What are NFTs and why are some worth millions?

NFTs (non-fungible tokens) are gaining traction in the gaming and art markets. With new communities and ways to earn and sell, the lives of digital artists and gamers have changed. Several celebrities have also become aware of this new way to connect with fans and also have NFT Investments.

According to blockchain news, fine art, music, and even rocks are being sold for millions of dollars. Some experts claim that NFTs are revolutionising the global investment market.

What is a Non-Fungible Token (NFT)?

An NFT is a way of representing ownership of a unique item. Things such as art, collectables, and real estate can be tokenised, allowing us to place tokens on them. NFTs are digital assets that prove ownership using the blockchain.

The term “fungibility” refers to an asset’s ability to exchange hands with another asset of the same type. Both money and cryptocurrency are fungible assets. For instance, one dollar can be traded for another dollar. In the same way, you can swap five $20 notes for a $100 note, and the value remains the same. The same goes for trading one Bitcoin for another Bitcoin.

Non-fungible assets, by contrast, are unique and can’t be substituted with any other asset of a similar nature. In addition, a painting such as the Mona Lisa cannot be exchanged for another painting of the same name. You can take pictures of the painting or buy a print, but a second original piece will never exist.

Consequently, NFTs are composed of unique data maintained on the blockchain, allowing for public ownership records. A unique dataset can be represented through physical, musical, or virtual objects, thereby creating non-fungible assets.

The buyers of NFT receive digital tokens in the form of ownership certificates rather than physical assets. You can think of it as a digitalised version of the Mona Lisa, whose ownership is proved by encrypted data.

NFTs: why they are valuable?

NFTs are valuable thanks to their digital scarcity, which allows users to programme this into them. NFTs indeed have no inherent value like gold, currency, or crypto. Instead, value is a shared consensus or belief in a financial system. Simply put, something is valuable if people are willing to purchase, trade, or sell it.

It is common for NFTs not to be backed by tangible assets. This is similar to gold not backing fiat currency. A digital painting’s NFTs do not always correspond to tangible, physical versions of the same artwork.

NFTs exist as purely virtual objects in the virtual world. An example would be an ultra-rare and powerful sword from an adventure game that exists only in one version. The original version of this sword can be recorded as an NFT investments on a blockchain. If multiple players believe it is valuable, they can bid for and purchase the sword from the owner at a good price. At this point, a new transaction is recorded on the blockchain showing that ownership of the digital sword has transferred.

Afterwards, the sword can either be used in-game or resold or flipped for even more money. The game contains numerous other items that can be traded, creating an online marketplace of buyers and sellers.

Click here to Get the Latest NFT News & Market Update Straight to Your Inbox

The most expensive NFTs ever sold

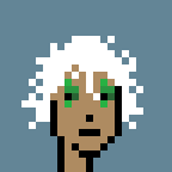

1. Larva Labs, CryptoPunk #9998 – $532 Million

1. Larva Labs, CryptoPunk #9998 – $532 Million

CryptoPunk #9998 is among the top crypto assets sold by NFT, with a sale price of USD 532 million. That’s the highest price CryptoPunks has ever received. A big part of CryptoPunks appeal is the fact that there is a female punk with wild, white hair.

Now, CryptoPunk 9998’s owner has decided to put the NFT up for sale for a cool $1 billion (250,000 ether).

2. Beeple, Everydays: The First 5,000 Days – $69.4 Million

2. Beeple, Everydays: The First 5,000 Days – $69.4 Million

Artist Beeple’s Everydays: The First 5,000 Days is a collection of 5,000 paintings and digital drawings. He created these images over a period of 5,000 days, from 2007 through 2021. The work sold at Christie’s for over $69 million.

Around 2.5 million people follow him on social media, so he has a large following. Every day, Winkelmann develops a new piece of digital art and publishes it. This project has been going on for 14 years.

3. Larva Labs, CryptoPunk #7523 – $11.75 Million

3. Larva Labs, CryptoPunk #7523 – $11.75 Million

CryptoPunk #7523 takes the third spot in our list, and is the second entry for the CryptoPunk collection. CryptoPunks are randomly generated digital collectable characters based on a computer algorithm. The NFTs were released on the Ethereum blockchain for the first time in 2017.

