Bitcoin has been struggling to sustain above the psychological level of $40,000 as the short-term price action continues to be dictated by the US equity markets. However, that has not halted Bitcoin purchases both by the whales and retail investors.

According to Marcus Sotiriou, analyst at the U.K.-based digital-asset broker GlobalBlock, Bitcoin whale holdings have risen to their highest level since September 2021. Similarly, analysts at research firm IntoTheBlock highlighted that retail buying had boosted the balance held by address with less than 10 Bitcoin to 2.08 million Bitcoin.

In another positive sign, a Goldman Sachs spokesperson told Bloomberg that the bank had lent its first Bitcoin-backed loan. This move by Goldman suggests that Wall Street banks are ramping up their crypto offerings to their clients and are entering areas previously dominated by firms that specialise in crypto.

The Central African Republic (CAR) followed El Salvador as the second country in the world to adopt Bitcoin as legal tender. Some analysts questioned the impact of this move because the internet penetration is only 11% in CAR and the nation is among the poorest in the world.

Several retail investors keep searching for the next cryptocurrency which could provide outsized returns. However, research suggests that a majority of the new coins underperform Bitcoin. According to an analysis by Jump Trading Group, 80% of newly launched cryptocurrencies offer zero to negative average returns relative to Bitcoin within a year. Several of the new coins start underperforming Bitcoin within the first month.

Could bulls sustain Bitcoin’s price above $40,000 triggering a relief rally in altcoins? If that happens, which are the coins to watch out for? Let’s study the charts of the five cryptocurrencies that are showing a positive chart structure.

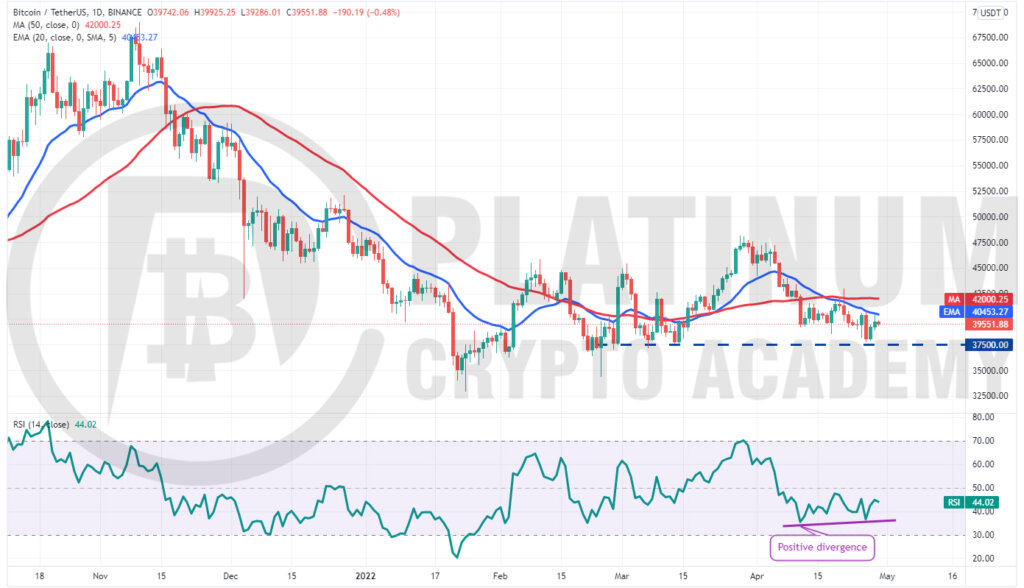

BTC/USD Market Analysis

Bitcoin bounced off the strong support at $37,500 on April 27, suggesting that bulls are attempting to defend this level. The relief rally has reached the 20-day exponential moving average (EMA) where the bears are expected to mount a strong resistance.

If the price turns down from the 20-day EMA, the bears will again try to sink the BTC/USD pair below the strong support of $37,500. If they manage to do that, the decline could extend toward $33,000.

The relative strength index (RSI) is showing a positive divergence indicating that the bearish momentum may be weakening.

If buyers propel the price above the 20-day EMA, the pair could rise to the 50-day simple moving average (SMA). The bears may mount a strong resistance in the zone between the 50-day SMA and $43,000 but if bulls overcome this barrier, the pair could rally to $47,500.

BNB/USD Market Analysis

Binance Coin bounced off the strong support at $385 on April 27, indicating that the bulls are buying the dips to this level. The price has reached the moving averages where the bears are expected to mount a strong resistance.

If the price turns down from the current level, the bears will again attempt to sink the BNB/USD pair below $385. If they succeed, the pair could drop to the next strong support at $349.

