Hi Crypto Network,

Facebook’s Libra project continues to face stiff regulatory hurdles. Germany’s finance minister Olaf Scholz said that currency issuance is “a core element of national sovereignty,” hence, his government will not allow private companies like Facebook to issue money. However, Scholz was in favour of E-euro as he believed that such a system would be good for Europe.

It is not only governments and regulators who are opposing Libra. Even Apple took a pot shot at Facebook when its CEO Tim Cook said that “currency should remain in the hands of the state. I’m not comfortable with the idea that a private entity can create a modern currency.”

Libra will have a tough time addressing the concerns of the regulators; however, we like the way it is forcing the nations to consider issuing their own digital currencies. Though a centralized digital currency is no match to a decentralized cryptocurrency, it can nonetheless bolster adoption of cryptocurrencies.

After the recent correction, most major cryptocurrencies are attempting to form a bottom. The chart patterns suggest that altcoins are likely to outperform Bitcoin in the short-term. Let’s see if we find any buy setups in the top five cryptocurrencies by market capitalization.

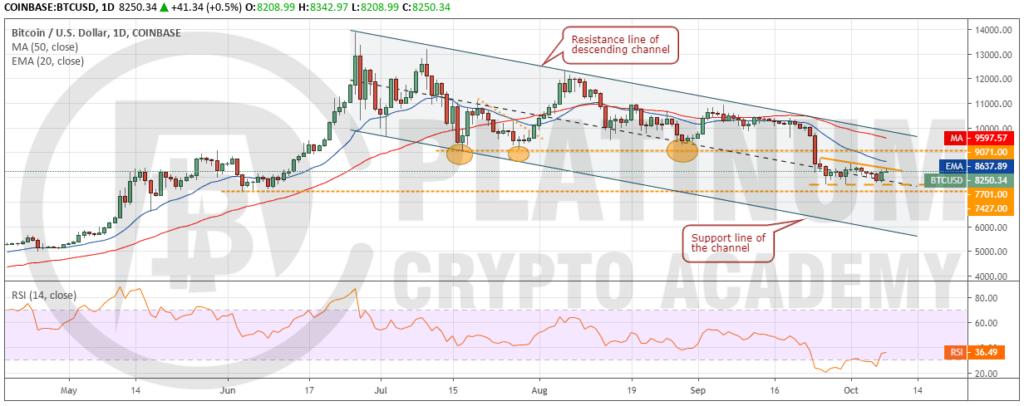

BTC/USD

Bitcoin has been trading inside the descending channel and below both moving averages. This shows that the bears have the upper hand. However, they have not been able to sink the price below the immediate support of $7,701, which indicates buying at lower levels.

We now expect the bulls to attempt to push the price above the 20-day EMA. If successful, the recovery will face resistance at $9,071 but if this level is scaled, it will be an indication that the markets have rejected the lower levels. A breakout of the resistance line of the descending channel will signal a change in trend. Therefore, traders can buy on a breakout and close (UTC time) above the channel and keep a stop loss of $7,700.

Our bullish view will be invalidated if the cryptocurrency turns down from one of the overhead resistances and breaks below $7,701-$7,427 support zone. In such a case, a drop to the support line of the channel is possible. However, we give this a low probability of occurring.