CryptoPunk #7523 was sold for $11,754,000 during the online auction at Sotheby’s. This expensive NFT punk was bought by Shalom Mackenzie, the biggest shareholder in digital sports company DraftKings.

4. Larva Labs, CryptoPunk #3100 – $7.58 Million

4. Larva Labs, CryptoPunk #3100 – $7.58 Million

CryptoPunks are rare creatures with a group of nine even rarer aliens. The stock of CryptoPunks is just 10,000 punks, and the alien trait only appears in 0.09% of this 10,000.

The headband on CryptoPunk #3100 is white and blue, making it stand out from the other nine alien punks. The item sold for $7.58 million because of a few factors, chief among them being the scarcity of the alien trait, but secondly because of the scarcity of having a single trait atop the punk type, in this instance being the headband.

5. Larva Labs, CryptoPunk #7804 – $7.57 Million

5. Larva Labs, CryptoPunk #7804 – $7.57 Million

Among Larva Labs’ nine Alien CryptoPunks, CryptoPunk #7804 is the rarest among them. CryptoPunks such as aliens, apes, and zombies are rarer than the majority, with 9 aliens, 24 apes, and 88 zombies.

This teal-coloured punk broke the record for the biggest payment for a punk at the time. Initially purchased for 12 Ethereum in 2018, this punk was put up for sale in February 2021 and sold for 4,200 Ethereum.

6. Crossroad By Beeple – $6.6 Million

6. Crossroad By Beeple – $6.6 Million

Mike Winkelmann, aka Beeple, created this NFT called Crossroad. The photo depicts former President Trump lying in a heap after losing the 2020 presidential election. The sale was part of his haul of $2.2 million in just three days, which included crypto art worth $582,000 in just five minutes. Currently, Beeple is the most popular NFT artist.

7. Beeple’s Ocean Front – $6m

7. Beeple’s Ocean Front – $6m

Beeple is widely known and well respected as a digital artist, and his price tags prove that. Beeple’s Ocean Front is a combination of large containers, a caravan, and a tree. TRON founder and CEO Justin Sun was able to purchase this painting by Beeple. This acquisition cost $6 million, a price ten times lower than his original offer for “Everydays”.

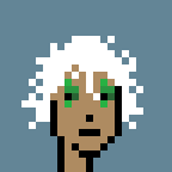

8. Tim Berners-Lee, World Wide Web Source Code – $5.43 million

8. Tim Berners-Lee, World Wide Web Source Code – $5.43 million

Tim Berners-Lee surprised many when he announced he would auction the original source code of the World Wide Web (WWW). This announcement led to much criticism and controversy regarding the source code of the web. However, the sale proceeded as planned. Sotheby’s sold it for $5,434,500 million to an unknown buyer in the final week of June 2021.

9. Stay Free by Edward Snowden – $5.4 million.

9. Stay Free by Edward Snowden – $5.4 million.

Snowden’s contribution to society is yet another gift from the whistleblower. The piece of art is part of the National Gallery of Art. The digital artwork, Stay Free, was sold in April 2021 for $5.4 million. Platon’s artwork includes his image of Snowden on top of court documents, proving the surveillance programme at the National Security Agency is illegal. Funds raised from the sale of this artwork went to the Free Press Foundation. It was a non-profit organisation focused on promoting free expression and press freedom.

10. Mad Dog Jones, Replicator – $4.1 million

10. Mad Dog Jones, Replicator – $4.1 million

The auction of Michael Dowbak’s first cryptocurrency artwork at Phillips made him the most expensive living Canadian artist. He designed Replicator to update NFTs every 28 days or every month – it acts as a photocopier. Eventually, the buyer could own 220 NFTs. The secondary market would value each NFT individually.