Although the marginally downsloping 20-day EMA indicates advantage to sellers, the RSI just below the midpoint suggests that the bearish momentum may be weakening.

If bulls push and sustain the price above the downtrend line, it will suggest that the short-term correction may be over. The pair could rise to $431 and later attempt a breakout of the stiff overhead resistance at $460.

TRX/USD Market Analysis

Tron has been range-bound between $0.072 and $0.057 for the past few days. Although buyers pushed the price above the resistance of the range on April 21, they could not sustain the breakout.

This may have tempted profit-booking by short-term traders which pulled the price below the moving averages. A minor positive is that the bulls have not allowed the price to drop the strong support at $0.057.

The flattish moving averages and the RSI near the midpoint indicate the pair may remain stuck inside the range for a few more days.

If bulls push and sustain the price above the moving averages, the TRX/USD pair could rally to the overhead resistance at $0.07.

Contrary to this assumption, if the price turns down from the moving averages, the pair could again drop to the support at $0.057.

XMR/USD Market Analysis

Monero corrected sharply from $289.50 on April 22 to $221.50 on April 27 but a minor positive is that the bulls have not allowed the price to break below the 50-day SMA. This suggests buying at lower levels.

The buyers will now attempt to push the price above the 20-day EMA. If they succeed, it will suggest that the corrective phase could be over. The XMR/USD pair could first recover to $265 and later attempt a retest of $290.

Alternatively, the failure to push the price above the 20-day EMA may keep the pair stuck between the moving averages for a few days. The 20-day EMA has started to turn down and the RSI has dipped into the negative territory, indicating that bears have a slight edge.

If the price breaks below the 50-day SMA, the correction could resume and the pair may drop to the psychological support at $200.

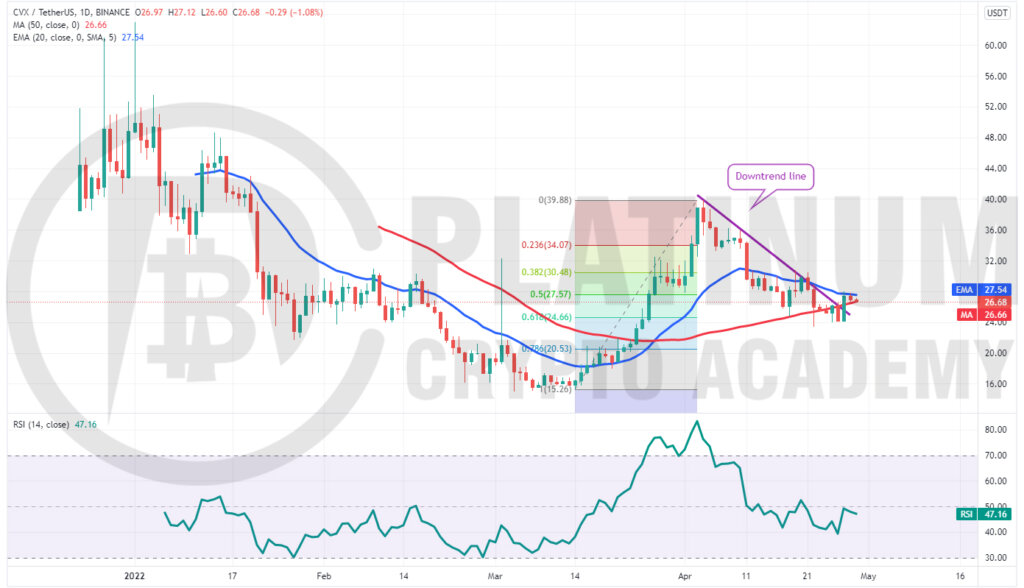

CVX/USD Market Analysis

Convex Finance has been finding support near the 61.8% Fibonacci retracement level of $24.66. Strong buying by the bulls pushed the price above the downtrend line on April 27.

However, the bears have not yet given up as they continue to pose a strong challenge at the 20-day EMA. If the price turns down from the current level, the bears will make another attempt to extend the correction.

If the price slips below $23.40, the CVX/USD pair could drop to the 78.6% Fibonacci retracement level of $20.53.

The RSI has risen above 47 and the 20-day EMA is attempting to flatten out, indicating that bulls are on a comeback. If buyers drive and sustain the price above the 20-day EMA, it will suggest strong demand at lower levels.

The pair could rally to $30.73 and if this level is scaled, the up-move could extend to the overhead resistance zone between $36 and $39.88.

Hopefully, you have enjoyed today’s article for further coverage please check out our crypto Blog Page. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.