Although crypto investors believe that Bitcoin is an uncorrelated asset and a store of value similar to gold, its recent price action has been closely correlated to the US tech stocks. According to data compiled by Bloomberg, Bitcoin’s 40-day correlation coefficient with the Nasdaq 100 is close to its all-time highs, indicating that Bitcoin is behaving as a large tech company. However, MicroStrategy CEO Michael Saylor is unfazed by the fall in Bitcoin.

In a recent interview on Irish economist David McWilliams' podcast, Saylor said that if investors are not prepared to hold Bitcoin for a decade, then they should not hold it even for ten minutes. SoFi CEO Anthony Noto told CNBC that he and his family own Bitcoin, Ethereum and a few other cryptocurrencies but added that it was a “very small part” of their overall portfolio as “it’s an unproven asset and highly volatile.”

Noto warned companies that “if you don't innovate, and you don't use cryptocurrency as a technology platform, you'll get left behind."

We had mentioned in our previous analysis that Bitcoin is likely to face stiff resistance in the zone between £32,382.23 and £34,031.76 and that is what happened. The BTC/GBP pair dropped to the 20-day exponential moving average on February 14, which has acted as strong support.

This suggests a change in sentiment from sell on rallies to buy on dips. The bulls will again attempt to drive the price above the overhead zone. If they manage to do that, the pair could start a rally to £36,000 and then to the stiff overhead resistance at £39,299. However, the bears are unlikely to give up easily.

They will try to defend the overhead zone aggressively. If the price turns down from the zone, the bears will try to pull the pair below the 20-day EMA.

If they succeed, the pair could drop to the strong support at £29,000. Short-term traders may look for buying opportunities on dips as long as the price remains above the 20-day EMA.

Lastly please check out the advancement’s happening in the cryptocurrency world.

Enjoy the issue!

FEATURING IN THIS WEEKS EDITION

– Deepsquare

– Jimizz

– BOUJEE LEOPARDS CLUB

– Bitshiba

– Smartchem (SMAC)

– bitcci

– Chosen Ones

– Faith Tribe

– Candao

– Mine Network

– Onino

-Hubble Protocol

CRYPTO TRADE OPPORTUNITIES

BITCOIN – BTC/GBP

We had mentioned in our previous analysis that Bitcoin is likely to face stiff resistance in the zone between £32,382.23 and £34,031.76 and that is what happened.

The BTC/GBP pair dropped to the 20-day exponential moving average on February 14, which has acted as strong support. This suggests a change in sentiment from sell on rallies to buy on dips.

The bulls will again attempt to drive the price above the overhead zone. If they manage to do that, the pair could start a rally to £36,000 and then to the stiff overhead resistance at £39,299. Read more

ETHEREUM – ETH/GBP

We had projected in our previous analysis that bears will pose a stiff challenge in the zone between the 50-day simple moving average (SMA) and £2,492 and that is what happened.

Ether turned down from the overhead zone on February 10 and slipped below the 20-day EMA on February 11. However, the bears could not build on this advantage and the bulls have pushed the price back above the 20-day EMA. Read more

RIPPLE – XRP/GBP

XRP closed above the overhead resistance at £0.63 on February 8 but the bulls could not sustain the higher levels. The bears pulled the price back below the breakout level and the XRP/GBP pair plunged to the 50-day SMA on February 11.

The bulls aggressively defended the level and the pair rebounded sharply on February 12. The moving averages have completed a bullish crossover and the RSI is in the positive territory, indicating advantage to buyers. Read more

CARDANO – ADA/GBP

Cardano turned down from the 50-day SMA as we had suggested in the previous analysis. The failure of the bulls to defend the 20-day EMA shows that the sentiment remains negative.

The bulls are attempting to defend the support at £0.75 but a minor negative is that the rebound lacks strength. This indicates that buyers may not be aggressively accumulating at the current levels. Read more

BINANCE – BNB/GBP

We had suggested traders book partial profits on their long positions as the bears were likely to defend the 50-day SMA with vigour. That proved the right thing to do as Binance Coin turned down sharply on February 8, indicating aggressive selling near the 50-day SMA. Read more

Subscribe to the latest crypto news digital magazine for the latest updates about profit and loss in cryptocurrency.

