Let me tell you a story that, frankly, blew my mind.

It’s about DeFi. It’s about power. And it’s about how one trader used pure strategy 4D chess to force one of the biggest perpetual protocols, Hyperliquid, into revealing just how centralized things really are beneath the surface.

Now, I’ve been in the crypto trenches long enough to know that DeFi isn’t always as “decentralized” as we want to believe. But this move? It exposed everything—from weak liquidation systems to emergency switches hidden behind protocol curtains.

Let’s unpack this chaos. Because if you’re a trader, investor, or even just DeFi-curious, this one hit close to home.

The Setup: Galaxy Brain Levels of Planning

Here’s what the trader did:

- Took a $6 million short position on a small-cap token: $JELLY

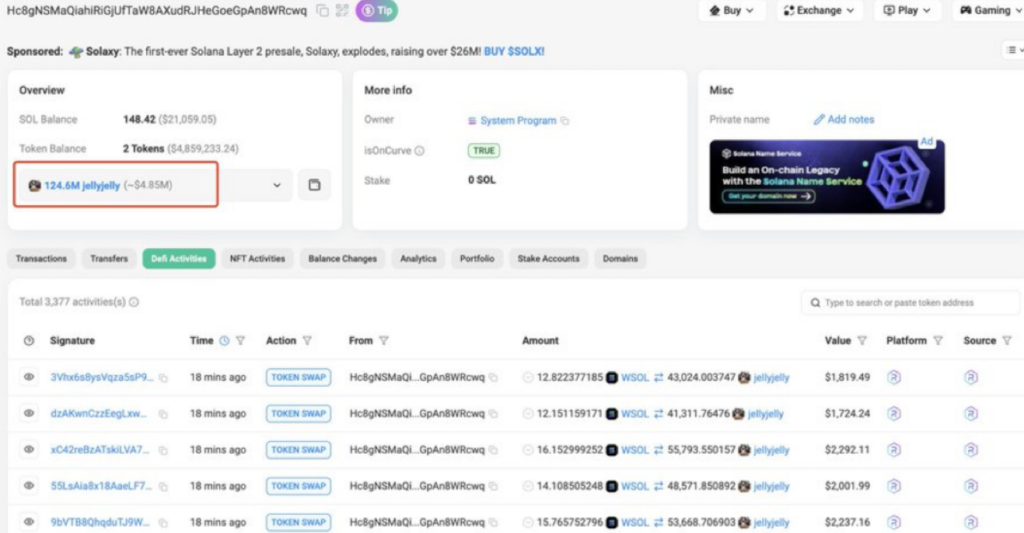

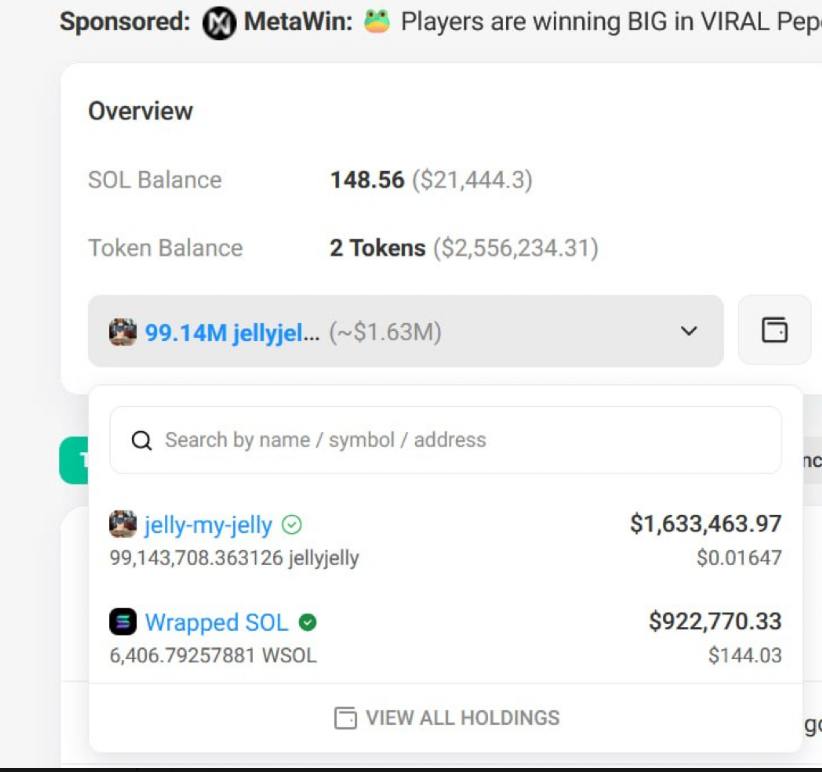

- Simultaneously went long on spot, stacking the asset

- Then intentionally pumped the price of $JELLY triggering their own liquidation

Wait, what?

Yeah, on purpose.

The goal? Force Hyperliquid’s protocol vault (the HLP) to inherit a toxic, high-leverage short on a mooning coin. A total reverse rug pull—only this time, it was the protocol getting rugged.

And it worked—brilliantly.

