The world of digital art and non-fungible tokens (NFTs) has experienced a whirlwind of growth, evolution, and volatility over the past few years, with platforms like MakersPlace playing a pivotal role in shaping the NFT landscape. Launched in 2018, MakersPlace emerged as a significant digital art marketplace, offering artists, creators, and collectors an innovative space to mint, buy, and sell unique NFT-based artworks. The platform quickly gained attention for its use of blockchain technology to provide secure, verifiable ownership for digital art, enabling artists to monetize their creations in ways that were previously unimaginable. Over the course of its existence, MakersPlace became one of the leading platforms in the NFT space, partnering with renowned artists and securing investments from major backers like Pantera Capital, Coinbase Ventures, and Sony Music Entertainment.

However, in a shocking turn of events, MakersPlace announced its closure on January 15, 2024, citing ongoing market challenges and financial difficulties that made it impossible to sustain operations. The platform, which once thrived during the explosive growth of the NFT market, was no longer able to weather the storm brought on by a significant downturn in the market. The announcement of MakersPlace’s shutdown is part of a larger trend within the NFT industry, which has faced a sharp decline in trading volumes and interest since its peak in 2021. As the digital art world grapples with the reality of a contracting market, MakersPlace’s closure serves as a stark reminder of the volatility inherent in the NFT space, illustrating how even well-established platforms can be swept away by shifting market dynamics.

MakersPlace: A Brief History and Rise to Prominence

MakersPlace was founded in 2018 with a clear and ambitious vision: to bring digital art to the forefront of the global art scene through the use of blockchain technology. The platform sought to create a new kind of marketplace for digital creators, where they could not only showcase their works but also monetize them in ways that were never before possible. By utilizing blockchain’s capabilities, MakersPlace allowed artists to mint their digital art as NFTs, providing a secure and verifiable proof of ownership that could be bought, sold, and traded on the open market. This approach was revolutionary in how it provided digital creators with the same kind of ownership and scarcity that traditional art forms enjoy.

The idea of NFTs (Non-Fungible Tokens) was still in its infancy when MakersPlace launched, but the platform quickly gained momentum by positioning itself as a trusted venue for both creators and collectors of digital art. Unlike traditional art marketplaces, which often required artists to depend on galleries, auction houses, or agents to reach buyers, MakersPlace offered a direct-to-collector model. This model empowered artists by allowing them to control the distribution and sale of their works, keeping more profits in their hands. Additionally, the blockchain-backed certificates of authenticity gave both buyers and sellers a sense of security and transparency that traditional art markets lacked.

MakersPlace provided artists with creative freedom while offering them a way to profit from their work. By allowing digital art to be sold as NFTs, the platform opened up new revenue streams for creators. Whether they were well-established artists with a large following or newcomers looking for exposure, the platform became an attractive option for anyone wanting to monetize their digital creations. The ability to mint NFTs on the blockchain meant that creators could also track their works, ensuring that they received the credit and financial compensation they deserved every time their art was sold or resold.