Addressing HPC Challenges on Metaverse

Quick Links

The Metaverse

A couple in the US recently wedded on the metaverse. They met on a virtual reality interview seven years ago and decided to tie the knot on the metaverse. Even though there was also a physical wedding, it was combined with avatars that were hosted in digital channels, mimicking real-life events that were taking place in the wedding. Guests could also join the event from any location in the world, and even did a toast. They could also dance to the music that was played. One could see avatars of the guests make dance moves. This is the new reality

In October of 2021, Facebook, one of the largest tech companies in the world with a market cap of over $800 billion, rebranded its parent company name to Meta. It now trades under this company name. Facebook says they believe that metaverse is the future and are committed to spending over $10 billion in the next 5 to 10 years to further development of the metaverse. It is also investing heavily into virtual and augmented reality to make this a possibility. Read more

https://youtu.be/hNav5XxNbOY

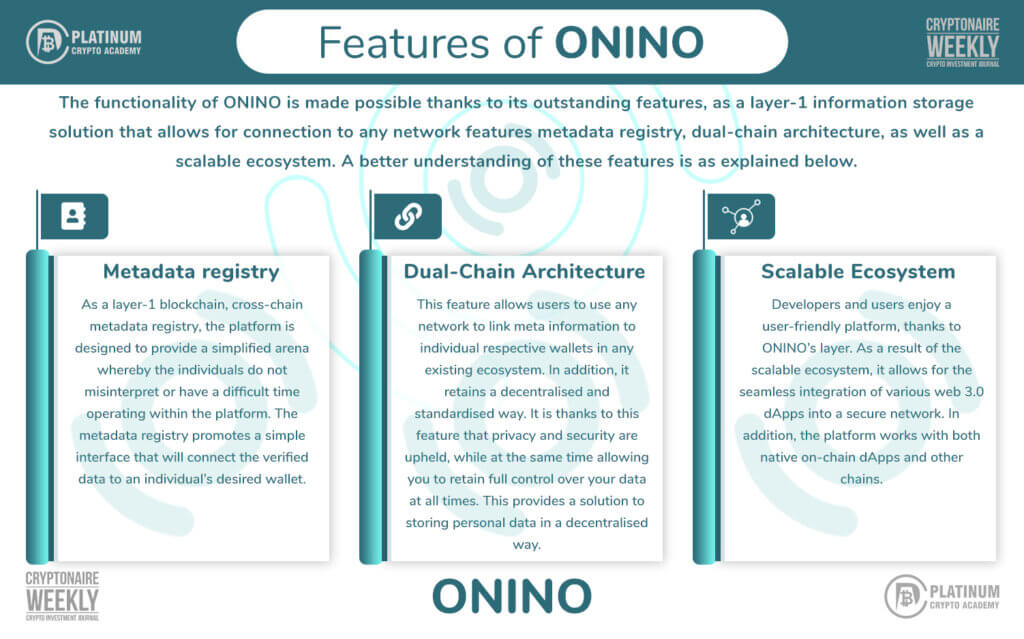

ONINO – The Multi-Purpose Cross-Chain Metadata Registry

Cryptocurrencies and blockchain applications are gaining in popularity in society across the globe. However, there are many more possibilities to explore and leverage the power of blockchain in the long-term. Therefore, it is important to bring all the different aspects of blockchain under one roof to facilitate real world identities and assets securely into the digital market. A key feature that is making crypto and blockchain attractive for users is its anonymity. However, many are seeking to identify a means of connecting personal information to individual digitally-owned assets. In an effort to address this concern, ONINO has come into play. Read more

BitShiba: Invest safely in a community-owned coin

SMAC : Awarded the Imagine Chemistry, Global Green Product & Champion Accelerator

The German SME, Intelligent Fluids GmbH (IFC), located in Leipzig, is ready to bring on companies to support its green chemistry product line. The company has thus launched its project called Smartchem, which aims to create an eco-friendly environment. This project addresses the issue of environmental pollution by implementing safe, solvent-free cleaning and stripping methods. Read more

DeepSquare, HPC solutions provider, Enters Health Tech Ecosystem

DeepSquare, a High-Performance Computing (HPC) service provider, has signed a partnership agreement with HealthTech Lisboa, a venture builder specialized in the healthcare and safety industries. This partnership onboards the HealthTech Lisboa community into the DeepSquare ecosystem.

