Hopes of a Santa rally both in the United States equities markets and the cryptocurrency markets are fading as traders continue to trim positions in risky assets. Market observers are concerned that the Fed’s rate hikes may push the economy into recession.

Millionaire investors are the most bearish since 2008. The majority of the participants in CNBC’s Millionaire Survey said they expect the economy to be “weaker” or “much weaker” at the end of 2023. They believe the S&P 500 may continue its decline in 2023, with 56% of the respondents expecting a 10% decline while a third anticipate a fall of more than 15%.

Mike McGlone, senior commodity strategist at Bloomberg Intelligence also warned of further declines. “Some 1929-Like Forces at Work in 2022 – The 2021 pump in US liquidity can be compared with the stock-market bubble of 1929, with implications for similar outcomes,” McGlone tweeted on December 15.

Apart from dealing with the weakness in the equities markets, the cryptocurrency markets witnessed additional selling pressure after French audit firm Mazars, which recently did Binance’s proof-of-reserves report, said in an email statement that it had paused work with all their crypto clients globally. This raised questions around Mazar’s proof of reserves report issued earlier in the month which said that Binance’s Bitcoin reserves were over collateralized.

The negative sentiment in the crypto sector and fears of insolvency have increased the discount between the Grayscale Bitcoin Trust (GBTC) and its net asset value to more than 48.5% as of December 16. In his “End of Year CEO Letter to Investors,” Grayscale CEO Michael Sonnenshein said the firm will continue its efforts to convert GBTC to an exchange-traded fund (ETF).

However, if it fails in its endeavors, the firm plans to explore the possibility of a tender offer for 20% of the outstanding shares of GBTC after obtaining necessary approvals from the shareholders and the US Securities and Exchange Commission.

Will Bitcoin and the major altcoins break below their respective 52-week low or could they form a higher bottom? Let’s look at the charts to find out.

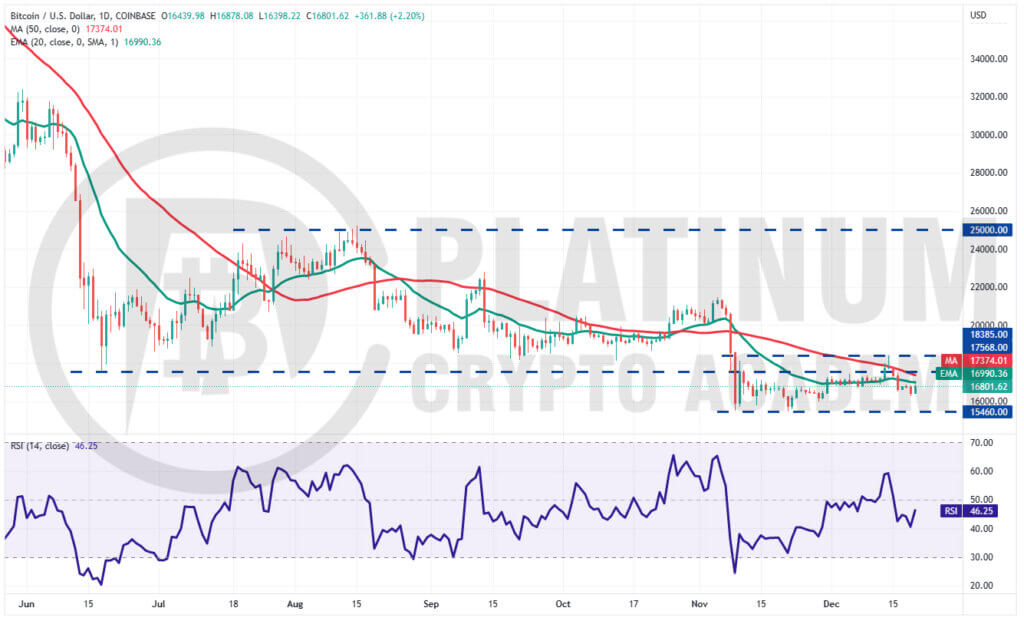

BTC/USD Market Analysis

We expected Bitcoin to pick up momentum and rally to $20,000 after breaking above $17,568 but that did not happen.

