The United States Federal Reserve Chair Jerome Powell dashed hopes of any slowdown in the central bank’s aggressive monetary tightening in his speech at The Jackson Hole Symposium on August 26. Powell said that curbing inflation “requires using our tools forcefully to bring demand and supply into better balance.” He also warned that higher interest rates may “bring some pain to households and businesses.”

This resulted in a meltdown in the US stock markets with the Dow Jones Industrial Index falling more than 1,000 points on August 26. The cryptocurrency markets also got clobbered and the total market capitalization fell below the $1 trillion mark, according to coinmarketcap data.

The central bank’s tightening has been negative for risky assets but the US dollar index (DXY) has been in a strong uptrend with no signs of topping out. There is a minor resistance near 110 but if this level is crossed, the DXY could continue its parabolic move and surge toward 120 as there is no major resistance in between. If that happens, the equities markets and crypto markets may remain under pressure as these assets generally have a strong inverse correlation with the DXY.

Macro headwinds have kept crypto investors on the edge. Bitcoin declined about 14% in August, its worst showing since the 18.67% decline in August 2015. The Bitcoin bulls may not find much respite in September either as it has been a weak month for Bitcoin, with an average decline of about 5.9% since 2013, according to CoinGlass data.

Although the short-term outlook remains uncertain, Bitcoin whales seem to be using the dips to accumulate for the long term. On-chain analytics firm Santiment tweeted on August 29 that whale addresses holding 100 to 10,000 Bitcoin have been buying in the past 30 days, which has increased their number by 103.

Is this a good time to accumulate or could Bitcoin and major altcoins fall further? Read our analysis of the major cryptocurrencies to find out.

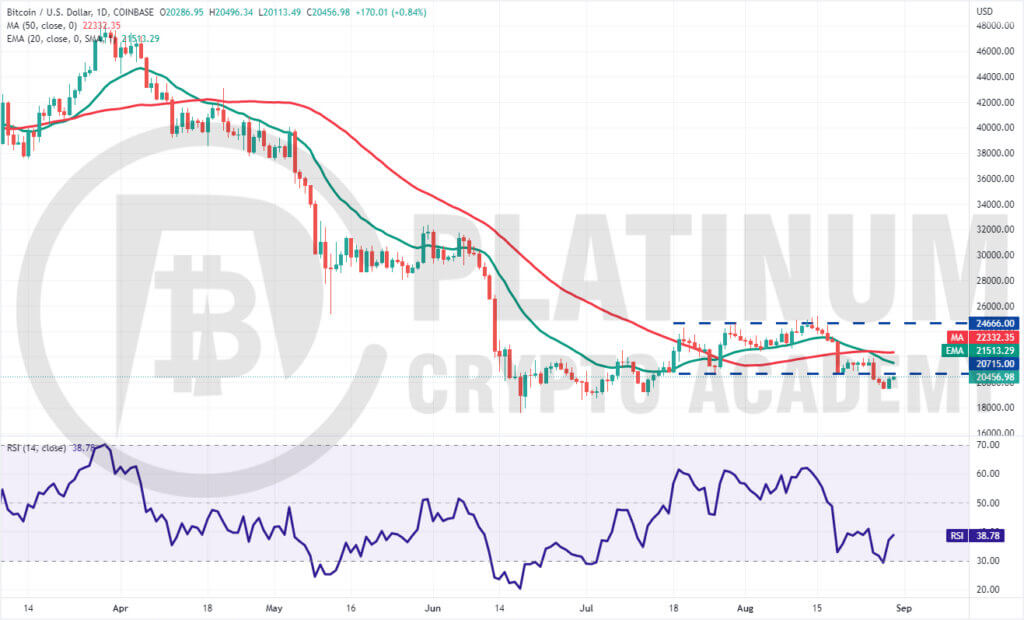

BTC/USD Market Analysis

We warned traders in our previous analysis that a shallow rebound off the strong support of $20,715 showed that demand was drying up at higher levels. Bitcoin turned down sharply from the 20-day exponential moving average (EMA) and plunged below the $20,715 support on August 26.