11. Jack Dorsey’s First Tweet – $2.9 Million

11. Jack Dorsey’s First Tweet – $2.9 Million

The very first tweet appears in our ranking of the most expensive NFTs for 2021. Jack Dorsey, the CEO and creator of Twitter, posted the first tweet in 2006 after founding the company. In the post, he wrote, “Just putting up my twttr.” This tweet was later traded as such an NFT for $2.9 million. Given the popularity of Twitter, it’s not surprising that the very first tweet has garnered so much attention. This tweet was sold to Oracle CEO Sina Estav, who thinks it is as important as owning the Mona Lisa. As well, this tweet was auctioned on Valuables, a website for online auctions.

Sales of these NFTs have set new records, and there are no signs of enthusiasm waning. There’s no doubt that NFTs will continue to shake up the art world for some time to come.

How NFTs prove ownership

It is not uncommon for new players to wonder how ownership works in NFTs, and how it can be proved. The key to this depends on where proof of ownership is kept. To prove ownership of NFTs, blockchains like Ethereum or Binance Smart Chain are used.

Blockchain’s decentralised nature allows for a public ledger to be maintained simultaneously by millions of computers (users or nodes) around the world. As a result, blockchains are secure, public, and tamper-proof. Thus, ownership proof can be traced on the blockchain. It allows users to identify whether one individual owns a particular NFT.

Since a digital asset can only have one original owner, there can be only one original copy. Regardless of how often images, videos, and audio are copied on the Internet, the blockchain shows who owns the original. Recent developments have also enabled fractional ownership of an NFT. Therefore, the micro investor can own a portion of expensive digital assets like an art piece worth $1 million.

What distinguishes an expensive NFT from the cheap one?

The market and demand determine an NFT’s value, just like those of other collectables. Because most marketplaces allow token sales through auctions, the market is highly speculative. Although the original owner sets an initial price, a competitive bidding process could lead to unexpected results. The more competition there is, the higher the prices will go.

The demand for an item is closely related to its rarity. There might be more than one NFT minted for the same collectable, so every card is not the same. Among collectors, exclusivity is important. Thus, a token that is minted once is more likely to be coveted than one with 40 analogues.

The popularity of the author is another important factor if we are talking about digital art forms. For example, Beeple has over 2.5 million followers on social media.

Additionally, rare items gain in value over time. As a result, many NFT investments or NFTs have appreciated secondary sales. In the resale of an artwork created by Beeple, Pablo Rodriguez-Fraile received a price increase of 1,000%. The crypto industry believes that NFTs have great potential for modern art forms, especially in the context of cryptocurrencies.

Analysing today’s most expensive NFTs, it is evident that they are unique digital images created through ownership of NFTs. Crypto Punks’ characters and Beeple’s collages are examples of NFT’s intellectual property.

NFTs Potential in Gaming Sector

Game developers have shown great interest in NFTs. Players can benefit from NFTs since they can provide ownership records for in-game items, fuel the in-game economy, and provide a host of other features. Many regular games allow you to buy items that you can use in the game. In other words, you could sell the item when you’re done with the game to recoup some of your money. Depending on the market, you might even make money from it.

As NFT issuers, game developers could receive a royalty for each item resold through the open market. This model benefits both players and developers, since they both earn from secondary NFT markets.

By using NFTs, you can also ensure that your collected items will remain yours, even if its developers no longer support a game. You will always have access to your in-game items, even if the game stops being maintained. As a result, in-game items have an external value outside the game. It is even possible to purchase virtual parcels of land in the virtual reality game Decentraland. The gaming sector has enormous potential to grow using NFTs as they can be used for many things.

NFT Investments

NFTs will be a driving force for digital art in the future, and these technologies are expected to grow exponentially in the years to come. Market profits from NFT investments are not guaranteed due to the volatility of crypto assets. Additionally, NFTs are subject to legal considerations and complexities.

NFTs typically indicate ownership rights to an underlying asset, while the copyright owner typically retains the copyright. Furthermore, NFTs can be structured to grant purchasers additional intellectual property rights, such as exclusive commercial rights, fair use rights, etc. You will retain these rights until the NFT is transferred to another party.

On some platforms, such as OpenSea, creators can add royalties to their NFTs. As a result, the creator can earn a percentage of every sale made in the future.

