The digital asset landscapehas once again presented a week filled with significant events, strategic advancements, and unexpected turns. For crypto investors and traders, understanding these developments is paramount. As we delve deeper into the week’s highlights, we’ll uncover the intricacies and implications of each event, offering a comprehensive perspective on the current state of the NFT and crypto sectors.

In other NFT news, trading volume saw a spike, driven mainly by DeGods volume. Larva Labs introduced the Voxelglyph NFT, which serves as a membership NFT for FingerprintDAO.

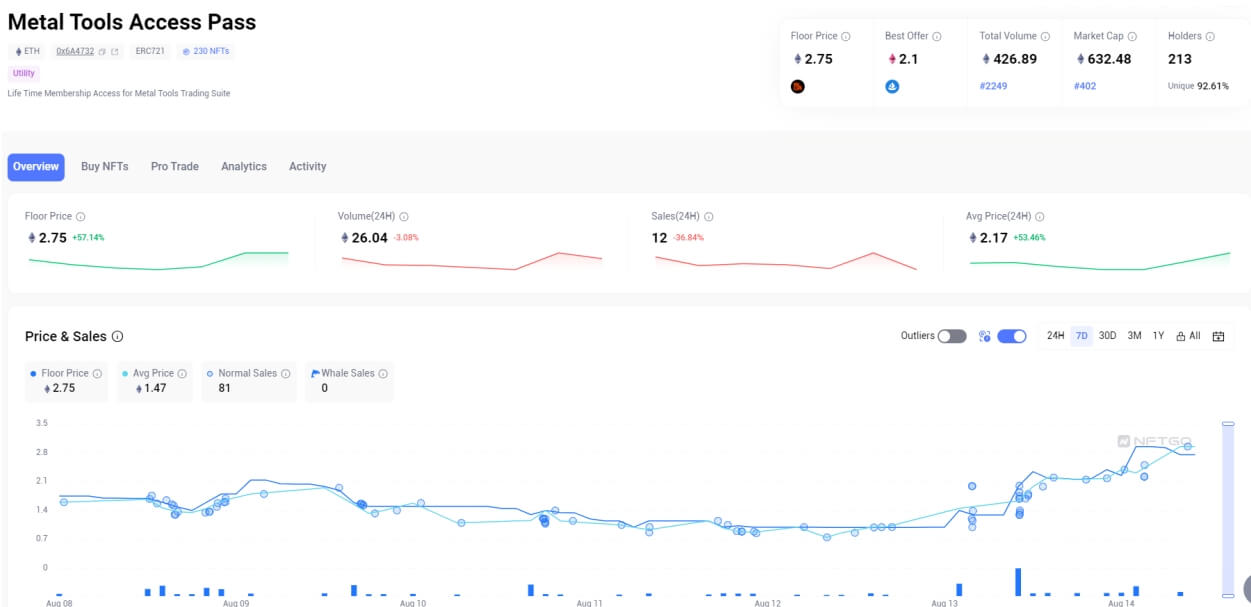

Metal Tools Access Pass soars 100% to 2 ETH leads top movers; Super Cool World and Winds of Yawanawa up 25% & 17% as well.

DeeKay Motion’s open edition on Base witnessed over 51,000 mints, and an anonymous user made headlines by transferring massive amounts of ETH and NFTs to burn addresses.

On the crypto front, the market experienced a slight downturn, with BTC and ETH witnessing minor drops. PayPal’s stablecoin PYUSD faced criticism, and Bitcoin Web3 wallet Xverse secured $5M in a seed round.Bored Apes back below a 29 ETH floor after 40 are dumped into bids So much for that relief rally, some say it was Machi.

