The investment environment is experiencing a significant change, and the tokenisation of real-world assets (RWAs) lies at the centre of this transformation. This innovative method is poised to redefine our perception and interaction with traditional investment options.

BlackRock, the world’s largest asset manager, is a prime example of this shift. It is taking substantial steps to tokenise an enormous $10 trillion in assets through its partnership with Securitise. This initiative aims to open up investment opportunities to a wider range of investors. TVVIN is leading the way in this, driving the transformation of RWA investment and enhancing its accessibility, transparency, and efficiency.

With this guide, we will explore the transformative trend of blockchain in democratising finance. Specifically, we will look into TVVINs innovative financial model and the diverse range of real-world assets available through its platform, highlighting opportunities for investors. Come with us on a journey to explore the captivating world of investment, where the fusion of technology and finance transforms the future.

Why is There A Hype For the Tokenisation of Real World Assets?

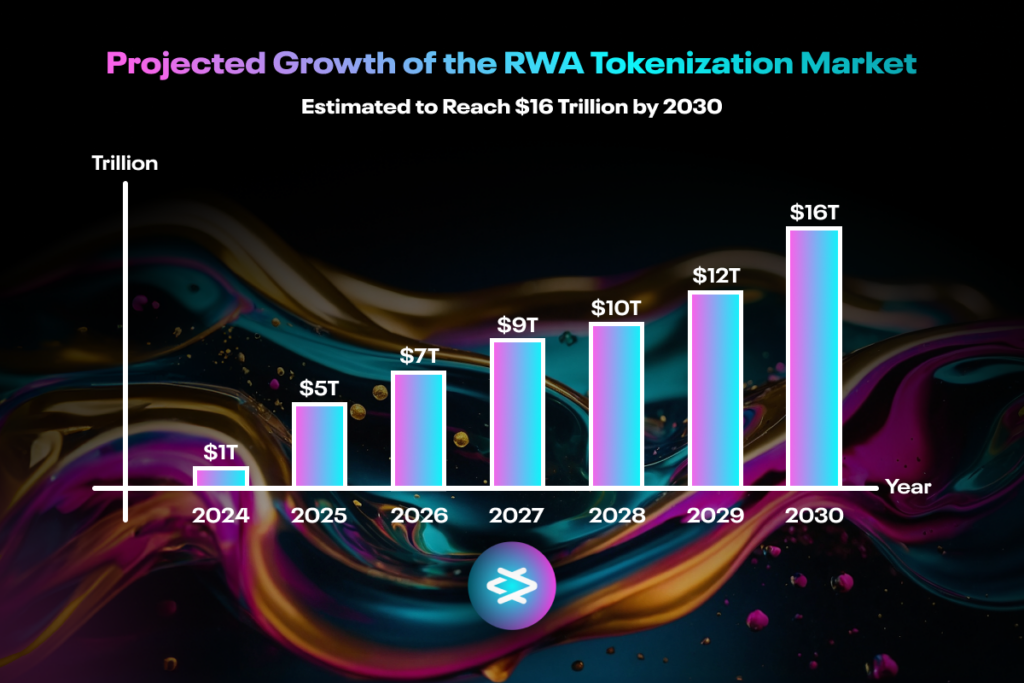

There is growing hype around tokenising real-world assets (RWAs) for several compelling reasons. As per BCG, one striking fact is that the RWA tokenisation market is projected to be a massive $16 trillion industry, accounting for approximately 10% of global GDP by 2030. This staggering figure highlights the immense potential and growing demand for tokenised RWAs.

Firstly, RWAs offer diversification benefits to investment portfolios. By including assets like real estate, commodities, and infrastructure, investors can reduce overall volatility and risk compared to traditional portfolios. For example, adding tokenised real estate to a portfolio can provide stability and potentially higher returns compared to stocks or bonds alone.

Secondly, many RWAs, such as gold and real estate, are considered effective hedges against inflation. Their values tend to increase or remain stable when the purchasing power of currency declines, preserving the real value of an investor’s capital. This is particularly important in today’s economic climate, where inflation concerns are prevalent.

Thirdly, certain RWAs, like rental properties or infrastructure projects, can generate stable and predictable cash flows, making them attractive during periods of market uncertainty or low interest rates. Tokenising these assets can provide investors with a steady stream of income, enhancing the appeal of RWA investments.

Furthermore, the tokenisation of RWAs can enhance accessibility and inclusion. In the past, significant capital was necessary to invest in assets such as real estate or precious metals, which limited participation to larger institutional players. However, tokenisation with TVVIN allows smaller investors to participate in these markets by purchasing fractional ownership and democratising access to wealth-building opportunities.