The Fallout: Protocol in Panic Mode

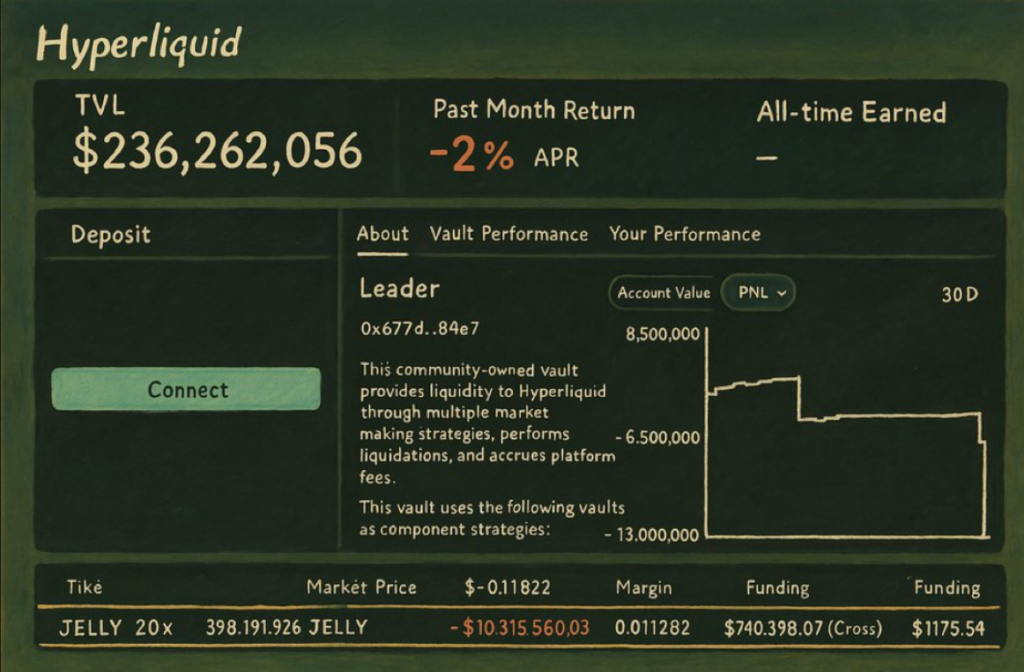

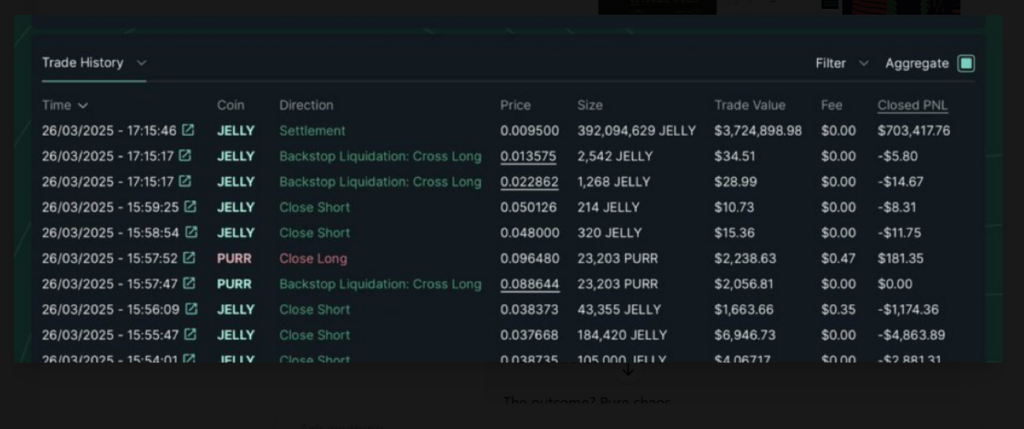

$JELLY shot up 429% in a single hour, ballooning from a $20M market cap to over $50M. Hyperliquid was suddenly bleeding millions in unrealized losses.

Every mechanism they built to manage risk. Cracking under pressure.

They had two options:

- Let the vault ride the short and risk a $12M+ loss.

- Step in and use centralized controls to shut it down.

Guess what they chose?

They force liquidated 392 million $JELLY tokens at $0.0095, while the market was trading around $0.50. And somehow, they walked away with $703K profit—but only by stepping in manually and force delisting $JELLY from the platform.

Yeah. You read that right.

The Lesson: DeFi Isn’t as Trustless as We Think

This trade exposed the deepest flaws in many perp protocols:

- Illiquid asset risk: No limits on position size.

- Oracle vulnerability: Price manipulation was all too easy.

- Forced position inheritance: The protocol had to take on that short.

- Emergency powers: “Decentralized” until the house is on fire.

We talk a lot about trustless finance. But when real capital is at stake, it turns out even the biggest platforms will press the panic button. Fast.

And that’s where this story becomes about us—the everyday users.

Why This Should Matter to You

If you’ve ever provided liquidity to a vault, traded perps, or even just chased small-cap pumps on a DEX, this affects you. Protocols love to sell the idea of safety through code but this story shows that when push comes to shove, human intervention is still the final backstop.

That’s not inherently bad. But it is something we deserve transparency about.

Because if a $230M vault can be nearly wiped by a single illiquid asset and one clever trader, then your money—our money—isn’t as secure as we think.

My Take? This Was Art. And a Warning.

The trader didn’t just make a bag. They made a point.

They exposed the hypocrisy in how “decentralization” is used as a buzzword, while protocols keep admin keys ready in the background for exactly this type of scenario.

Was it malicious? Maybe.

Was it genius? Absolutely.

And in a weird way, it makes me love DeFi even more. Because only in crypto can someone weaponize the rules of the game so effectively—and force the truth into the light.

Just make sure next time, you’re not the one holding the bag.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.