A list of the best NFT investments for 2021

CryptoPunks

Among the oldest NFT projects or NFT investments in the space, CryptoPunks was trading even before the term non-fungible token became trendy. CryptoPunks was launched by Larva Labs in June 2017 and featured exactly 10,000 retro-themed characters.

An alien video released by CryptoPunks went viral across all social platforms. CryptoPunk’s market growth is attributable to these videos.

Axie Infinity

Axie Infinity is considered to be the best-performing NFT project or NFT investments of all time by experts. The company had accumulated sales of $2.7 billion as of 30 October 2021. At the same time, other non-fungible tokens are collectables that can only be admired. As part of the Axie Infinity game, players can battle pets and earn cryptocurrencies.

The game format, which is available to play on PCs and Android and iPhone devices, is similar to the ever-popular Pokémon games. Recent months have seen a rise in interest in ‘play-to-earn’ games.

Bored Ape Yacht Club

Bored Ape Yacht Club is comprised of 10,000 unique NFTs. These are incredible tokens that completely inhibit the Ethereum blockchain. The Yacht Club allows its members to have their own membership cards. Their primary aim is to grant access to members of this club.

You can begin by logging into the collaborative graffiti board, THE BATHROOM. You can also activate the Roadmap to unlock future perks.

Dapper Labs

The next NFT crypto project or NFT investments we will look at is Dapper Labs. They own several famous non-fungible token brands.

One of Dapper’s most well-known cryptocurrency projects is NBA Top Shot. This paper illustrates clearly the potential for non-fungible tokens in bringing trading cards into the 21st century. The NBA partnered with NFTs to provide gamers with a way to collect “moments” from their favourite athletes. Furthermore, the NFL is expected to partner with the company to bring this successful format to American football as well.

CrypToadz

CrypToadz is an amphibious creature that wanders around the Uniswamp and consists of 6,969 different toads. It attempts to free itself from Gremplin’s oppressive rule. Gremplin founded it with the help of friends. Users can use it however they like.

Sneaky Vampire Syndicate

Sneaky Vampire Syndicate contains 8,888 vampires, each of which has its own characteristics. They all have unique characteristics. None of the vampires has similar characteristics to one another. There is an interesting story behind each of these NFT works.

There is a place called The Lair that vampires inhabit. It is often considered to be a place where vampires live. In this place, sunlight has a lower reach, so they can live because they cannot be harmed by sunlight or vampire hunters.

Cool Cats NFT

The Cool Cats NFTs are a group of 9,999 randomly generated, bombastically curated NFTs on the Ethereum blockchain. Cool Cats investors have a great opportunity ahead of them. The participants can take part in special events such as NFT claims, community giveaways, and more.

Each cat has certain traits and characteristics. Moreover, they have different colours, clothes, and faces, making them seem more relaxed. Cool Cats feature unique bodies, hats, faces, and companies. This makes them even more incredible. Moreover, you can personalise them in countless ways.

You should look into these NFTs projects as good NFT investments. The value NFTs now fetch, it is very likely that they will be around for a very long time. We are expecting further growth in the crypto and NFT markets this year. Thus, users should consider NFT investments in newer projects to make maximum profits and are likely to find it feasible to invest.

Is it Profitable to Invest in NFTs?

NFTs are considered speculative assets and so are NFT investments. These investments are risky because they are new, and their historical performance is limited. Nevertheless, they can’t be ignored since they can be purchased in small quantities as well.

The decision about NFT as investments or investing in NFT assets is purely personal. People with extra money may choose to purchase NFTs. Yet another may choose to buy a piece just because it represents something meaningful to them. Unlike stock prices, NFT assets are not influenced by technical, fundamental, or economic indicators. They are instead determined by how much buyers are willing to pay.

In addition, NFT assets or NFT investments could also generate mind-blowing gains over time, depending on how the asset can attain traction and value. At launch, one of the CryptoPunks collectables was free. Nowadays, one collectable can fetch millions of dollars.