Therefore, By integrating tokenised RWAs into broader financial and investment strategies, individuals and institutions can achieve more balanced, resilient, and comprehensive portfolios.

What is The Role of Blockchain in Democratising Finance?

Blockchain technology, with its core principle of decentralisation, is fundamentally changing the financial landscape. Blockchain throws traditional, often opaque, financial structures into disarray by empowering individuals and fostering a more inclusive system.

Transparency Through Distributed Ledgers

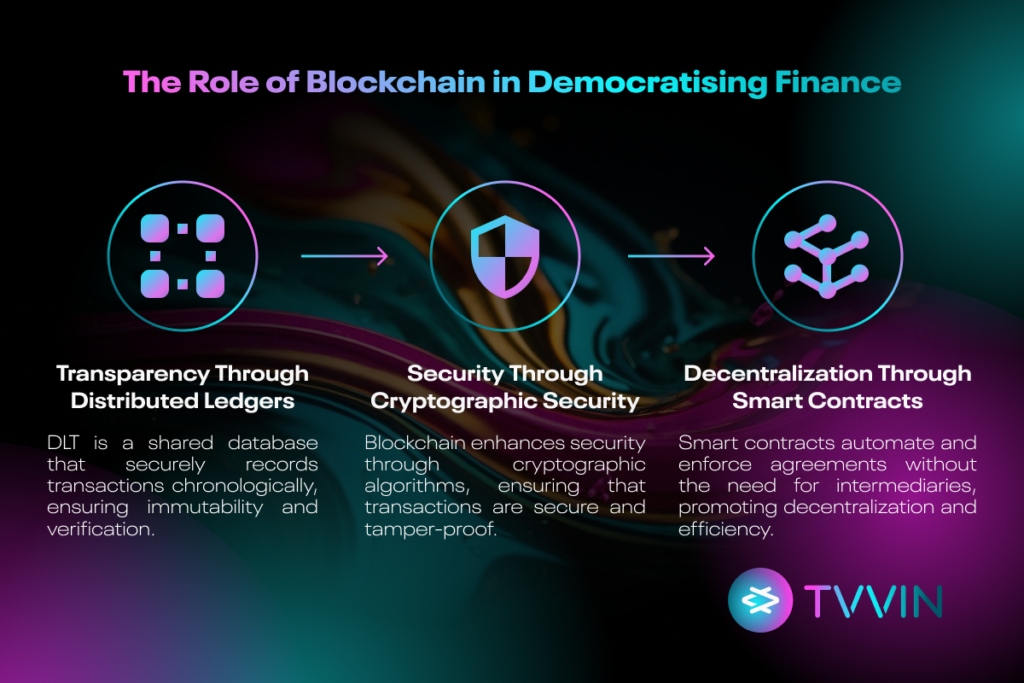

Traditional financial systems rely on centralised ledgers controlled by institutions like banks. These ledgers can be prone to manipulation and lack transparency. Blockchain, however, utilises a distributed ledger technology (DLT).

This DLT is a public or permissioned database shared across a network of computers. Every transaction is recorded chronologically and cryptographically hashed, creating an immutable and verifiable record. This fosters trust as all participants can access and audit the ledger, ensuring transparency in financial activities.

Decentralisation and Disintermediation

Traditional finance heavily relies on intermediaries like banks for transactions. These intermediaries add costs and can limit access for some demographics. Blockchain enables peer-to-peer (P2P) transactions, bypassing the need for central authorities. This disintermediation empowers individuals to manage their finances directly, reducing transaction fees and increasing accessibility for the underbanked population.

Cryptographic Security and Tamper-Proof Records

Blockchain leverages robust cryptography to secure transactions. Every block in the blockchain is cryptographically inter-linked with the blocks before and after it, establishing an immutable sequence of blocks.

Trying to alter a single block would require altering the entire chain, which is computationally impractical because the ledger is dispersed across a network of nodes. This cryptographic security safeguards financial data from unauthorised access and manipulation, enhancing trust and security in economic interactions.

Smart Contracts (Programmable Money)

Smart contracts are self-executing agreements stored on the blockchain, removing the need for intermediaries. These contracts automatically perform predefined actions when specific conditions are met, ensuring the terms of the agreement are fulfilled without human intervention.

For example, a smart contract can automate loan repayments upon receiving a borrower’s salary payment. This programmable money fosters efficiency and reduces the risk of human error in financial transactions.

