, and engage in a variety of experiences, all powered by blockchain technology. However, as time has gone on, the reality of building such a metaverse has proven to be more challenging than anticipated.

The question now is whether Yuga Labs can deliver a metaverse experience that meets expectations. The metaverse space is increasingly competitive, with companies like Meta (formerly Facebook) and other Web3 projects developing their own digital worlds. Some argue that Yuga Labs may have missed its window of opportunity to be a major player in this space. As the hype fades, so too might the enthusiasm for Yuga’s metaverse ambitions.

That said, the cultural value of BAYC still holds weight. Yuga Labs has built something bigger than just digital assets—it has built a brand. And that brand, which includes iconic projects like Cryptopunks, still has the potential to thrive, especially if they find a way to integrate their community into their metaverse projects more meaningfully.

The Bigger Picture: Communities and Long-Term Value

One of the key takeaways from Yuga Labs’ story is the power of community. Whether it’s BAYC or Cryptopunks, the core value of these NFTs lies in the networks and identities they create. These aren’t just digital assets—they’re social identifiers, badges of belonging for people who want to be part of something larger than themselves.

In this sense, Yuga Labs’ real success might not come from building a massive, Roblox-like metaverse. Instead, their strength lies in fostering a global community of like-minded individuals. The BAYC clubhouse in Miami and events like ApeFest demonstrate that there’s still a desire for real-world connections rooted in these digital assets. For many, owning a BAYC isn’t just about financial gain—it’s about being part of an exclusive, creative, and culturally relevant group.

This is where the future of Yuga Labs might lie. Rather than trying to compete with traditional gaming companies or massive metaverse projects, Yuga Labs can double down on its community-driven model, providing value through exclusivity and shared experiences.

Comparisons to Other NFT Projects

It’s worth noting that Yuga Labs isn’t the only project navigating the NFT space. Pudgy Penguins, for example, has garnered attention for its ability to deliver on its vision while maintaining a smaller, more focused community. The success of projects like Pudgy Penguins underscores an important point: building a long-lasting NFT project isn’t just about hype or capital—it’s about managing expectations and creating sustainable value for your community.

In comparison, Yuga Labs has raised much more capital and has much higher expectations to meet. This puts them in a more challenging position but also provides an opportunity to leverage their resources to innovate in ways that smaller projects simply can’t.

The Role of Venture Capital in Web3 Projects

It’s also important to consider the role of venture capital in shaping these projects. As we’ve seen with companies like Sixth Man Ventures, VCs play a crucial role in funding and guiding early-stage Web3 projects. But VCs are also known for their influence on the direction of these companies, sometimes pushing for rapid growth that may not always align with long-term sustainability.

In the case of Yuga Labs, their ability to balance the expectations of their investors with the needs of their community will be crucial. Venture capital has provided Yuga Labs with the capital to scale, but the question remains: will they be able to execute their vision without losing the authenticity that made them successful in the first place?

Final Thoughts: Is Yuga Labs Still a Good Investment?

So, is Yuga Labs still a good investment? The answer, as with most things in crypto, is nuanced. If you’re looking for immediate returns based on speculative hype, the ship may have sailed. The NFT market is no longer in its euphoric phase, and many of the initial buyers who got in during the peak may struggle to see their investments appreciate in the short term.

However, if you’re investing for the long haul and believe in the cultural significance of Yuga Labs’ projects, there’s still potential. Yuga Labs has proven itself to be a brand with staying power, and its community-driven model could continue to provide value in new and unexpected ways. The challenge will be in navigating the evolving landscape of Web3, particularly in the metaverse, where expectations are high and the competition is fierce.

For those willing to take a long-term view, Yuga Labs remains a project to watch closely. It’s not without risks, but in a space as dynamic as NFTs, the potential for innovation and cultural impact should not be underestimated.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.