Bitcoin rallied to $43,000 on April 21 but reversed direction and followed the US equity markets lower after US Federal Reserve Chairman Jerome Powell said that it was “absolutely essential to restore price stability,” and a “50 basis points (hike) will be on the table for the May meeting,” CNBC reported.

After the comments, expectations of a 50 bps rate hike in May soared to 99.8%, according to CME’s FedWatch Tool. However, a minor positive for the bulls is that Bitcoin has managed to hold on to the psychological level of $40,000.

The weakness in Bitcoin and Ethereum has resulted in declining rates of searches for both terms according to Google trends. Another sign of reducing interest from crypto traders was the drop in total exchange trade volumes on major exchanges, which dipped to $165.8 billion on April 19, its lowest level since October 2020, according to data from Blockchain.

Although Bitcoin’s price has failed to show upside traction in 2022, Terra blockchain has been a major buyer, amassing 42,530.82 Bitcoin. A Tweet from the firm’s official account said that things were to get “spicy real soon.”

Crypto investors made windfall profits in 2021 as Bitcoin and Ethereum prices soared. A report by cryptocurrency data firm Chainalysis said that investors raked in $163 billion in realised gains in 2021 compared to $32 billion in 2020. The total realised gains worldwide from Ether was $76.3 billion compared to $74.7 billion from Bitcoin.

With Bitcoin stabilising near $40,000, could the attention shift to altcoins? Let’s study the charts of the 5 cryptocurrencies that can be the future of cryptocurrency because they are showing a positive chart structure.

APE/USD Market Analysis

ApeCoin bounced off the support line on April 18 and broke above the overhead resistance at $15.55 on April 20. However, the bulls could not sustain the momentum and clear the next hurdle at $18.

This may have attracted profit-booking by short-term traders, which pulled the price back below the breakout level of $15.55 on April 21.

If the price rebounds off the 20-day exponential moving average (EMA), the bulls will again try to retest the strong overhead resistance at $18. If the buyers overcome this barrier, the bullish momentum could pick up.

The APE/USD pair could first rally to $22 and later to $26. The relative strength index (RSI) in the positive territory indicates a slight edge for the buyers.

Conversely, if the price continues lower and breaks below the 20-day EMA, the next stop could be the support line. A break and close below this support could tilt the advantage in favour of the bears.

AAVE/USD Market Analysis

AAVE has been attempting to rise above the downtrend line and signal a potential trend change. Although bulls pushed the price above the downtrend line on April 20 and 21, they could not sustain the higher levels as seen from the long wicks on the candlesticks.

However, a minor positive is that the bulls have not allowed the price to break below the 50-day simple moving average (SMA). This suggests that bulls continue to accumulate at lower levels.

If the buyers propel the price above the psychological level at $200, the AAVE/USD pair could rally to the overhead resistance zone at $250 to $261.20. A break and close above this zone could suggest the start of a new uptrend.

Contrary to this assumption, if the price once again turns down from $200, it will suggest that bears are defending the level aggressively. That could increase the possibility of a break below the 50-day SMA. If that happens, the pair could drop to $150.

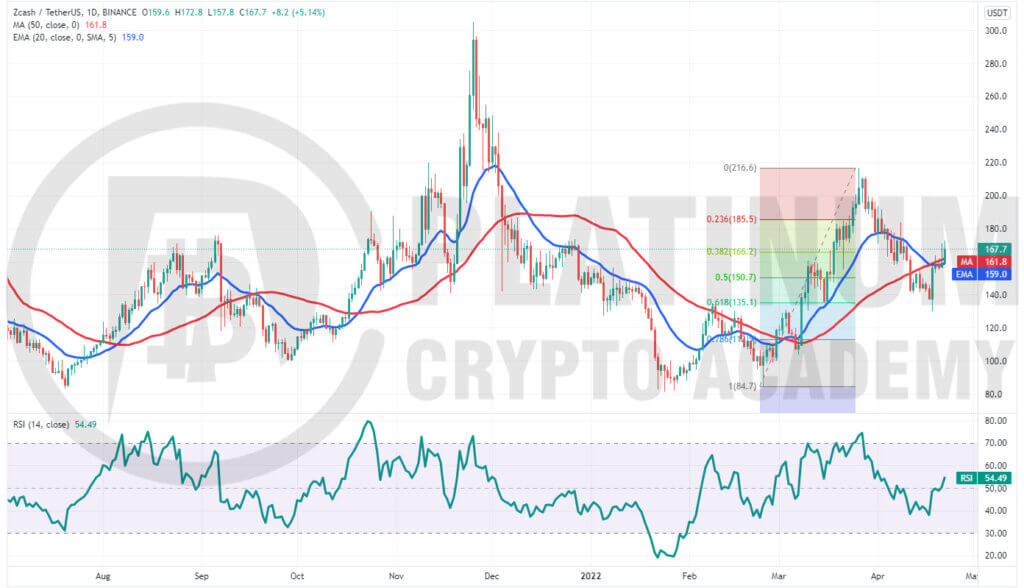

ZEC/USD Market Analysis

Zcash rebounded off the 61.8% Fibonacci retracement level of $135.1 on April 18 and is currently attempting to sustain above the moving averages. If that happens, it will suggest that the short-term correction may be over.

The RSI has jumped into the positive territory, which also suggests that bulls are on a comeback. The buyers will now attempt to push the price to $183.9.

If the price turns down from this level but rebounds off the 20-day EMA, it will suggest that the uptrend remains intact. The buyers will then try to drive the price toward the psychological level of $200 and later to $216.60.

This positive view will invalidate in the short term if the price turns down and breaks below $150. Such a move will suggest that the bears remain active at higher levels. That could pull the ZEC/USD pair down to the strong support of $130.

KCS/USD Market Analysis

KuCoin has been trading inside a range between $17.50 and $21.25 for the past several days. Although the bulls pushed the price above the overhead resistance on March 29, they could not sustain the higher levels. The bears pulled the price back inside the range on March 31.

The price has been stuck between the 20-day EMA and $21.25 for the past few days. The 20-day EMA has started to turn up marginally and the RSI is in the positive territory, suggesting that the path of least resistance is to the upside.

If bulls propel the price above the overhead resistance zone at $21.25 to $22, the KCS/USD pair could pick up momentum and rally toward $24. A break and close above this resistance could extend the up-move to the pattern target of $25.

This positive view could invalidate in the short term if the price breaks and sustains below the 20-day EMA. That could pull the price down to the 50-day SMA.

GMT/USD Market Analysis

STEPN (GMT) has been in a strong uptrend in the past few days. The GMT/USD pair bounced off the 20-day EMA on April 18 and surged above the strong overhead resistance at $3.13.

However, the bulls could not build upon this strength and the price turned down from $3.85 on April 20. The bulls are currently attempting to stall the decline at $3.13 and flip the breakout level into support.

If that happens, the buyers will again try to push the pair above $3.85. If they succeed, the pair could rise to $5.57. The rising 20-day EMA and the RSI in the positive zone indicate advantage to buyers.

Contrary to this assumption, if the price breaks below $3.13, the next stop could be the 20-day EMA. A strong rebound off this support will suggest that the positive sentiment remains intact. The buyers will then make one more attempt to resume the uptrend.

But if the price slips below the 20-day EMA, the selling could intensify and the pair could slide to the strong support at $2.

Hopefully, you have enjoyed today’s article for further coverage please check out our crypto Blog Page. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.