Fractional Ownership and Democratised Investment

Blockchain enables the fractionalisation of assets, such as stocks and real estate. This allows individuals to invest in high-value assets with smaller amounts of capital, democratising access to previously exclusive investment opportunities. Additionally, tokenisation of assets facilitates faster and more efficient transactions than traditional methods.

Microtransactions

Blockchain facilitates secure and cost-effective microtransactions. Traditional financial systems often incur high fees for small transactions. By utilising blockchain’s peer-to-peer structure, which diminishes the need for intermediaries, individuals can engage in secure and cost-effective microtransactions. This technology broadens financial accessibility for the underbanked and individuals lacking access to conventional banking services.

What is TVVIN’s Financial Model?

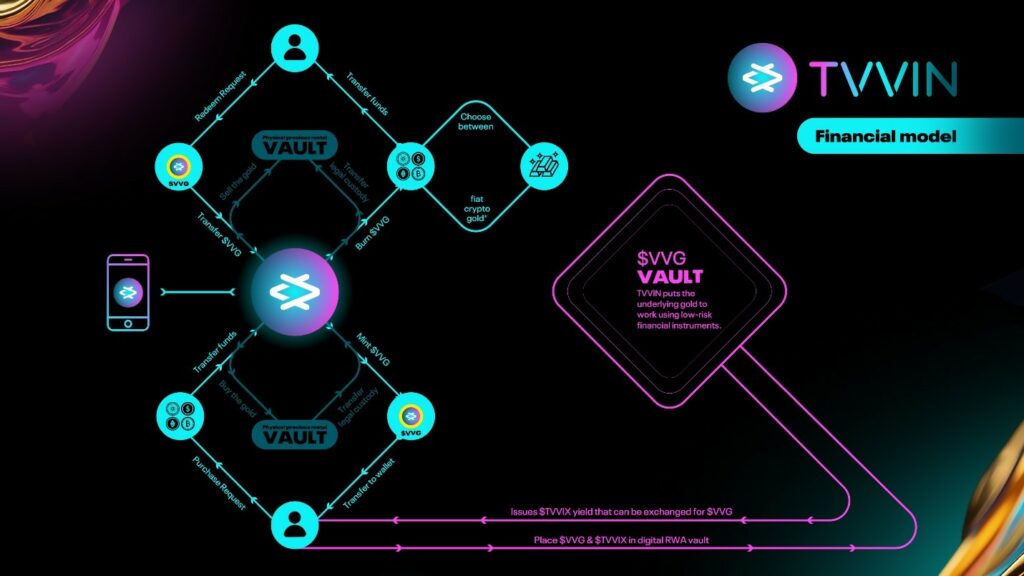

TVVIN’s financial model is centred around generating revenue from the underlying real-world assets (RWAs), particularly gold, that back its tokens like the $VVG gold token. The major revenue sources for TVVIN are:

- Transaction fees: Purchase & Redemption fees generate income. These can be significant especially in case of institutional day trading.

- Trade Margins: TVVIN earns from having preferential rates with its supplier.

- Gold Monetisation: This is a significant revenue stream for both the platform and the token holders. Token holders can place their gold tokens in TVVIN’s digital RWA Vaults in order to earn a yield. TVVIN generates this yield by putting the underlying gold to work in financial markets through various mechanisms:

a) Using the gold as collateral for loans to purchase yield-generating assets like treasuries.

b) Creating gold futures contracts in collaboration with traditional and crypto exchanges.

c) Lending out the gold to manufacturers, jewellers, and more for a fee.

d) Holding the gold in interest-bearing accounts.

- Partnerships with Institutions: TVVIN collaborates with market makers, hedge funds, exchanges, and institutional buyers. It generates revenue through arrangements like market-making agreements, investment solutions, listings, and liquidity provisions.

- Educational Marketing: TVVIN plans to generate income through educational programs and marketing initiatives related to its products and services.

How Can You Grow Gold with TVVIN? (Using Yield Bearing Vaults)

TVVIN offers an innovative way to grow your gold holdings through its yield-bearing vaults. The platform allows users to leverage their gold assets to generate additional returns, utilising various financial mechanisms.

To start, TVVIN provides a secure physical custody service for gold and other precious metals, ensuring that your assets are stored safely and are regularly audited. The platform’s native token, $TVVIX, grants access to the vaults where you can deposit your commodity tokens, such as gold-backed tokens, and earn a yield over time.

