Azuki has been making waves this collection, renowned for its unique profile images that have become a staple in the crypto community, has witnessed a staggering 47% price increase in just the past month. From a floor price of 3.7 ETH a month ago, Azuki has soared to a commendable 5.3 ETH.

A Closer Look at Azuki’s Meteoric Rise

Opensea data reveals that Azuki’s floor price has surged by 33% in the last 7days. With a market cap exceeding $90 million and a current price tag of 5.5 ETH Azuki is undeniably a force to be reckoned with in the NFT space.

Launched in early 2022, the Azuki collection boasts 10,000 unique NFTs, predominantly in the pfp format. These aren’t just any profile images; they’re generative NFT avatars inspired by anime-style artwork, exuding a distinct artistic flair. The initial minting saw 8,700 Azuki NFTs fly off the virtual shelves at 1 ETH each in a Dutch auction that concluded in a mere 4 minutes!

Origin of the Garden ⛩️ pic.twitter.com/oN4rY2b72d

— Azuki (@Azuki) September 7, 2023

Azuki’s Price Journey: Peaks and Valleys

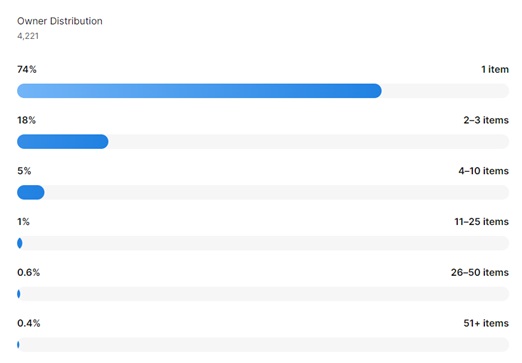

Currently, the Azuki collection is held by over 4,219 unique owners. However, its price journey has been a rollercoaster. After its launch, the floor price skyrocketed to an all-time high of 31.8 ETH in April 2022. But by May, it had plummeted to 8.3 ETH. Despite these fluctuations, the price remained above this floor for a significant duration. It was only in July 2023 that it dipped below, touching a low of 3.55 ETH in August. But as we’ve seen, the past month has been bullish for Azuki.

Elementals: Azuki’s New Venture

In June 2023, Azuki unveiled its latest collection, Elementals, comprising 20,000 NFTs on the Ethereum blockchain. This collection was introduced via a Dutch auction, with each NFT starting at 2 ETH. Chiru Labs, the innovative Web3 startup behind Azuki, envisioned this as an expansion of their original anime-themed project. Existing Azuki NFT owners were gifted an Elemental, with half the supply reserved for public sale.

However, it’s worth noting that July 2023 saw a dip in Azuki’s floor price, which some attribute to the Elementals collection’s perceived mismanagement. Critics also raised concerns about the team holding a whopping 20,000 ETH with seemingly little progress over the year.