My portfolio’s deep in the red.

If you’ve held altcoins over the last few months, you probably know the feeling.

This isn’t just a dip. It’s a prolonged bleed.

But what if that’s the point?

What if the silence, the boredom, and the fear are exactly what come before the next breakout?

I’ve been through multiple crypto cycles. And what I’ve learned is this:

Markets don’t hand out 10x gains during hype. They reward those who accumulate when it hurts.

We’re entering one of those moments again. Here’s why.

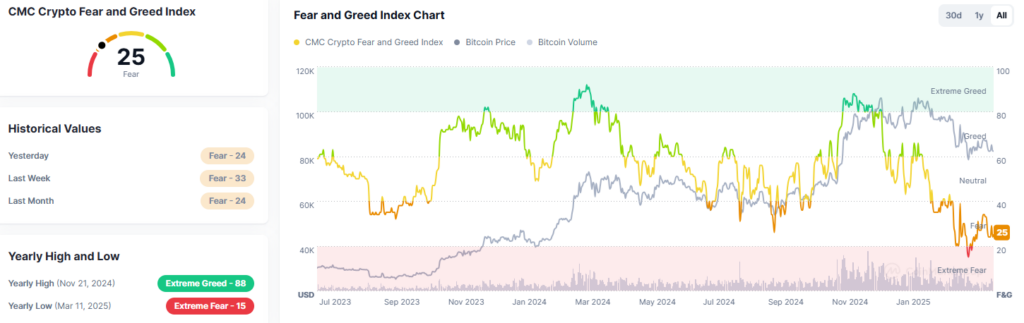

Psychology of the Cycle: Fear ≠ Finality

Right now, most altcoins are in brutal technical downtrends trading far below their 200-day EMAs, with zero signs of momentum. Social sentiment is low. Telegram groups are dead. Crypto Twitter has turned into a ghost town.

But from a historical perspective, this kind of pain and disinterest has often been a launchpad for parabolic runs.

In 2018, Ethereum dropped from $1,400 to $80 before reversing in 2020.

In 2020, Solana was $0.60. Avalanche was nearly unknown. Within a year, they were household names.

And those who entered during the “nobody cares” phase were the ones who reaped the biggest rewards.

So while fear dominates the narrative, smart money is accumulating and the signs are starting to show.

Bitcoin Dominance: The Setup Beneath the Surface

As of this writing, Bitcoin dominance is hovering near 58.8%, the highest since early 2021.

To the untrained eye, that might just mean Bitcoin is leading again. But for seasoned cycle watchers, it’s a flashing signal.

Historically, Bitcoin dominance peaks right before altcoins begin to run. In 2017 and again in late 2020, a dominance reversal signalled capital rotation into altcoins sparking some of the biggest rallies in crypto history.

Right now, that rotation hasn’t happened yet.

Capital is still consolidating in Bitcoin, largely driven by institutional inflows via spot Bitcoin ETFs.

Why does this matter?

Because once Bitcoin cools and it always does that capital will seek higher beta assets, i.e., altcoins.

Ethereum/BTC: A Contrarian Signal

The ETH/BTC ratio just fell to 0.0225, its lowest level since May 2020. Technically, it’s breaking down from a bear flag and on the surface, this looks extremely bearish.

But take a step back.

In May 2020, ETH/BTC was at similar levels and Ethereum was just $200.

Over the next 12 months, it ran to $4,000, and altcoins followed in a vertical climb.

This ratio isn’t just a chart. It’s a gauge of risk appetite.

When ETH underperforms BTC, it often precedes altcoin rotations not because ETH is weak, but because it’s the last domino before speculative appetite returns.

Right now, ETH is being ignored by institutions (zero ETF inflows), crushed by sentiment, and down on every major pair. That’s not a reason to avoid it. That’s a reason to start watching it closely.

The M2 Money Supply: Liquidity Leads Price

Here’s where we shift from charts to macro.