The value of NFTs is also being recognised by traditional industries, demonstrating that they are here to stay. Sotheby’s has created its own auction house among renowned auction houses, where NFT art is auctioned with pieces fetching more than a million dollars.

FAQs

What is the most expensive NFT ever sold?

Among 10,000 CryptoPunks, CryptoPunk #9998 was sold for $530 million. Currently, this NFT is the most expensive ever sold and one of the best NFT investments. CryptoPunk #9998 was bought for 124,457 Ethereum.

Among 10,000 CryptoPunks, CryptoPunk #9998 was sold for $530 million. Currently, this NFT is the most expensive ever sold and one of the best NFT investments. CryptoPunk #9998 was bought for 124,457 Ethereum.

This punk is pixelated with white hair and green eyes. CryptoPunks are some of the most highly desired NFTs in the world. Developed by American studio Larva Labs, CryptoPunks is one of the very first NFTs to be released on the Ethereum blockchain.

Why are NFT investments are controversial?

The NFT market is very lucrative, but there is also a great deal of controversy due to its climate impact. It requires a great deal of computing power to create NFTs, thus, a great deal of energy. Some have expressed concern about the effect this craze may have on the environment.

‘Coronavirus’ is a piece of NFT art that CryptoArt developed. It consumed an incredible 192 kWh during its construction. This amount represents the energy consumption of one European Union resident for two weeks. Is it a large chunk? A “simple” NFT GIF consumes about the same amount of energy.

Why Do NFTs Have Value?

Often, people wonder what the point of spending so much money on things they can copy, watch, or download for free. This is because NFTs have a single owner. The work of the author remains his or her intellectual property. The owner, however, has exclusive rights to use traditional art in any way they like.

Characters, buildings, and spaces are also created with NFTs for virtual gaming. In the past, game developers owned in-game content. By contrast, NFTs allow users to legally resell their gaming assets. Due to blockchain auditing mechanisms, there is extremely little risk of forgery, which means it is less likely to buy a fake NFT. Replicating an original isn’t impossible, but it’s harder without being detected.

The same rule applies to NFTs as it does to trading. Those NFTs are rare, and in high demand among gamers, investors, and collectors, meaning their supply is less than their demand. This results in higher prices.

Can you make money selling NFTs?

You can sell your NFT for money or cryptocurrency, just like art. That is a new way to use NFT in investments.

What are NFT investments?

NFTs can be sold for a profit, but they cannot be exchanged for one another. Just like cryptocurrencies, token assets are tracked by the blockchain. Token assets are linked to the original owner’s digital assets. NFTs can actually be anything that is digital.

What Gives an NFT Value?

NFT values are impacted by consumer interest, just as they are for our hypothetical art collection pieces. With trading cards, the value depends on the rarity and popularity of the cards. Although images can be converted into NFTs, they remain freely accessible. The blockchain, however, shows who owns which assets.

What is the Future of NFTs?

It is relatively unknown what the future holds for these blockchain experiments. NFTs aren’t going anywhere anytime soon, according to prominent publications. Due to wealthy investors pouring NFT investment funds into them, these will likely become more mainstream as time goes on, especially as NFT investments.

The consumer can purchase the right to use music assets without transferring title ownership. The best way to tap into NFT investments opportunities with the least amount of risk is to invest in everything you own that is creative. In addition to game sprites, NFTs can also be music you’ve recorded, photos you’ve taken, and accounts you have on various websites and forums.

Click here to Get the Latest NFT News & Market Update Straight to Your Inbox

Conclusion

Recently, NFTs have been in the news due to a recent surge in popularity. If you plan on flipping NFTs or buying NFTs that are valuable, then it can be a good NFT investments strategy. It is very common to buy NFTs that are overpriced compared to their actual value. The value of owning a rare or priceless NFT (such as art, music, video clips, etc.) may increase in the future.

Digital creators around the world are making their lives better thanks to NFTs. Their view of NFTs is as a way of earning the true value of their work. Further applications of NFTs in the real world are expected in the future, attracting more NFT investments from investors to make it a viable alternative investment option. Although you shouldn’t rely on this advice for investing, you should conduct your own research.