The Decline of the NFT Market

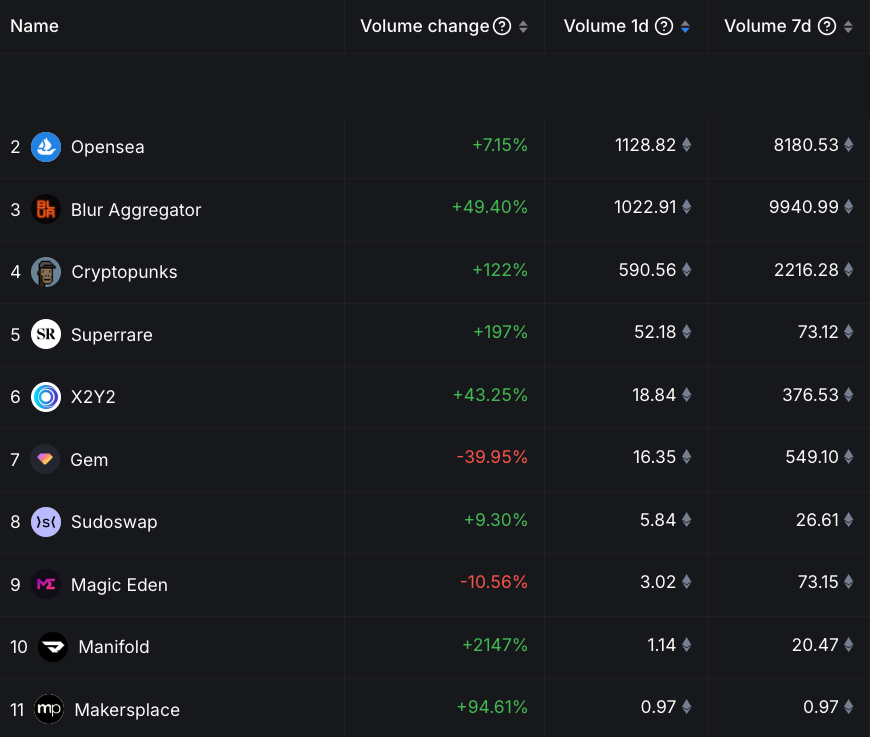

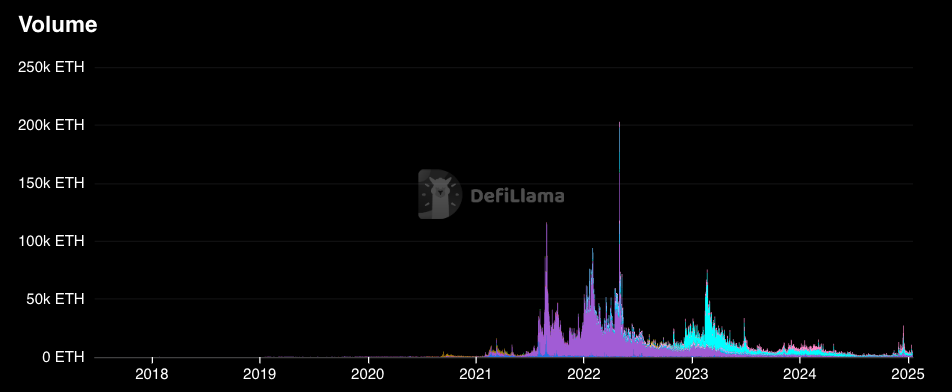

However, the rapid rise of NFTs was followed by an equally swift decline. By 2024, the NFT market was experiencing its worst performance levels since its inception. Trading volumes, which had surged to all-time highs in 2021, plummeted, and the enthusiasm surrounding NFTs began to fade. This decline was particularly pronounced in the wake of the broader cryptocurrency market downturn, which affected investor sentiment and liquidity.

At its peak in 2021, the NFT market was worth billions of dollars, with platforms like OpenSea, Rarible, and MakersPlace leading the charge. The advent of highly sought-after NFT collections, such as the Bored Ape Yacht Club and CryptoPunks, generated widespread media coverage and excitement. The popularity of NFTs was driven by their perceived potential to revolutionize the way digital art and collectibles were valued and traded, creating new avenues for artists and investors to profit.

But as the crypto market entered a “crypto winter” in 2022 and 2023, the demand for NFTs began to wane. The high volatility of cryptocurrencies, coupled with regulatory uncertainty, made investors hesitant to commit large sums to digital assets. Additionally, the saturation of the market with low-quality projects and speculative investments led to a loss of trust among many collectors and artists. As the excitement around NFTs faded, platforms like MakersPlace, which had thrived during the boom, began to face increasing financial pressure.

MakersPlace Shuts Down: What Happened?

On January 15, 2024, MakersPlace officially announced its closure. According to the company’s content manager, Brady Evan Walker, the platform’s inability to sustain operations amidst the market downturn and ongoing funding challenges led to the decision. MakersPlace revealed that while new account sign-ups and NFT minting would be disabled immediately, users would still be able to buy, sell, and transfer NFTs on the platform until it completely shut down in June 2025.

MakersPlace’s closure was a direct result of the broader decline in the NFT market. The announcement cited the company’s failure to maintain a steady flow of revenue in the face of declining interest and competition from other platforms. Despite raising $30 million in funding from major investors such as Pantera Capital, Coinbase Ventures, and Sony Music Entertainment in 2021, MakersPlace struggled to stay afloat as the market shifted away from NFTs and digital collectibles.

MakersPlace’s Funding Journey and The 2021 NFT Boom

In 2021, MakersPlace was one of the many platforms that capitalized on the NFT market boom. The platform raised $30 million in a Series B funding round, which included investment from major players in the venture capital and entertainment sectors. This round of funding was aimed at expanding MakersPlace’s operations, building out its infrastructure, and increasing its user base as NFTs became a mainstream phenomenon.