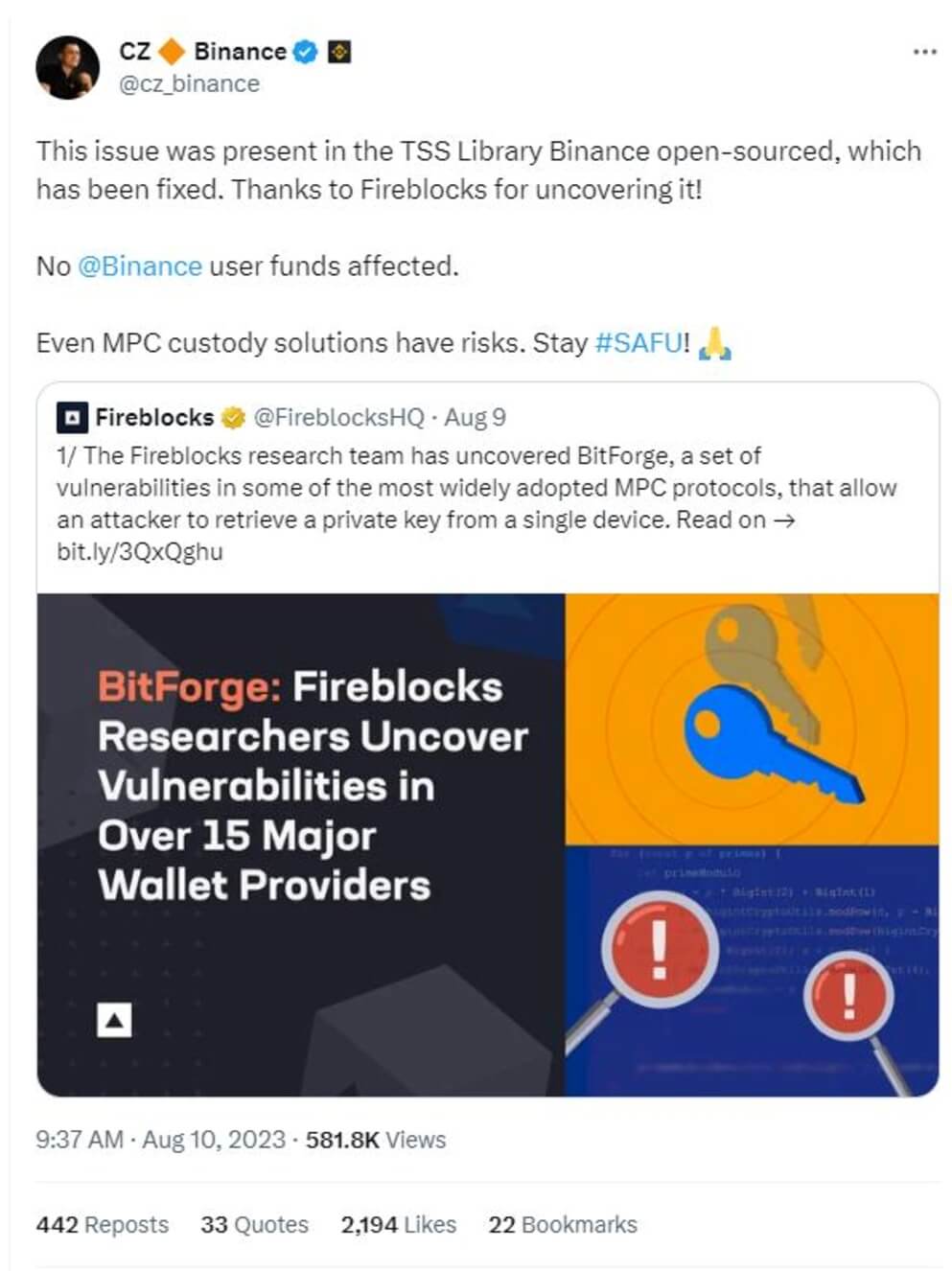

Web3 Security Crisis Averted

In what could have been a catastrophic event for the crypto community, Fireblocks, a leading crypto infrastructure firm, identified a critical vulnerability named “BitForge.” This flaw had the potential to jeopardize the assets of millions of Coinbase and Binance users. The vulnerability was rooted in the multi-party computation (MPC) protocols, designed to enhance security by splitting private keys across multiple entities. However, BitForge could have allowed hackers to reconstruct the full private key by compromising just one device. The implications of such a breach would have been staggering, with potential losses running into millions of dollars. Thanks to Fireblocks’ proactive approach, they not only identified the issue but also promptly alerted affected providers. This collaborative effort ensured that the vulnerability was addressed before any malicious exploitation could occur, underscoring the importance of vigilance and collaboration in the crypto space.

$8M in Digital Assets Burned: An Unexplained Strategy

The crypto community was taken aback when an anonymous wallet holder made the baffling decision to burn digital assets worth over $8 million. This act of “burning” in the crypto world refers to the intentional sending of tokens to an address from which they can never be retrieved, effectively removing them from circulation. The wallet in question had been known for accumulating a diverse range of NFTs from sought-after collections like Bored Ape Yacht Club, Pudgy Penguins, and World of Women.

The sudden and unexplained burning of such valuable assets has led to widespread speculation. While some view it as a statement on the impermanence of digital assets, others theorize it could be a form of digital art or performance. Whatever the motivation, this event has highlighted the unpredictable nature of the NFT space and has become a focal point of discussion among investors and traders.

NFT Market Dynamics: Key Developments

The NFT market has been buzzing with activity. Trading volumes experienced a noticeable uptick, with DeGods leading the charge in terms of volume. Larva Labs, known for their innovative contributions to the NFT space, introduced the Voxelglyph NFT. This unique NFT serves as a membership token for FingerprintDAO, a decentralized autonomous organization.

Additionally, DeeKay Motion’s open edition on Base witnessed a staggering 51,000 mints, showcasing the growing interest and demand for unique digital art pieces. In a separate yet equally intriguing development, an anonymous user transferred vast amounts of ETH and NFTs to burn addresses, further adding to the week’s enigmatic events. On the broader crypto front, while BTC and ETH saw minor fluctuations, other developments like the scrutiny of PayPal’s PYUSD and the funding secured by Bitcoin Web3 wallet Xverse provided ample topics of discussion for investors.

Conclusion

The past week in the NFT and crypto world has been nothing short of eventful. For investors and traders, these developments offer both challenges and opportunities. Staying informed and understanding the nuances of each event is crucial for making informed decisions. As the digital asset landscape continues to evolve, one thing remains certain: the world of crypto never ceases to surprise and intrigue.