As a crypto enthusiast, you’ve probably heard the buzz about the yield curve and its ominous predictions. It sounds like some obscure economic jargon, right? But let me tell you, it’s one of the most accurate predictors of a recession, and if you’re invested in crypto, you should pay attention. In this article, I’ll break down what the yield curve is, why it matters, and what it could mean for our beloved crypto markets.

What Exactly is the Yield Curve, and Why Should You Care?

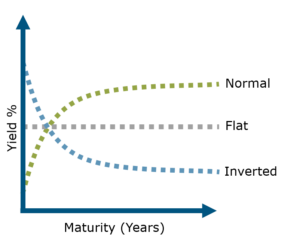

Let’s start with the basics. The yield curve represents the difference in interest rates (yields) between short-term and long-term US government bonds. Normally, the curve slopes upward, meaning you get higher returns for locking your money away for longer periods. But sometimes, things flip—short-term bonds offer higher yields than long-term ones. This is called a yield curve inversion, and it’s a big red flag.

Historically, every time the yield curve inverts, a recession has followed within months. Just look at the data: from the recessions in the early ‘80s to the 2008 financial crisis and even the short-lived COVID-19 recession, the yield curve has been a reliable predictor. And guess what? The yield curve has been inverted since July 2022, and it’s showing signs of returning to normal soon.

Is a Recession Inevitable?

Here’s where it gets tricky. The yield curve’s track record is impeccable, but does that mean a recession is a sure thing? Not necessarily. Economists love to debate the “why” behind yield curve inversions, and honestly, there’s no clear answer. Some say it’s due to investors flocking to long-term bonds in search of security during uncertain times. Others think it’s a sign that markets are bracing for economic slowdown.

So, are we on the brink of another recession? I’m 50-50 on this one. Betting against the yield curve feels counterintuitive, especially when you consider that even the Federal Reserve and major financial institutions like JP Morgan and Goldman Sachs are giving it a high probability. But there’s also a case to be made that this time might be different.

Why This Time Might Be Different

We’re in an election year, and if there’s one thing politicians hate, it’s a recession on their watch. The Fed and the Treasury Department are pulling out all the stops to keep the economy afloat until after November. That includes buying back $50 billion in treasuries and possibly cutting rates—moves that could stave off a downturn, at least temporarily.

The US economy is also showing surprising resilience. GDP growth remains strong, unemployment is relatively stable, and despite all the noise, the economy keeps chugging along. Could we see Bitcoin hit $150,000 by November? Maybe. But if a recession does hit, it might be short-lived, with the markets bouncing back faster than we expect.

What Does This Mean for Crypto?

Now, let’s get to the crux of the matter—what does all this mean for our crypto portfolios? If a recession hits, we could see a sharp decline in cryptocurrency prices. Remember how Bitcoin took a 50% nosedive during the COVID-19 recession? That kind of volatility could happen again. But here’s the flip side: those who were prepared back then saw one of the most significant wealth accumulation events in crypto history as the market rebounded.

If the yield curve is right (and history suggests it probably is), having some cash on hand to buy during the chaos could be a savvy move. But don’t forget, if we see a strong rally in Q4 this year, take some profits, especially on those volatile altcoins. The last thing you want is to be caught off guard when the market takes a turn.

Final Thoughts: Stay Vigilant and Be Ready

I’ve learned the hard way that taking profits and preparing for downturns is crucial. The yield curve has been a reliable indicator for decades, and while this time might be different, it’s better to be safe than sorry. Whether we face a recession in the next few months or manage to push it off, remember that there’s always another downturn around the corner. The key is to stay informed, stay flexible, and always be ready to adapt.

So, what’s your take? Do you think the yield curve will lead us into another recession, or is this time truly different? Whatever happens, keep your strategy sharp and your eyes on the horizon.he crypto party, and here’s to a prosperous journey ahead!rsection of AI and blockchain, NEAR Protocol offers a compelling narrative and a promising future. The ongoing developments and strategic directions underscore NEAR’s potential to become a leading force in the next wave of technological innovation. Let’s embrace this journey and look forward to what lies ahead.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.