The bulls are attempting to push the price back into the range but may face stiff resistance at the breakdown level of $20,715. If the price turns down from this level, it will suggest that the bears have flipped the level into resistance.

That could increase the likelihood of a drop to $18,600 and then to the June 18 intraday low of $17,567.45. The bears will have to sink the price below this crucial support to signal the resumption of the downtrend.

Alternatively, if bulls push the price back above $20,715, it will suggest strong demand at lower levels. The moving averages may pose a strong challenge but if bulls overcome this barrier, the pair could attempt a rally to the resistance of the range at $24,666.

A break and close above the $25,000 level will be the first sign that the pair may have bottomed out. Until then, the pair could remain in a bottoming formation.

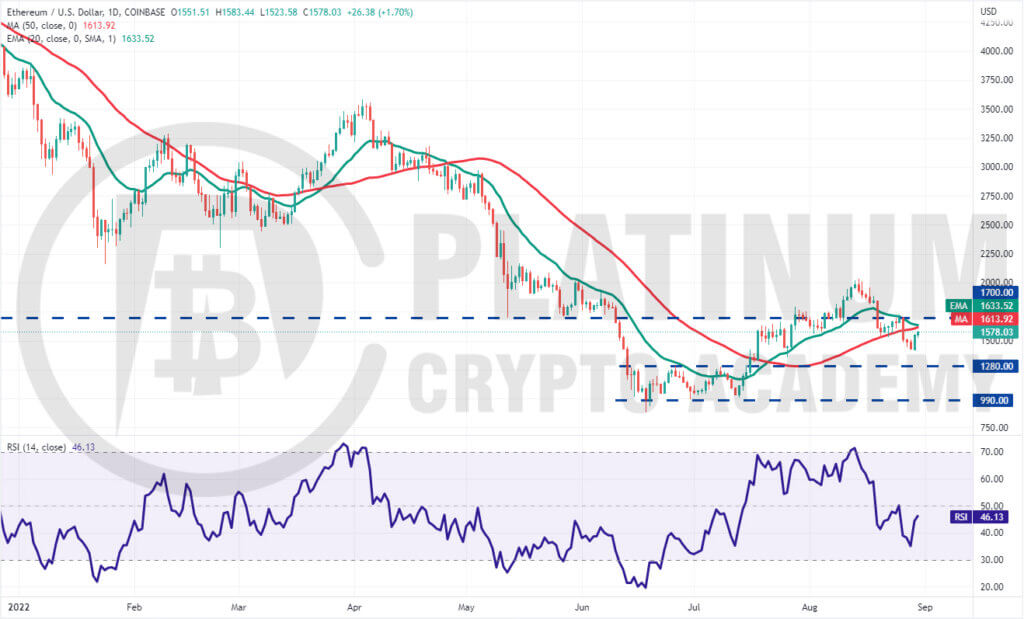

ETH/USD Market Analysis

We mentioned in our previous analysis that the bears are trying to flip the $1,700 level into resistance. That is what happened on August 26 when Ether turned down sharply from $1,700 and plummeted below the 50-day simple moving average (SMA).

However, a minor positive is that the bears could not sink the price to the strong support at $1,280. The price turned up from $1,420.74 on August 29, indicating that bulls are not waiting for a deeper correction to buy.

The bulls will again attempt to push the price above the moving averages and the stiff overhead resistance at $1,700. If they succeed, it will suggest that the correction may be over. The ETH/USD pair could then rally to $2,032. A break and close above this level could indicate the start of a new uptrend.

Contrary to this assumption, if the price turns down from the overhead resistance, it will suggest that bears are in no mood to relent. The pair could then oscillate between $1,400 and $1,700 for some time.