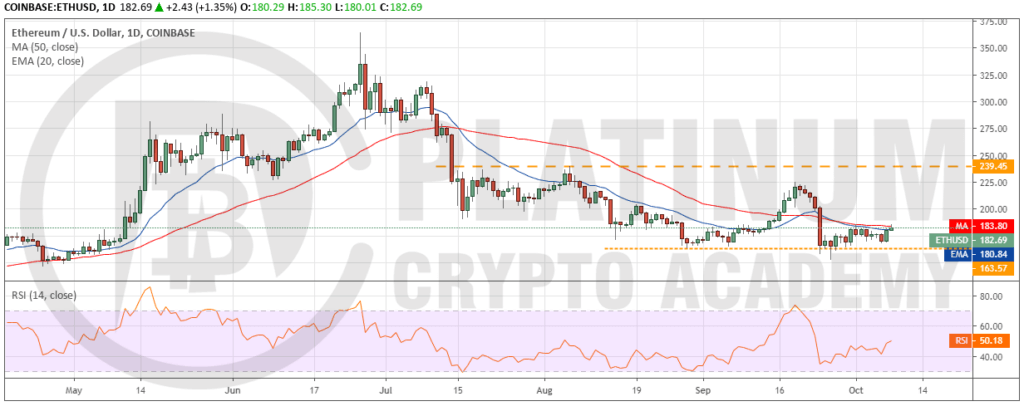

ETH/USD

Ether again bounced from close to the critical support of $163.57 on October 07, which is a positive sign. This shows that buyers are accumulating on dips to this support. The bulls are currently attempting to push the price above both moving averages. If successful, a rally to $224.71 and above it to $239.45 is possible. Therefore, the traders can buy on a close (UTC time) above the 50-day SMA with a stop loss of $163.

Both moving averages have flattened out and the RSI has risen to the midpoint. This suggests a range formation in the near term. The boundaries of the range are $163.57 and $239.45. A breakout of $239.45 will be a huge positive, which will start a new uptrend that can carry the price to $315.33 and above it to $364.49.

Our view will be invalidated if the cryptocurrency reverses direction from the moving averages and plummets below $163.57-$152.11 support zone. If that happens, the next support to watch on the downside is $122.

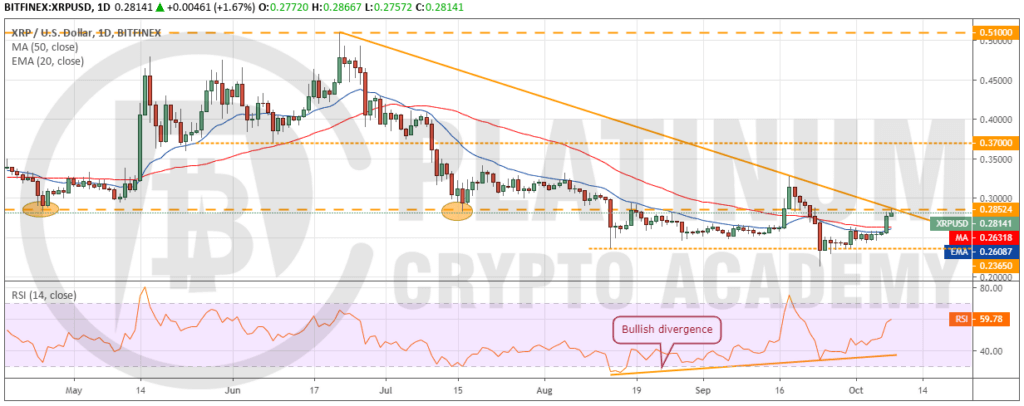

XRP/USD

XRP held above the critical support of $0.2365 last week. This is a positive sign as it shows that buyers are keen to load up on dips. The cryptocurrency has picked up momentum in the past two days and has broken out of the moving averages. It is currently challenging the downtrend line.

If the bulls can propel the price above the downtrend line, it will indicate a change in trend. The next level to watch on the upside is $0.37 and if this level is also scaled, a rally to $0.51 in the medium-term is possible. Therefore, traders can buy at $0.29 with the stops placed at $0.23.

Our bullish view will be invalidated if the bears defend the resistance level and sink the cryptocurrency below the $0.2365-$0.21262 support zone. However, we give this a low probability of occurring.