The BTC/USD pair turned down from $18,385 on December 14 and slipped back below $17,568 on December 15, indicating that the sentiment remains negative and traders are selling on rallies.

The 20-day exponential moving average (EMA) is flattish and the relative strength index (RSI) is just below the midpoint, suggesting that the pair may oscillate inside the large range between $15,460 and $18,385 for some time.

To invalidate this neutral view, buyers will have to clear the obstacles at the moving averages and then again at $18,385. If they manage to do that, the recovery could accelerate and the pair may soar to $20,000 and later to $21,500.

On the other hand, if the price turns down from the 20-day EMA and breaks below $16,273, the pair could plummet to the strong support at $15,460. The bulls are expected to defend this level with all their might because a break below $15,460 could start the next leg of the downtrend.

ETH/USD Market Analysis

Buyers pushed Ether above the 50-day simple moving average (SMA) on December 13 and 14 but they could not sustain the higher levels as seen from the long wick on the candlestick.

This may have attracted selling by the short-term traders, pulling the price back below the 20-day EMA on December 16.

The 20-day EMA is flattening out and the RSI is near 46, indicating equilibrium between buyers and sellers. That could keep the pair stuck inside the range between $1,071 and $1,280 for a few days.

If buyers propel the price above $1,280, the pair could rise to the downtrend line. The bulls will have to overcome this barrier to signal a potential trend change.

Contrarily, a break below $1,071 could strengthen the bears and sink the pair to the June low at $879.

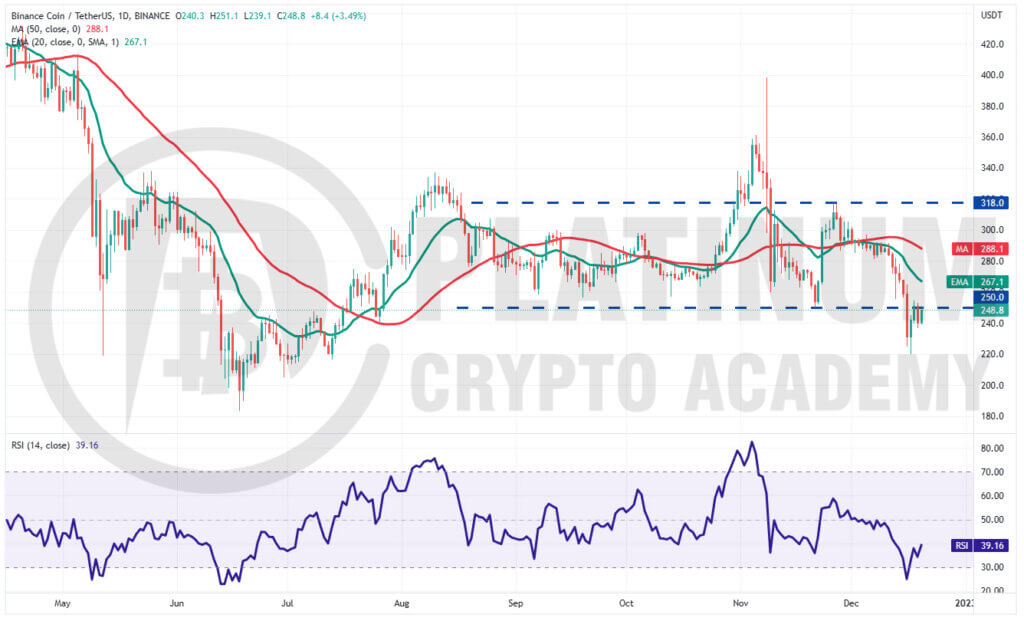

BNB/USD Market Analysis

We said in our previous analysis that bears have the upper hand and a break below $250 could sink Binance Coin to $216 and that is how it played out. The BNB/USD pair fell to $220 on December 17.