Global M2 money supply a key indicator of liquidity has historically led Bitcoin price action by 2–3 months. When M2 contracts, markets drop. When M2 expands, markets rise. Bitcoin, and by extension crypto, lags that move. Back in December, M2 began expanding again and now, we’re starting to see the early signs of a reversal.

Bitcoin’s pullback in late March? It mirrored a small drop in M2 from two months prior.

If the pattern holds, the next bullish leg could start in late April or early May right as liquidity rises again and macro stress softens.

That window, between now and then, is the accumulation zone.

Regulation & Altcoin ETFs: The Sleeping Giant

For the last few years, the U.S. regulatory environment has been one of the biggest headwinds in crypto. But that’s changing fast.

In recent months:

- The SEC dropped lawsuits against Coinbase, Kraken, Uniswap, Gemini, and more.

- The FDIC reversed prior anti-crypto guidance, giving banks more freedom to interact with digital assets.

- The Circle IPO was greenlit, signaling a new era for crypto capital markets.

But the biggest news?

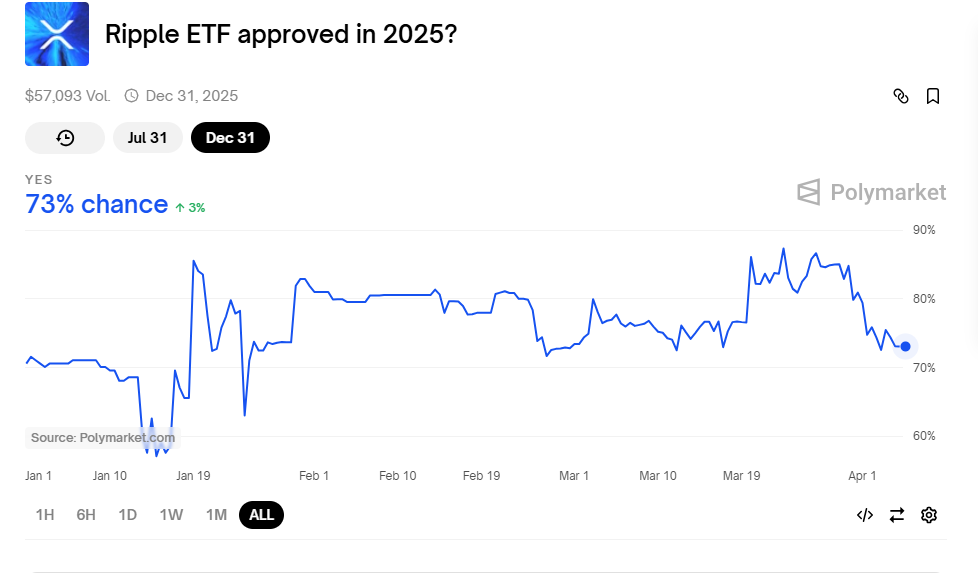

Altcoin ETFs are being reviewed.

Multiple filings for altcoin ETFs including XRP, Litecoin, Solana, Cardano, Dogecoin are now under formal review. According to Polymarket, XRP ETF approval odds have jumped to 87% since the Ripple case was dropped. Final deadlines for the first wave? Late April and Mid-October. If approved, these ETFs could open the floodgates for mainstream altcoin exposure, just like Bitcoin spot ETFs did in January.

The market isn’t pricing this in. Yet.

The Bottom Line: Don’t Confuse Silence with Death

This isn’t a call to go all-in. This is a call to wake up. Markets are built on mispricing.

And right now, altcoins are arguably the most underpriced they’ve been since 2020 both technically and fundamentally.

We’ve got:

- Historic Bitcoin dominance

- Ethereum trading like it’s 2020

- Global liquidity ticking upward

- Regulatory pressure easing

- Altcoin ETF catalysts within weeks

And most people? They’re still on the sidelines. Watching. Doubting.

This is the silence before the surge. If you’re reading this, you’re early. You don’t need to ape. You just need to be awake.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.