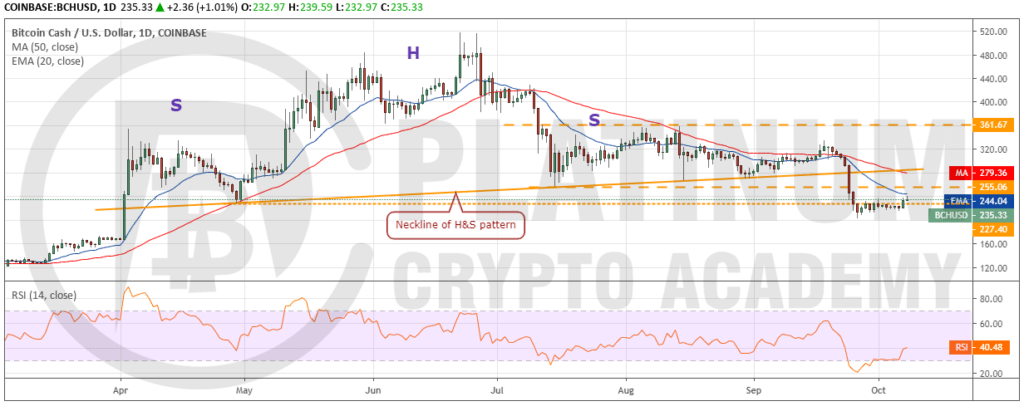

BCH/USD

The pullback in Bitcoin Cash has reached the 20-day EMA. If the bulls can push the price above this resistance, a move to the neckline of the head and shoulders pattern is possible. We anticipate a stiff resistance at this level. However, if the momentum can propel the cryptocurrency above the neckline, it will indicate that the fall due to the negative setup is over.

Conversely, if the cryptocurrency turns down from the 20-day EMA or the neckline and plunges below $201.66, its next stop is likely to be $166.98. The down trending moving averages and the RSI in the negative zone suggest that bears have the upper hand. As the digital currency had broken down after forming a bearish pattern, we will wait for it to form a new buy setup before proposing a trade in it.

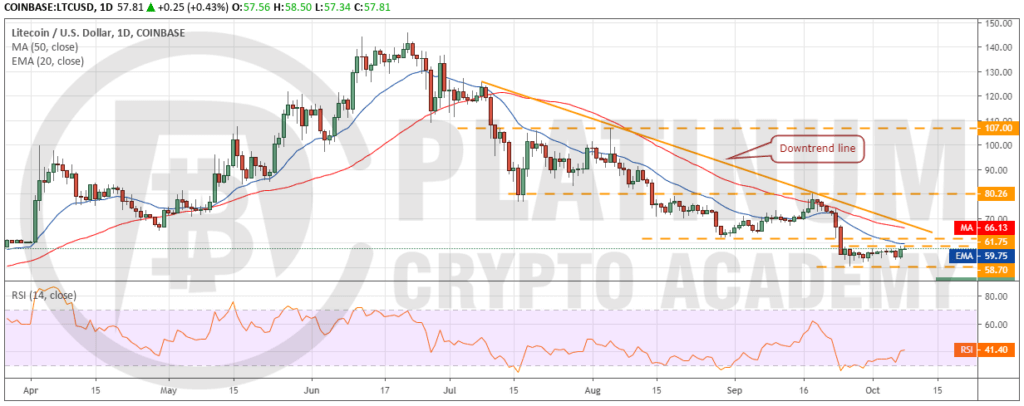

LTC/USD

Litecoin is consolidating in a downtrend. It has been trading in a tight range of $50.25-$58.70 for the past few days, above which a pullback to the downtrend line is likely. This is a critical overhead resistance to watch out for because previous relief rallies had hit a roadblock at this resistance. If the cryptocurrency again turns down from this resistance, the bears will attempt to sink it below $50.25. The next level to watch on the downside is $40.

Conversely, if the bulls can push the price above the downtrend line, it will indicate a change in trend. Therefore, traders can buy on a breakout and close (UTC time) above the downtrend line with stops placed at $50. The first target is a move to $80.26 and above it $107.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.