Buyers are attempting to push the price back above the breakdown level of $250. If they do that, the pair could rise to the 20-day EMA. The bears are expected to defend this level aggressively.

If the price turns down from the current level or the 20-day EMA, the pair could retest $220. If this level gives way, the decline could extend to $200.

This negative view could invalidate in the near term if bulls push and sustain the price above the 20-day EMA. The pair could then attempt a rally to the 50-day SMA.

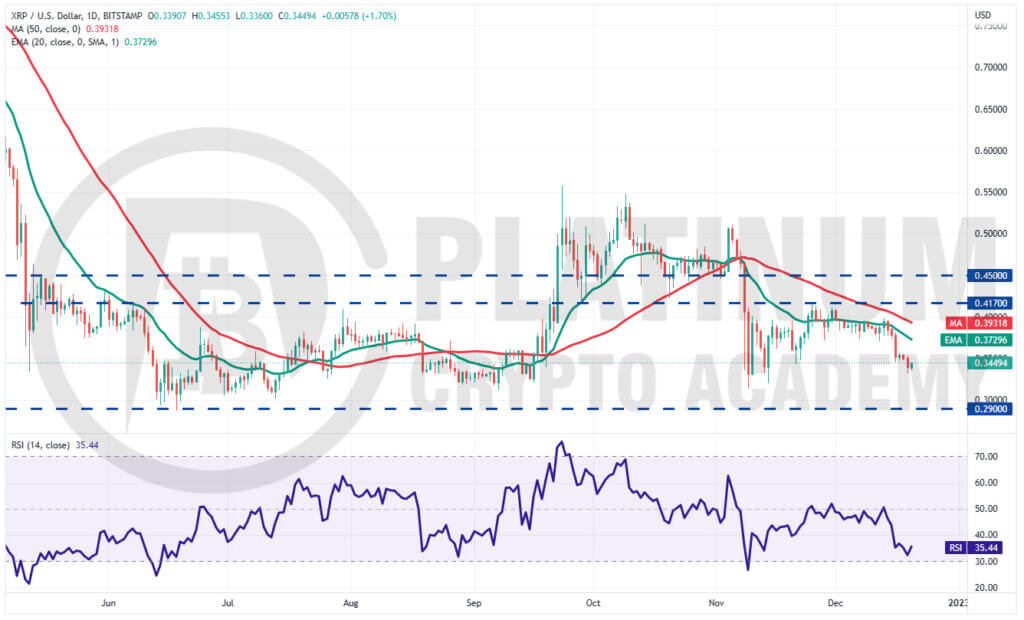

XRP/USD Market Analysis

The bulls pushed XRP above the 20-day EMA on December 13 but the bears pulled the price back below the level on December 14, trapping the aggressive bulls.

The selling picked up momentum after a break below the immediate support at $0.37. Buyers are attempting to start a recovery but that is likely to be met with heavy selling near the 20-day EMA.

If the price turns down from this level and breaks below $0.32, the pair could drop to $0.29. The bulls may vigorously defend the zone between $0.32 and $0.29. The pair is likely to spend some more time inside the large range between $0.29 and $0.41. A break of either level will be the first indication of the start of a possible trending move. Until then, the pair may remain volatile

ADA/USD Market Analysis

Cardano turned down from the 20-day EMA on December 14 and broke below the support at $0.29. The ADA/USD pair thereafter plunged to $0.25 on December 19 as we had forecast in the previous analysis.

The sharp fall of the past few days has invalidated the positive divergence that had been forming on the RSI. The downsloping moving averages and the RSI in the oversold zone indicate that bears remain firmly in control.

Any recovery attempt could face selling near $0.27 and then again at the 20-day EMA. If the price turns down from the overhead resistance, the bears will try to pull the pair below $0.25 and resume the downtrend. The next target on the downside is $0.21.

The first sign of strength will be a break and close above the 20-day EMA. That could clear the path for a possible rise to the downtrend line of the descending channel.

Hopefully, you have enjoyed today’s article for further coverage please check out our crypto Blog Page. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.