MakersPlace’s Role in the Digital Art World

MakersPlace was not just a marketplace—it was a community of digital artists, collectors, and enthusiasts. The platform fostered an environment where creators could thrive, express themselves, and monetize their work in new and innovative ways. Through its support of limited-edition drops, collaborations with established artists, and a curated collection of works, MakersPlace quickly became a hub for digital creativity.

The limited-edition drops were one of the key factors in MakersPlace’s rise to prominence. By allowing artists to release exclusive collections of digital art, MakersPlace was able to generate excitement and anticipation for these works, creating an atmosphere of exclusivity and scarcity. Collectors were drawn to the idea of owning something truly unique—something that no one else could replicate. This sense of scarcity, combined with the authenticity of the blockchain, made NFTs on MakersPlace particularly appealing to collectors looking for high-value assets.

MakersPlace also supported emerging artists by offering them exposure to a global audience. The platform’s curated approach to NFT art meant that only the most promising works were featured, helping to maintain a level of quality that appealed to both collectors and investors. At the same time, MakersPlace offered a supportive environment for newcomers who were looking to make their mark in the NFT space. Through its easy-to-use platform, artists could quickly mint their works and begin selling them, reaching a global audience of potential buyers.

The partnerships that MakersPlace forged with top artists and companies helped the platform stand out from other NFT marketplaces. Beeple, one of the most well-known names in the NFT space, partnered with MakersPlace to release several of his works on the platform. His work, “Everydays: The First 5000 Days,” made history when it sold for $69 million at a Christie’s auction in March 2021. This sale marked a pivotal moment for the NFT industry, and MakersPlace played a key role in showcasing Beeple’s work to the world. The platform’s association with such high-profile figures added legitimacy to the NFT space and helped fuel the frenzy around digital art.

The decline of the NFT market began to take hold after the speculative bubble burst in early 2022. With the rise of cryptocurrencies and NFTs, many investors flocked to the digital asset space, hoping to profit from the surge in prices. However, as the market became increasingly saturated, demand for NFTs began to slow down. The oversupply of low-quality projects and the growing number of NFT platforms made it difficult for any one platform, including MakersPlace, to maintain its dominance.

The Broader Impact of MakersPlace’s Shutdown on the NFT Market

MakersPlace’s closure marks a significant turning point in the NFT space. The platform’s shutdown is just one of several NFT marketplaces that have ceased operations in recent years. In 2023, platforms like Recur and Voice also shut down due to similar challenges in the crypto market. The closures of these platforms highlight the volatility of the NFT market and the risks involved in investing in digital assets.

While the shutdown of MakersPlace is a sign of the times, it also raises questions about the long-term sustainability of the NFT industry. Many experts and analysts believe that the market will eventually recover and evolve, but the current downturn has led to a consolidation of resources and a shift away from speculative investments. The closure of MakersPlace signals that platforms that fail to adapt to the changing market conditions may not survive in the long run.

Despite the challenges, some industry figures remain optimistic about the future of NFTs. Animoca Brands chairman Yat Siu has expressed confidence that NFTs will make a comeback, potentially outperforming their previous peak. According to Siu, the market will mature, and NFTs will become more integrated into mainstream industries, including gaming, entertainment, and digital ownership.

The Environmental Concerns: Sustainability Issues Facing NFTs

One issue that has weighed heavily on the NFT market is the environmental impact of blockchain technology, particularly Ethereum, the network on which many NFTs are minted. Ethereum’s Proof of Work (PoW) consensus mechanism has long been criticized for its high energy consumption and carbon footprint. While the Ethereum network has transitioned to Proof of Stake (PoS) in an effort to reduce energy use, environmental concerns remain a significant point of contention for both creators and buyers in the NFT space.

As awareness of climate change grows, the demand for environmentally friendly digital platforms has increased. This shift could drive the development of more sustainable blockchain technologies that allow for energy-efficient NFT transactions. Platforms like Tezos and Flow are already working on this issue, but broader industry changes may be necessary for NFTs to overcome the environmental concerns that have plagued them from the start.

Lessons from MakersPlace: What Can We Learn from the Platform’s Journey?

The rise and fall of MakersPlace offer valuable lessons for those looking to understand the broader trends within the NFT space. One of the key takeaways is that the NFT market is highly speculative, and platforms must adapt quickly to changing market conditions. MakersPlace, despite its strong initial backing and success, struggled to maintain relevance as the market shifted away from NFTs.