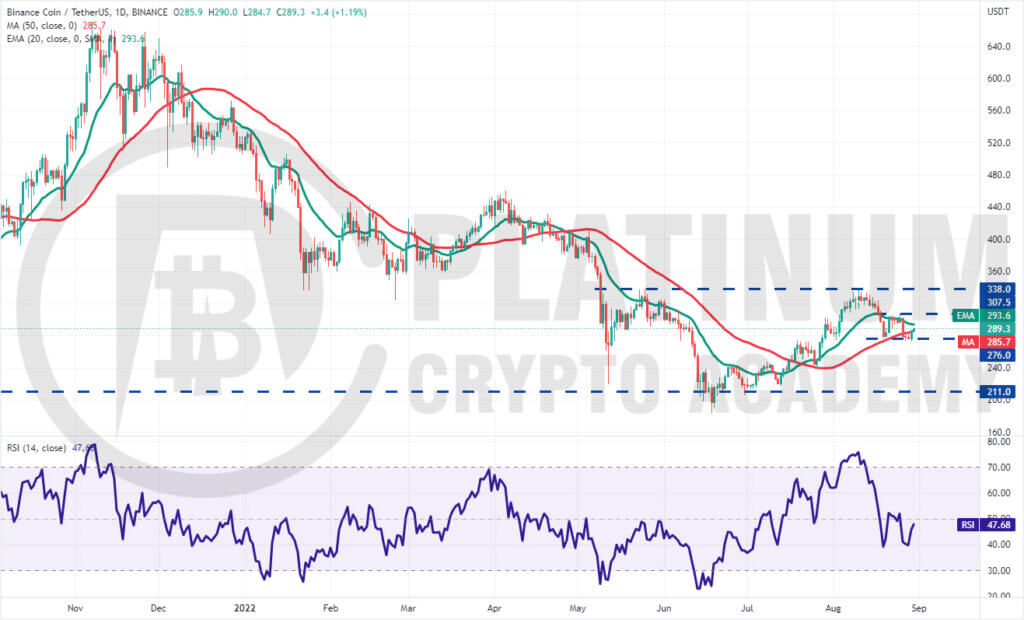

BNB/USD Market Analysis

Buyers pushed Binance Coin above the 20-day EMA on August 25 but the long wick on the day’s candlestick shows strong selling at higher levels. The ETH/USD pair turned down sharply on August 26 and plunged below the 50-day SMA.

However, the bears could not build upon this advantage as the bulls defended the immediate support at $276. The bulls pushed the price back above the 50-day SMA on August 29, indicating that the selling pressure may be reducing.

The bulls may encounter stiff resistance at the 20-day EMA and then again at $307.50. If the price turns down from the overhead resistance, the pair may oscillate between $276 and $307.50 for some time.

If bears sink the price below $276, the selling could pick up momentum and the pair may drop to the next major support at $240. Conversely, if buyers drive the price above $307.50, the pair could rally to the stiff overhead resistance of $338.