Following the partnership agreement with HealthTech Lisboa, the Project lead at DeepSquare, Diarmuid Daltún, said, “We don’t have to explain the importance of innovation and developments in the health industry and their implications on the overall life quality. Being able to support these innovations with the platform for reliable, efficient and sustainable high-performance computing is something that we are very proud of. At the same time, it is an additional validation of our concept and approach, and how instrumental HPC infrastructure is to innovation.”

bitcci, Blockchain platform redefining the sex industry, has on ongoing ICO

bitcci is creating a platform that seeks to dignify and modernize the sex industry. The platform currently has an ongoing ICO where it seeks to sell 20 billion bitcci cash tokens.40% of the tokens have been sold so far and the ICO is expected to come to a close on the 31st of March 2022. Crypto enthusiasts can take part in the ongoing ICO by visiting the platform’s website.

bitcci Cash tokens are erc20 compliant. Over 50 crypto currencies are accepted when purchasing these tokens. The current ICO price for each token is 0.00166 Swiss franc. Users can use metamask or an erc20 compliant wallet to purchase and hold these tokens. There is also an IEO set to start on the 1st of March 2022.This IEO will run on 10 exchanges, Some of the exchanges where the token is expected to be traded are: p2pb2b, Coinsbit, Bitforex, Dextrade and Indoex. Talks are underway to onboard more exchanges.The token will be trading for 0.002 USD during the IEO.The IEO will last for 30 days and once it is over, token listing should start on the 1st of April 2022. Read more

NFT MARKET SUMMARY

As more and more people are becoming aware of the potential benefits of NFTs, many developers of NFT projects are a step ahead by announcing their plans for the metaverse. To further add to the enthusiasm surrounding the metaverse, some of the biggest global consumer brands are either announcing their foray into the metaverse or registering trademarks to pave their entry into the metaverse in future, as and when the market develops further.

Here is a list of some of the NFT projects that are launching soon or have been launched and also have future plans for the metaverse

Ripple Partners With Central Bank Digital Currency Think Tank

Ripple has partnered with the Digital Euro Association (DEA) to jointly work on central bank digital currencies (CBDCs). The DEA, based in Frankfurt, Germany, is a think tank focused on CBDCs, stablecoins, crypto assets and other forms of digital money. The organization aims to influence CBDC and crypto-related policy through research and giving a platform to policymakers, technologists, and economists to discuss digital

Singapore’s DBS looks to bring crypto to the masses

DBS, which launched a digital exchange for institutional clients in December 2020, is looking to bring its digital asset trading services to retail clients by the end of 2022. Singapore’s largest bank by assets, DBS, intends to begin offering digital asset trading to its retail clients by the end of 2022, CEO Piyush Gupta said during the lender’s annual earnings webcast on February 14th. Gupta said during the earnings call that DBS has already begun working on how it can bring the digital trading service to its retail client base “in a sensible way,” however, the lender’s focus for the first three quarters of 2022 will be to improve access for its credit investor base.

Uber CEO Says App Will Accept Bitcoin “At Some Point” In The Future

Uber CEO Dara Khosrowshahi has revealed that the app will accept Bitcoin and other cryptocurrencies “at some point” in the future. Uber Platform Will One Day Accept Bitcoin And Other Cryptos As Payment In an interview with Bloomberg, the Uber Technologies Inc. CEO Dara Khosrowshahi has said that the company has been having internal discussions about cryptocurrencies “all the time.” The CEO has revealed that the Uber platform intends to “absolutely” accept Bitcoin (and other cryptos) “at some point” in the future. However, Khosrowshah has also said that now isn’t the “right point” for it. The high transfer fees and the negative environmental effects of mining cryptocurrencies