The lesson for future NFT projects and marketplaces is clear: sustainability is key. Platforms that rely on short-term trends and speculative buying will likely face the same fate as MakersPlace. Instead, the future of NFTs may lie in their integration into industries such as gaming, virtual reality, and digital ownership. Projects that prioritize long-term value, real-world applications, and sustainable business models will have a better chance of thriving in the coming years.

The Future of NFTs: Will They Recover?

While MakersPlace and other NFT platforms have struggled to maintain relevance in the current market climate, the future of NFTs is still uncertain. Some believe that NFTs are simply undergoing a natural market correction, while others argue that the technology itself is flawed and unsustainable in its current form.

The NFT industry’s future may depend on its ability to adapt and find new use cases beyond digital art and collectibles. One promising area of growth is the integration of NFTs into gaming and virtual worlds. Projects like Decentraland and The Sandbox are exploring the use of NFTs for in-game assets, virtual real estate, and other forms of digital ownership. Additionally, NFTs are being explored as a means of authenticating physical goods and intellectual property rights, offering a broader range of applications outside the art world.

Another factor that may influence the future of NFTs is the regulatory environment. Governments around the world are beginning to take a closer look at NFTs, with some considering potential regulations to address concerns about fraud, money laundering, and environmental impact. As the industry matures, it is likely that clearer guidelines will emerge, which could help restore confidence among investors and creators alike.

Conclusion

MakersPlace’s closure is a sobering reminder of the volatility that exists within the digital asset space. The platform’s rise and fall mirror the larger boom-and-bust cycle that has characterized the NFT market. Despite its struggles in the face of market decline, MakersPlace played a significant role in the early days of the NFT movement, helping to establish digital art as a legitimate and valuable asset class.

While MakersPlace may be shutting down, its legacy will continue to influence the NFT space. The platform’s contributions to the democratization of digital art and its role in fostering a global community of artists and collectors cannot be understated. As the NFT market continues to evolve, MakersPlace’s story will serve as a cautionary tale of the risks and rewards of investing in emerging technologies.

In the end, MakersPlace’s closure is not the end of NFTs, but rather a reflection of the challenges that come with operating in a rapidly changing market. The future of NFTs may look different, but the technology and its potential for transforming industries like art, gaming, and digital ownership are here to stay. Whether the NFT market experiences a full recovery or undergoes a dramatic transformation, one thing is certain: the impact of NFTs on the world of digital assets is far from over.

FAQs

1. What is MakersPlace?

MakersPlace is a digital marketplace that allows artists to mint, showcase, and sell their digital art as NFTs (Non-Fungible Tokens). Founded in 2018, it leverages blockchain technology to offer secure, verifiable ownership of digital art, empowering artists to directly engage with collectors. It became a leading platform for digital creators and art enthusiasts worldwide. MakersPlace helped shape the early landscape of NFTs and became one of the top venues for buying and selling exclusive digital artworks.

2. How do NFTs on MakersPlace work?

NFTs on MakersPlace function as unique, blockchain-backed digital assets that represent ownership of a specific piece of digital art. Artists mint their works as NFTs, which are then sold on the platform. Buyers can verify the authenticity and ownership of the art, and artists earn royalties from secondary sales, creating a new revenue model for creators. The NFTs are minted on the Ethereum blockchain, ensuring a decentralized and transparent marketplace.

3. Who can sell art on MakersPlace?

Anyone can sell their digital art on MakersPlace, provided they meet the platform’s approval process. This includes both established artists and newcomers. MakersPlace has a curatorial approach, ensuring that only high-quality, original works are featured, offering a trusted environment for collectors. New artists are given opportunities to showcase their work alongside well-known creators, gaining visibility and exposure in the growing NFT market.

4. What types of digital art can be sold on MakersPlace?

MakersPlace allows the sale of various forms of digital art, including illustrations, animations, videos, and even music. The platform supports a wide range of creative expressions, making it an ideal venue for diverse creators to explore the world of NFTs. Artists have the freedom to experiment with innovative mediums, combining digital technology with traditional art forms to create groundbreaking, collectible digital pieces.

5. Why did MakersPlace shut down?

MakersPlace announced its closure due to the NFT market downturn and challenges in securing additional funding. Despite being a key player in the NFT space, it faced difficulties amid market fluctuations, regulatory uncertainty, and the overall slowdown of the cryptocurrency market, leading to the platform’s decision to shut down operations by June 2025. Despite its closure, MakersPlace remains a significant part of the history of NFTs, having contributed to the digital art revolution. The platform will allow users to offload NFTs until June 2025, giving them ample time to transition.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.