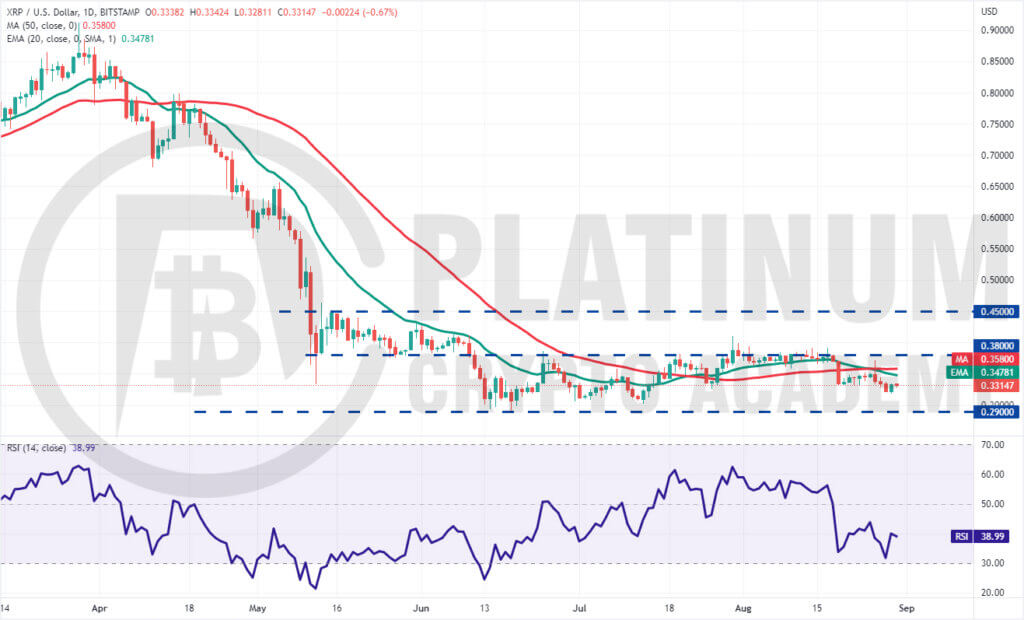

XRP/USD Market Analysis

XRP has been oscillating between $0.29 and $0.38 for the past few days. The bulls tried to push the price above the overhead resistance at $0.38 on August 26 but the long wick on the day’s candlestick shows that the bears are defending the level with vigor.

The price turned down and broke below the immediate support of $0.33 on August 28. The 20-day EMA is gradually sloping down and the RSI is in the negative territory, indicating advantage to bears.

If the price turns down from the 20-day EMA, the XRP/USD pair could drop to the crucial support of $0.29. The bulls are expected to defend this level with all their might because if they fail to do that, the pair could resume its downtrend.

Alternatively, if bulls push the price above the moving averages, the pair could rise to the overhead resistance at $0.38. A break and close above this resistance could open the doors for a rally to $0.45. The bulls will have to clear this hurdle to indicate that the pair may have formed a bottom.

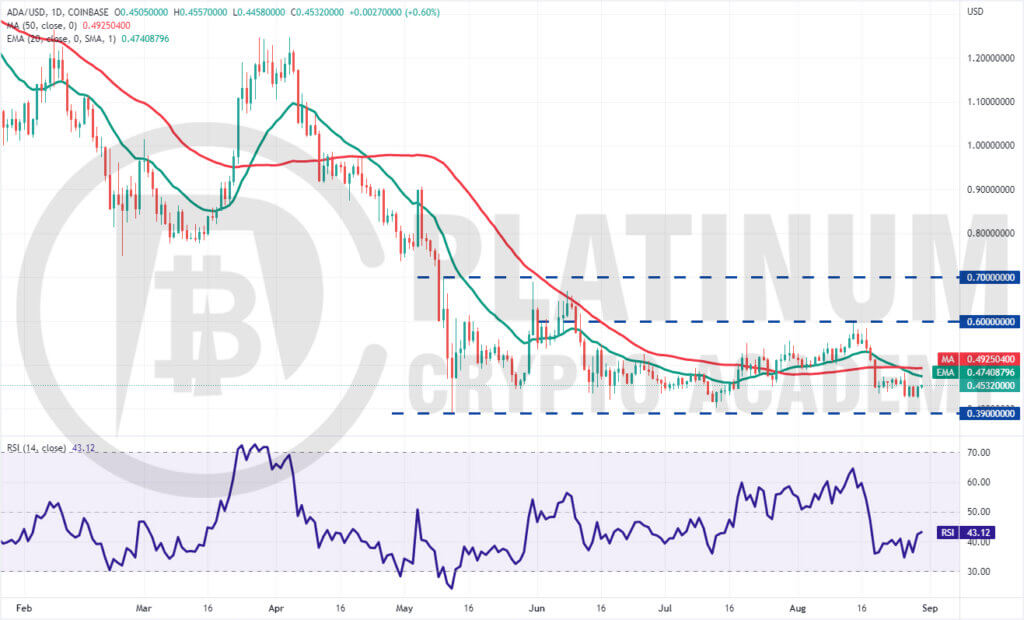

ADA/USD Market Analysis

Cardano has been stuck between $0.39 and $0.60 for the past few days. The bulls attempted to push the price above the moving averages on August 26 but the bears held their ground.

The downsloping 20-day EMA and the RSI in the negative territory indicate advantage to bears. The ADA/USD pair could gradually drop to the strong support at $0.39. This is an important level to watch out for because a strong rebound off it will suggest that the pair may extend its range-bound action for a few more days.

On the other hand, if bears sink the price below $0.39, it will suggest the start of the next leg of the downtrend.

In the short-term, if buyers drive the price above the moving averages, the pair could attempt a rally to the overhead resistance at $0.60.

.

Hopefully, you have enjoyed today’s article for further coverage please check out our crypto Blog Page. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.