The yield is generated through several financial strategies. One of these is to use the underlying gold as loan collateral for purchasing yield bearing assets such as short term US Treasury Bills. Loans against gold collateral carries minimal interest and gives a very high Loan-To-Value ratio.

Additionally, futures contracts allow investors to gain exposure to gold prices without physically holding the metal, creating another revenue stream through fees from these transactions. Gold lending to industries such as electronics and jewellery manufacturing further enhances income, and so does earning interest from holding gold in accounts designed to accrue interest.

The vaulting mechanism is straightforward. Users need to possess $TVVIX tokens proportional to the amount of Real-World Asset (RWA) tokens, like gold-backed tokens, they want to vault. These tokens are locked in the vault for a specified period, during which they generate yield in the form of additional $TVVIX tokens.

The yield rates depend on the amount of RWA tokens deposited and the duration of the vaulting period. When the vaulting period ends, users can withdraw their RWA tokens along with the generated yield.

What Other Real World Assets TVVIN Let’s You Invest In?

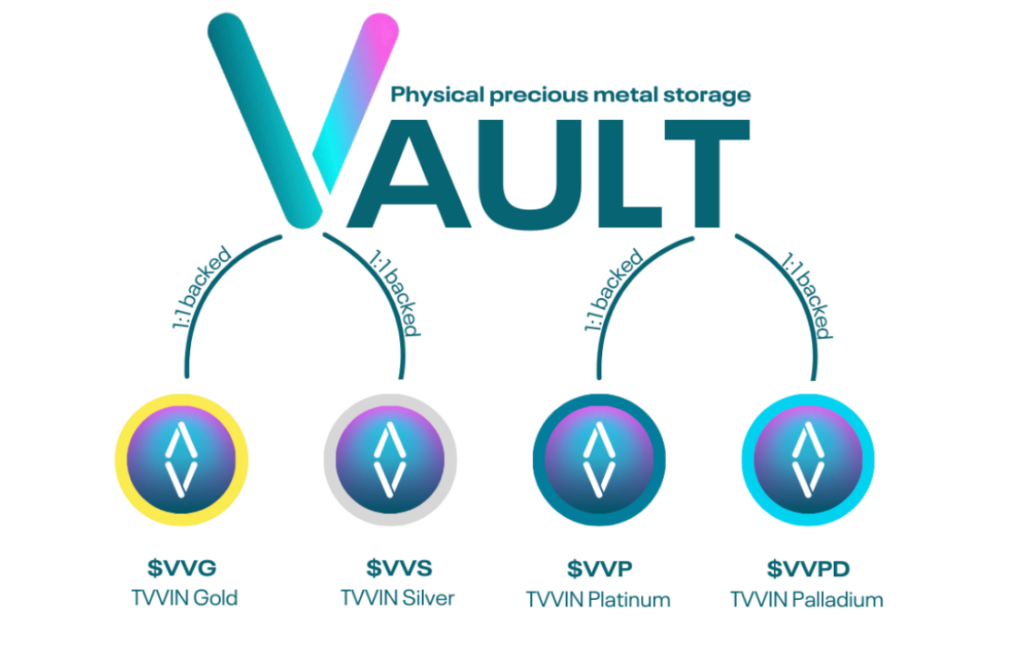

TVVIN, currently providing a secure and blockchain-based method for gold investment via tokenisation, intends to broaden its scope to encompass a range of other real-world assets (RWAs).

Future offerings will include tokens backed by silver, platinum, and palladium, providing investors with diverse options within precious metals. Beyond metals, TVVIN aims to tokenise a wide range of RWAs, such as minerals, agricultural commodities, real estate, land deeds, intellectual property, and unique artists’ rights.

Through the effectiveness and clarity offered by blockchain technology, investors are powered to diversify their portfolios through a wide range of digitised assets. This provides them access to stable and tangible investment opportunities. By bridging traditional assets with modern digital solutions, TVVIN enhances liquidity and offers new avenues for wealth growth and preservation.

Conclusion

In a world where investing opportunities were previously dominated by large financial institutions and inaccessible to many, TVVIN is emerging as a game-changer. TVVIN is transfiguring the financial industry by utilising blockchain technology, providing individuals with the means to engage in wealth-generating prospects that were previously inaccessible.

By democratising investments and tokenising assets, TVVIN has created a reliable and transparent platform that enables everyone to participate in markets that were previously limited to an elite few. TVVIN’s unorthodox yield-bearing vaults introduce a unique approach to growing gold holdings and diversifying portfolios through a range of real-world assets. To explore how TVVIN can elevate your financial journey, visit their website.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.